EMI share scheme for small business

Tax efficient rewards for your employees

We will set up & design a tax-efficient EMI Scheme perfect for your business needs and growth.

Liaise with HMRC on your behalf, file all relevant documentation and make any revisions, as required.

10% introductory discount

Partnership with Vestd

Tax advisory services

Two-way companies house & HMRC integration

Stay compliant

Enterprise Management Incentives (EMI) scheme

EMI is perfect for companies that want to incentivise, retain, and attract talent without having to pay bigger firm salaries.

HM Revenue and Customs (HMRC) has approved EMI as one of the most efficient and flexible share option plans. Taxes can be taken care of through the sale or transfer of any convertible assets. When granted, EMI options are free of income tax, and only upon sale are they subject to the 10% capital gains tax.

We can help you set up an EMI share scheme, which is the most tax-efficient way to grant stock options to employees and the company, as your London accountants.

You can also invite us to join your platform. We will be able to retrieve and store key documents from your own secure vault.

We are also delighted to offer a 10% introductory discount to any clients that sign up with us and our Partner Vestd on their share scheme digital platform.

What is an EMI scheme (government‑backed share options)?

EMI offers a simple, customisable, and tax-efficient way to give your team equity. The scheme was designed to help small businesses grow and to be more competitive when it comes to retaining or recruiting talent. By having an EMI scheme, you can offset the costs and the tax benefits achieved by your employees, against your company’s tax liability.

EMI is the first choice for 80% of scaleups, start-ups and small to medium-sized businesses.

It is the most tax-efficient way of giving employees shares, both for the business and the recipient.

Although EMI is frequently the best solution, there are a few other options for distributing stock, including growth shares, unapproved options, and ordinary shares. Let’s look at the primary differences between these four different scheme kinds and how they might be used.

The advantages and disadvantages of

the four primary share schemes

| EMI options | Unapproved options | growth shares | Ordinary shares | |

|---|---|---|---|---|

| Tax efficient for employees | ✔ | ✕ (not typically) |

✔ (second best to EMI) |

✕ |

| Tax efficient for non-employees | ✕ (not available) |

✕ (not typically) |

✔ | ✕ |

| Incurs tax on award | ✕ | ✕ | ✕ | ✔ |

| Incurs tax on exercise | ✔ (income tax on value at award) |

✔ (income tax on value at excercise) |

n/a |

n/a |

| Incurs tax on sale | ✔ (CGT at lower rate) |

✔ (CGT) |

✔ (CGT) |

✔ (CGT) |

| Benefits from entrpreneurs relief | ✔ | ✕ | ✕ | ✕ |

| Shares issued immediately | ✕ | ✕ | ✔ | ✔ |

| Options* | ✔ | ✔ | ✕ | ✕ |

| Conditional shares** | ✔ | ✔ | ✔ | ✕ |

| Typically used when exchanging equity for cash | ✕ | ✕ | ✕ | ✔ |

| * Shares issued at a later date, at pre-agreed price.

**Ability to set specofic requirements that must be met to complete share ownership. |

||||

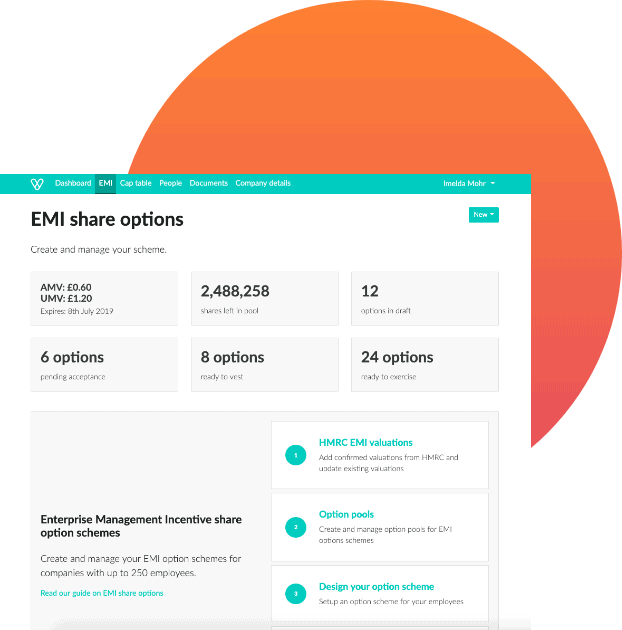

Introducing our partner Vestd

Vestd is the UK’s first, most advanced and only regulated digital share scheme platform for SMEs, helping hundreds of UK small businesses design tax-efficient schemes making it easy to distribute and digitally manage your equity.

