Xero Integration with GoCardless. How it actually works

Reading Time:

Reading Time: 7 minutes

In this article, we will be looking at how GoCardless integrates with Xero. We will walk you through step-by-step on setting it up (or view the ‘how to get started’ video below), then look at how the integration works once you have set everything up.

GoCardless integration with your Xero account is very simple to set up. It only takes a few minutes to sync up the two online platforms, and then you are good to go!

The fast and simple set-up process:

- Connecting your Xero account to GoCardless. For this, you need to create a GoCardless account to collect invoice payments which should only take a few minutes. Then you need to complete the GoCardless for Xero online registration form. Once completed, your Direct Debit account will immediately appear on your Xero Dashboard. As soon as it does, you will be all set to receive payments.

- Set up your customers. You can do this either automatically or manually. Just send your customers a request to fill out the online registration form so that they can start paying by Direct-Debit.

- Set up to collect payments. All your payments will now be collected on the invoice due date. The payments will come directly into Xero.

- Automated reconciliation of payments. Once you have created the setup, and customer payment automation is ready to go, all your incoming payments/invoices will be matched and reconciled. Now, that this has been set up, you will not need to have any further involvement in the process as GoCardless will do this for you and notify you as soon as it is done. It will also provide you with records of the fee being paid to Xero. The GoCardless fee will be recorded as a fee straight to Xero.

Watch this video to get started collecting bank-to-bank payments with GoCardless for your Xero online invoices.

GoCardless is a bank-to-bank payment method. It uses direct debit, ACH and PAD to automatically collect payments directly from your customer’s bank account.

Your customers only need to enter their payment details once, and that’s it. After that, you are then authorised to collect all future payments without further action from your customer.

GoCardless is built for recurring payments, whether invoicing regular customers for fluctuating amounts or set, subscription-style billing. Issue an invoice after everything is set up, and payment is collected immediately as soon as it is due.

Adding GoCardless is, an online payment service in Xero is simple. Give your customers the option to pay via GoCardless in just a few clicks.

The Direct Debit timeline of the GoCardless process.

Set up mandate

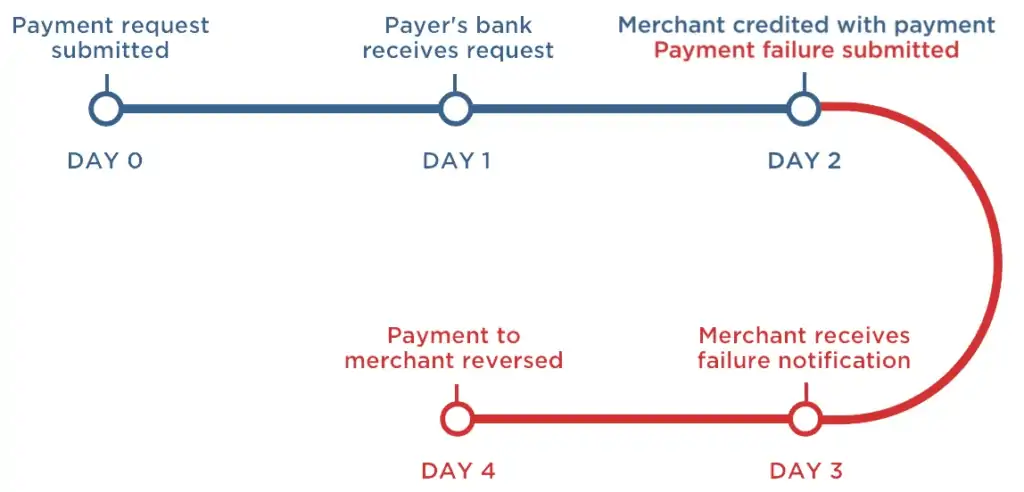

Once submitted to the banks, Direct Debit payments are processed using the BACS three-day cycle. Because of the specifics of how Direct Debit works they can only be considered successful if no failure report is received several days later.

Invoice

All you have to do is create a Xero invoice in the name of the customer.

3-days notification

GoCardless will automatically send the customer a three days notice, which will remind them of the payment’s deadline, so you will not have to. The third step does not require any effort from you. GoCardless will automatically collect payment from the customer and inform you. The income will then be deposited two days post the due date. The fee is automatically reconciled as well.

Due date

As you can see that there are at least 5 working days between the time you request GoCardless to collect payment through DD and when you actually get the money into your account. It is important to understand each stage as different entries are made in Xero for these stages.

2 days after the due date

- If a Direct Debit mandate is already in place, payment is collected 2 working days after submission, can be considered 99% confirmed 3 working days after submission, and 100% confirmed after 4 working days.

- If a Direct Debit mandate needs to be created, payment is collected 4 working days after submission, can be considered 99% confirmed 5 working days after submission, and 100% confirmed after 6 working days.

But it’s important to know what happens when payments fail. Due to the nature of Direct Debit, even failed payments are credited on day 2. If your customer’s bank believes the payment was improper (due to an overdraft), they will notify your bank to reverse it. Failure notifications are sent via a three-day Bacs cycle and are generally submitted by the customer’s bank on working day 2 (the due date):

GoCardless Pricing

In addition to the above stages, it is also important to understand that GoCardless offers two pricing methods: Plus and Pro. This is because the double entries differ in both pricing methods.

We will show you how the pricing works for each.

