Accounting

Made Simple

Top UK chartered accountants in London, supporting small to medium-sized businesses with their accounting, tax, and business advisory needs. Tailored services at fixed monthly fees, including:

Comprehensive business services

Award-winning accounting software

Dedicated qualified accountants

And much more

About Us

Chartered Accountants in London, here to help your business grow

At Fusion Accountants, we’re more than just number-crunchers — we’re ICAEW-regulated Chartered Accountants in London committed to helping your business thrive. Whether you’re a startup, freelancer, or established company, we blend traditional expertise with modern technology to streamline your finances and maximise tax efficiency.

You’ll be supported by a dedicated, fully qualified accountant who understands your goals and works closely with you to spot issues early, automate reporting, and run regular tax reviews. Our advice is practical, proactive, and focused on helping you save money and grow with confidence.

Get your business off

to the best start.

We have helped thousands of UK businesses with their accounting needs. We seem to be doing a good job

as our clients are always happy to tell us.

Who do we help?

As Chartered Accountants in London, we tailor our accounting services to fit your business needs.

Small Business

We love helping small and startup businesses thrive. As your London-based chartered accountants, we provide full-service support from company formation to long-term growth.

Sole traders

Comprehensive accounting services for sole traders. We take the stress out of your accounting work so you can focus on growing your business.

Specialist sectors

At Fusion Accountants, we offer tailored accounting solutions for a range of specialist sectors, helping businesses navigate their unique financial challenges.

We work for you

You shouldn’t have to worry about extra bills every time you call your accountancy practice. This is why you can ring, arrange a video call or have a 1-2-1 meeting (when it is safe to do so) with your dedicated accountant as and when you need it.

Why choose us

Dedicated accountant

Our clients will receive an extremely high-quality service, which is central to everything we do. You will have a single point of contact that knows your company and can help you with your accounting needs.

Accredited accountant

Our client managers are qualified and accredited by our accounting software providers, Xero, Quickbooks and FreeAgent. So, you can relax as you are in good hands.

ICAEW & ATT registered

Our skilled and dedicated team provide expert business advice and we are members of professional bodies the Institute of Chartered Accountants in England and Wales (ICAEW) and the Association of Taxation Technicians (ATT).

Transparency

We guarantee you will never get an unexpected bill from us. All our competitive monthly fees have a fixed price and are inclusive, with no hidden costs.

Forward thinking

We love bringing clients the most up-to-date technology and tools that will help them automate and streamline procedures, supercharge cash flow, and become more efficient through focused tax planning processes.

Value add service

We are always looking to improve our accountancy service to boost your financials. This includes Cash flow forecasting software, Legal services & Contractor insurance.

Switching to us made simple

Are you worried about leaving your old accountant? When you sign up with us, we will contact your accountant and get your business up and running for you. If you switch now, you can get £100 in cash or a gift card!

Fusion services

We provide a comprehensive range of accounting and tax services to help launch your new venture.

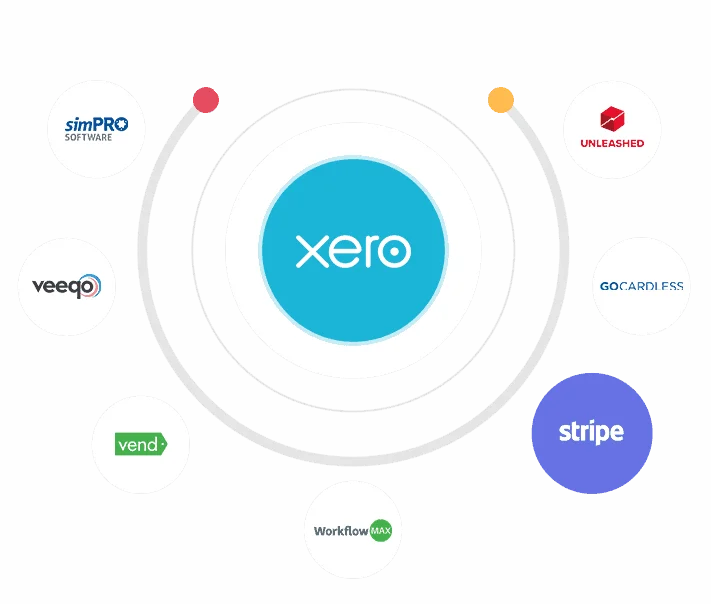

Xero beautiful business

We are Xero Platinum Partners and love their cloud accounting software. The right apps have helped hundreds of clients successfully migrate to Xero to automate and streamline business processes.