Vestd will generate the initial and annual HMRC notifications, and we can advise you when they are due. It is also the perfect platform to extract key information simply and easily to deliver as part of a two-way integration with HMRC (and Company House) as your tax deadline approaches, ensuring any audit process is as smooth as possible, and always staying compliant.

You can even use your own documents if they have already been prepared or use standard templates to get started.

Does your business qualify for an EMI scheme?

A business will usually qualify for an EMI if it meets the following requirements:

- Up to 249 employees.

- £30m or less in assets.

- Is not majority-owned or controlled by another company.

- Not one of the excluded industries, including banking, farming, property development, legal services, shipbuilding, or leasing,

Many start-ups and scaleups – and most established SMEs – will meet these eligibility requirements.

If your company doesn’t, then one of the other ways of distributing equity will be a better fit.

Your benefits at a glance

Attract and retain the best people over longer periods of time.

Give employees a sense of ownership in your company.

Reward those who help you grow the business by enabling the team to share in its success.

Benefit from a more committed and engaged workforce – businesses with share schemes tend to outperform those that do not share ownership.

The tax implications of an EMI option scheme are more beneficial to employees than the alternatives

No more spreadsheets!

A platform built for performance

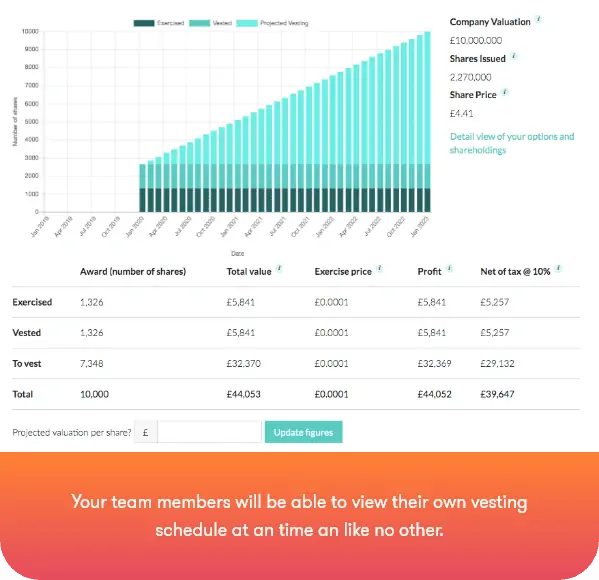

If your primary goal in setting up an EMI scheme is to motivate your team, this might be the right fit for you. Each of your team members can view their own recipient’s portal, giving them a clear overview of the value of their shares today and enabling them to model the value of their assets should the company shares increase in value. A great incentive for your business!

How to make EMI share schemes work for you

Founders, CEOs, and CFOs use the platform to take the hassle out of managing share schemes:

Start-ups:

You can give co-founders and foundational hires a slice of the action.

Growth companies:

Your EMI share scheme can help to attract and retain the talent you need to smash your goals.

Scale ups:

Save time by going digital. Minimise the time it takes to add and remove people from your scheme.

Mature companies:

Reward your loyal employees by giving them a piece of the pie.

VCs and investors:

Track the portfolio activity that is important to you and view real-time (and historic) cap tables.

The tax implications of an EMI scheme

Businesses offering EMI options are eligible for a Corporation Tax relief if employees acquire qualifying shares upon exercising an EMI option.

Corporation Tax relief is typically the difference between what the employee pays for their shares and their value when their options are exercised.

Employees who get option grants via EMI are eligible for Entrepreneurs’ Relief when sold. To qualify for this tax break, the options or shares must be held for 24 months from the date of grant.

If a disqualifying event occurs that causes your company, an employee, or the options scheme to no longer meet the qualifying criteria, the options will lose their tax advantage unless they are exercised within 90 days of the event.