- Example

- The percentage scheme

- Volume-based pricing

- Issues with GoCardless reconciliation with Xero

- In conclusion – the real benefits

Example

We are going to collect payment for a sales invoice of £100 (with and without VAT) in Xero using GoCardless. In our example, we are assuming that the Direct Debit mandate and the GoCardless integration are already set up with Xero.

The percentage scheme

In this scheme, GoCardless charges 1% of the invoice amount for each transaction. There are no other charges.

Step 1: Setting up the mandate

This can be set up either through the GoCardless dashboard or through Xero by sending a request to your client to enter his bank details and approve a DD mandate. We are not going to go through this as we have assumed this is already set up.

Step 2: Create Xero invoice

Standard double entry at this stage posted by Xero and nothing happens from GoCardless.

Step 3: Select GoCardless to collect payment

Once an invoice is created in Xero, you get an option to collect payment via DD mandate using GoCardless. Once you tick this option, Xero sends a signal to GoCardless to collect the funds.

GoCardless then makes a Xero bookkeeping entry to show that the customer has made the payment by pushing the customer debt to the ‘Undeposited Funds’ account (a Balance Sheet account which is created during the initial integration phase by GoCardless).

Note here that, in reality, the customer has not yet made the payment. In fact, at this stage, they get a notification from GoCardless that payment will be taken from their account within three days. During these three days, the customer can choose to cancel the payment at any time.

In short, the payment could very well not go through. You will always get some clients now and then where payments will bounce or be blocked. This is one of the fundamental weaknesses in how GoCardless double entries work, as when you look at your Debtors ledger at this stage, you may think that your debtor balance is a lot lower.

Step 4: GoCardless collects payment from Customer

Where successful, GoCardless will collect the payment from your customer’s account and then hold that money in its own account for further 2 days.

At this stage, the following entries are made through a journal to reflect what has happened.

| Double Entry without VAT | Double Entry with VAT |

|---|---|

| CR Undeposited funds £100 | CR Undeposited funds £120 |

| DR GoCardless Rec Acc £100 | DR GoCardless Rec Acc £100 |

After this journal is made to reflect the fees being charged by GoCardless of 1%.

| Double Entry without VAT | Double Entry with VAT |

|---|---|

| DR GoCardless Fees (P&L) £1 | DR GoCardless Fees (P&L) £1.20 |

| CR GoCardless Rec Acc £1 | CR GoCardless Rec Acc £1.20 |

Step 5: GoCardless pays into your account

This is the final stage where GoCardless will the money it has collected through DD to your account net of fees charged.

| Double Entry without VAT | Double Entry with VAT |

|---|---|

| DR Bank £99 | DR Bank £118.8 |

| CR GoCardless Rec Acc £99 | CR GoCardless Rec Acc £118.20 |

After this stage, both the Undeposited funds and GoCardless Reconciliation account should be zero.

Volume-based pricing

Selecting this pricing method, GoCardless does not charge a percentage for each amount. Instead, a fixed amount of £200 is charged per month. The charges are billed through a monthly invoice which is posted as a normal purchase invoice.

Hence the only difference here is that in Stage 4 above, the GoCardless Fees (P&L) entry does not take place. All other entries are exactly the same.

Issues with GoCardless Reconciliation with Xero

You should carry out GoCardless reconciliation on a regular basis. Even though GoCardless, in theory, should work just fine, sometimes due to integration glitches, an entry is missed, and sometimes where a payment collection is cancelled or rejected, GoCardless fails to post the correcting entry.

The best way to check whether payments have been reconciled, login to your GoCardless dashboard (on the GoCardless website) and you should see the following in the Home menu:

Pending

In GoCardless, these are all of the amounts that have been asked to be collected through DDM but haven’t been collected from your client’s account yet. Xero Balance sheet account: So, this should be the same as the amount in your “Undeposited Funds” account.

Collected

As the name implies, these are the amounts that have been paid but are still with GoCardless. They should match the amount in the “GoCardless Reconciliation Account” in the Xero Balance Sheet account. You may also need to add the “Next pay-out today” below to make the balance work.

Next Payout

These are the amounts that are to be paid to your account. If these amounts have not yet hit your bank, or you have not explained these in Xero yet, then you need to add this amount to your overall reconciliation.

In Conclusion – the real benefits

The Xero and GoCardless integration offer a smooth and fast set-up and syncing process. Once you have gone through the simple set-up process and your customers sign up, the automatic collection of payments will start, and all the information regarding the transactions is sent to your Xero account and saved.

It will save you hours of admin and provide accurate information for bookkeeping purposes. In addition, the double-entry method used always makes sure your account is in balance. Features such as Direct Debit has been game-changer for companies and customers as it speeds up the payment process and provides better cash flow insights.

We strongly recommend that if you appoint an accountant who is experienced with GoCardless integration with Xero Accounting software, which is where we can help you, please call our Accounting team in Hounslow.

Edward Berks, EMEA Director, Fintech & Ecosystem at Xero, Xero UK, said:

“The success of GoCardless’ Integration with Xero has been proved by the faster payments and cash flow improvements our UK customers have reported.

More payment options mean we are levelling the playing field for small businesses, and the expansion of GoCardless to Australia shows how our app marketplace can help innovative tech companies to boost their growth across the world, improving effectiveness and efficiency for businesses everywhere.”