Xero has one of the most extensive third-party software integrations for small businesses on a budget, making it ideal for real-time financial management.

Please contact one of our Xero accountants today to discuss your business requirements.

Xero Accountants

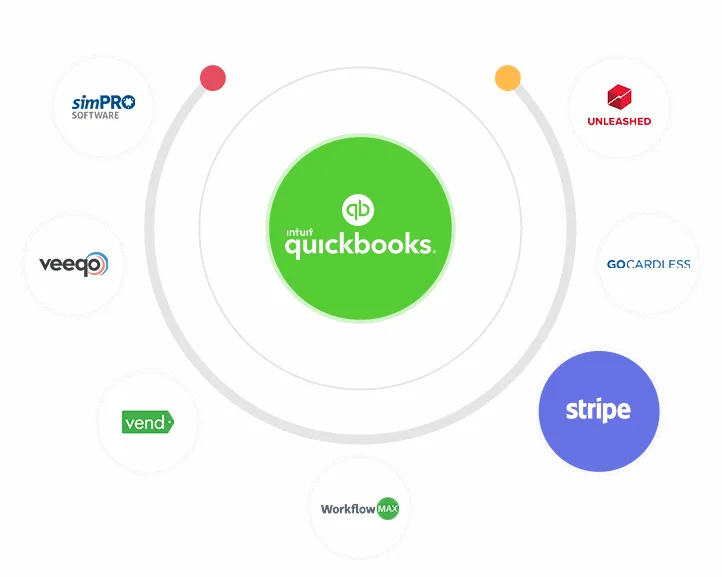

QuickBooks small business accounting software

Online cloud accounting system perfect for small and medium businesses. Automate business financials with accounting software, including a central dashboard and third-party app integrations.

In addition, we are QuickBooks Platinum Pro Advisors, so we have the experience, accreditation, and know-how to assist our clients. Use Quickbooks mobile app to view business reports, upload receipts and expenses, send invoices and manage payments.

Quickbooks Accountants

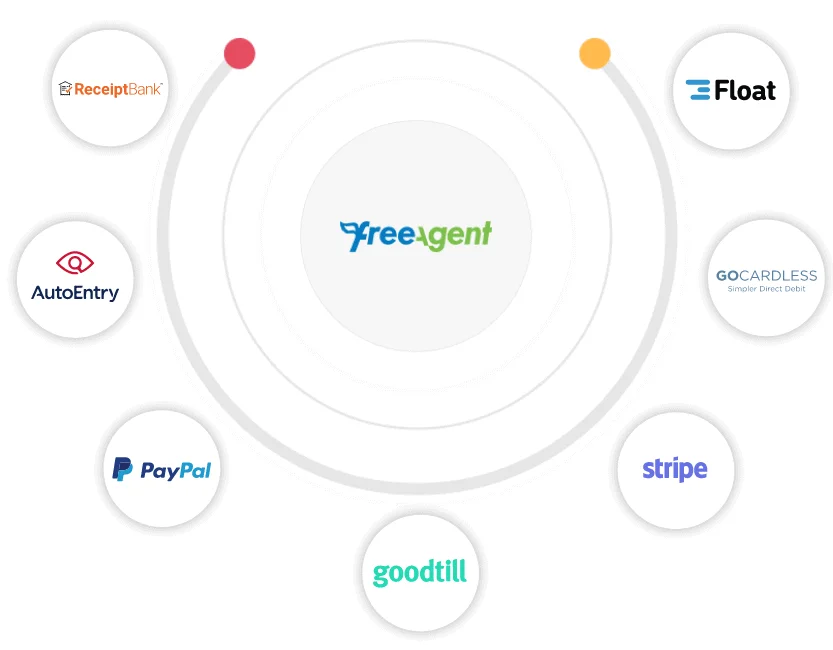

FreeAgent accounting software for UK small businesses

FreeAgent allows you to quickly snap an expense, trigger invoices, and check your daily cash flow. Take care of your business, anytime, anywhere.

As a Premium Partner with FreeAgent, we have helped 100’s UK contractors and small business clients. We bring complete visibility to the performance of your business’s financials using their award-winning cloud accounting software to take care of your tax needs.

Freeagent Accountants