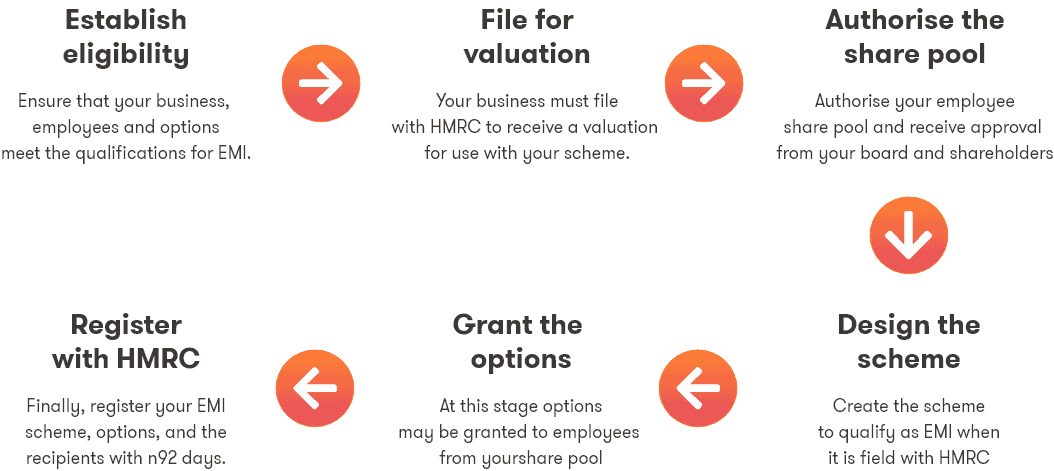

What does the EMI scheme setup process look like?

Why Choose us?

We have helped hundreds of business owners maximise their equity. The digital share scheme platform for startups, scale-ups, and SMEs is a simple way to reward employees who help grow the company.

Using Fusion Accountants in London and our EMI scheme partner will make distributing shares simple! Using an EMI scheme minimises your company’s tax obligation by offsetting employee tax benefits.

Goodbye, paperwork!

Day to day management of your scheme

You will need to update your cap table to reflect the current options issued as well as add/remove beneficiaries from the EMI scheme. You will always have our team of professionals on hand to assist you create and maintain your scheme, and it will be lot more convenient.

What we can provide you

- Get your scheme up and running.

- Manage EMI scheme members.

- Digitally manage everything.

- Exercise options digitally.

- Make Companies House notifications.

- Execute your scheme.

- Receive valuations.

- Enjoy dynamic vesting schedules.

- Build customised vesting schedules to meet your needs.

Post-setup activities

There are a few things to do after the initial setup phase is complete.

All activities can be managed by yourself via the app unless stated below:

- Activities you can carry out

- Activities carried out by our EMI scheme partner

What the platform also offers

- Issues shares and options instantly.

- Quickly create new option schemes.

- Get shareholder approval…digitally.

- See a 100% accurate real time cap table.

- Keep Companies House updated.

- Model future scenarios (funding rounds & exits).

Key benefits for founders

- Ongoing access to equity specialists

- Guided scheme design and set up.

- Legal docs included if needed

- An in-house valuations team if needed.

- The only platform with full

- Companies House integration

- Five-star support

Interested?

Your next three simple steps:

Book a free discovery call with one of our specialists to discuss your EMI needs/goals.

Mention “Vestd EMI scheme” when you call us.

Get free publicity! Vestd will interview your founder and blog about it. We will also share it on our social media channels!

FAQ ‘s

How do employees qualify for an EMI scheme?

- They must spend at least 25 hours per week or 75% of their total working time as a company employee.

- They may not hold more than 30% of the company’s shares.

- They may not hold options worth more than £250,000 (at the time of grant).

How many shares should I give to people?

This is one of the first questions you need to consider, and there are three key decisions you need to make first:

- How much of my company equity should I set aside for the scheme?

- How many shares should each team member receive?

- How do I manage dilution as new team members join the scheme?

What is a vesting schedule?

When you award options to employees, they do not become available to them immediately. Instead, the options go through a ‘vesting’ period and become available over time (usually after twelve months, but could be longer).

When can my team access their shares?

Actual shares are granted immediately, but some options are subject to vesting, which comes in two distinct forms: exit-only or exercisable. Execiseable: Require a vesting timeline and/or performance milestones, allowing team members to exercise when fully vested. Exit-based options: can be exercised when your company is sold or goes through a restructuring. Vesting and performance milestones can also be used here.

What kind of conditions can I set?

Some schemes can be conditional, and you decide what the conditions are. Options schemes usually align with time-based vesting over the years, but you can also set performance milestones. EMI option schemes are the perfect vehicle for conditional equity rewards.

How should I price my shares?

This depends on how you want to distribute equity (e.g., actual shares, growth shares, or options). There are tax implications for each of these methods.

You can allow employees to exercise EMI options at the nominal value or an agreed actual market value. The former is subject to income tax, whereas the latter is not. It can be a lot to take in, so book a no-obligation call with one of our experts using the link above. Remember to mention “Vestd EMI scheme” when you call.

What happens if someone leaves?

As a business owner you have plenty of protection in the event that an individual leaves or does not deliver, so long as the right conditions are in place.

However, it is important for the equity to create the desired impact and incentive. That means the recipient also needs to feel that the criteria is fair.

How do I manage an EMI option scheme?

In the long run you will need to manage your EMI scheme by adding new recipients, removing recipients, and updating your cap table to reflect the current options issued. You will also need to notify HMRC of any changes, such as new option grants, employee departures, or a company exit (buyout or change in ownership)