Auto enrolment services

Complete Auto Enrolment Service, from planning to implementation and maintenance.

Reduce your admin time with our fully compliant automatic enrolment solution!

End-to-end implementation

Complete compliance management

Supporting employer responsibilities

Dedicated client accountant

Our auto-enrolment service

Fusion Accountants provides your complete Pensions and Auto Enrolment solution from planning to completion.

For the past 30 years, we have helped our businesses clients set up their pension plans. With you, every step of the way, we will oversee your company’s planning and implementation as well as deal with the impact the new workplace pension scheme might have on your payroll and systems. We provide extremely competitive auto-enrolment packages which are all-inclusive. Contact us to find out more.

What is Auto-Enrolment who does it apply to?

The government had become concerned that the UK’s workforce was not putting enough away for their retirement. As a result, in 2012, the automatic pension enrolment scheme was put in place, making it mandatory for employers to put all eligible workers into a workplace pension plan.

Visit the DWP website to find the annual thresholds for the 2021 – 2022 tax year.

All businesses in the United Kingdom now have to set up employees pensions who meet specific requirements, including contributions from employers and employees. To be eligible:

- Be aged at least 22

- Be below state pension age

- Earn more than £10,000 a year in 2020/21

- Work in the UK.

Paying into workplace pension plans is a shared responsibility, not just yours and your employees’. In addition, the government provides tax relief.

You must comply with the Act if you own a business that employs one or more workers. You will need to:

- Set up a workplace pension scheme that meets the new rules

- Automatically enrol all eligible workers

- Pay contributions into the retirement pots (pensions) of eligible workers

- Enrol other workers if they ask to join the scheme

If you have started your pension staging duties we can offer you a complete auto-enrolment solution. We can assist you with the successful implementation and ongoing business compliance and put you in touch with recommended financial adviser partners.

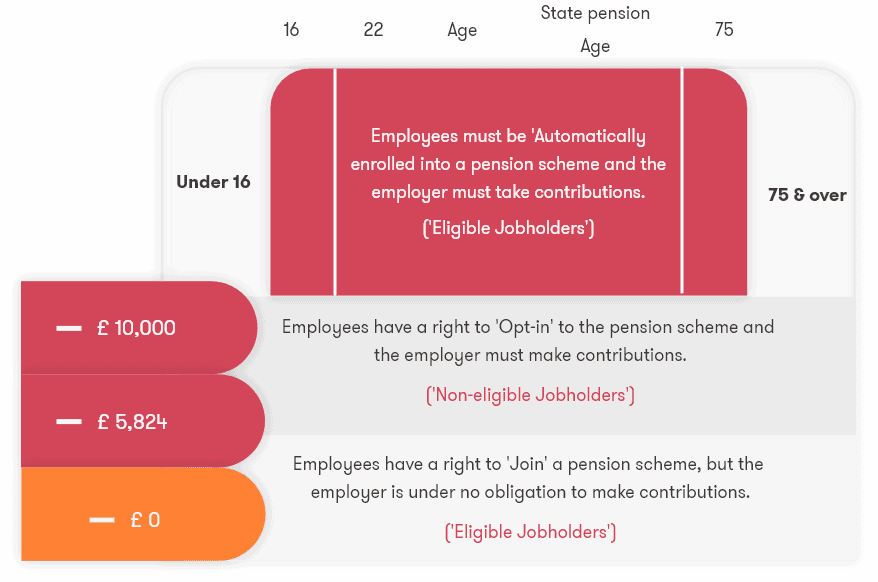

How to determine auto-enrolment

eligibility criteria

Eligible jobholders must be members of a qualifying scheme or auto-enrolled into an auto-enrolment scheme.

Non-eligible jobholders should be offered the opportunity of opting into the scheme.

Entitled workers must be given access to a pension scheme.

Once we have helped identify your eligible employees or entitled employees, we will oversee the following:

- Collect key information from employees

- Determine your Payroll and HR Process

- Review Employee contract for any legal issues

- Identify and select key points of contacts

We will also work with you to ensure you understand your responsibilities, both as an employer and your employees to maximise retirement income.

Employer and Employee duties/impact

| Employer duties/impact | Employee duties/impact |

|---|---|

| Legal duty to write to all your staff individually to explain how auto-enrolment applies to them. | The right to Opt-In or Out. |

| Must pay a minimum percentage of your ‘qualifying earnings’ into your workplace pension scheme. | Must pay a minimum percentage of your ‘qualifying earnings’ into your workplace pension scheme. |

| Reduced Profit due to contributions. | Joining a workplace pension scheme means that your take-home income will be reduced. |

| Deductible expense & not subject to NIC payments. Employee benefit increased. | You’re entitled to tax credits or an increase in the number of tax credits you get. |

| Give information to the pensions regulator about how you have met your auto enrolment duties every three years. | You're entitled to an income-related benefit or an increase in the amount of benefit you get. |

| Submit employee data every pay period to pay their contributions to the Pension Regulator. | Reduce the amount of student loan repayments you need to make. |

| Monitor employee’s ages and earnings to see if any one needs to be auto-enrolled . |

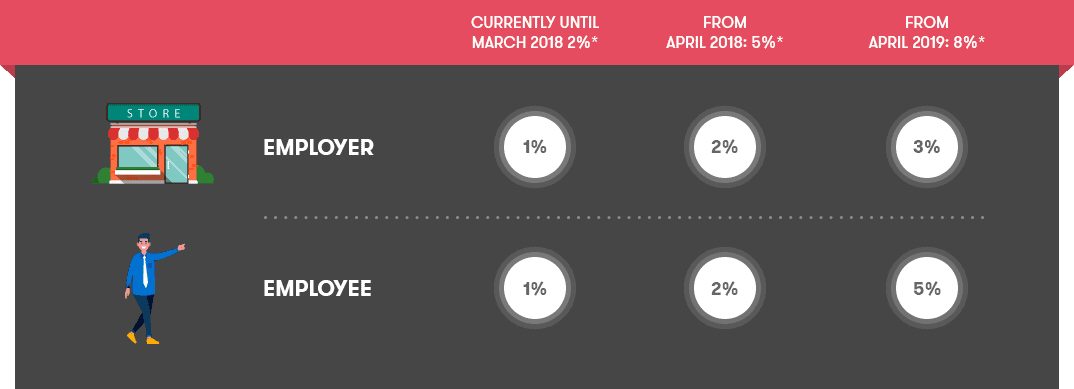

Minimum and maximum contribution levels

The amount you and your staff member pay into your pension scheme may vary depending on which pension scheme you choose. However, you and your staff must pay a minimum amount into your scheme by law.From April 2019, the minimum contribution increased to 8% of qualifying earnings, of which the employer must pay 3%, and the employee must pay a minimum of 5%.

Exemptions From Auto Enrolment

Automatic enrolment duties do not apply when a company or individual is not considered an employer or if you meet one of the following criteria:

- You are a sole director company, with no other staff

- Your company has many directors, none of whom has an employment contract, with no other staff

- Your company has many directors, only one of whom has an employment contract, with no other staff

- Your company has ceased trading

- Your company has been dissolved

- You no longer employ people in your home (cleaners, nannies, personal care assistants, etc.)

Why choose us

Dedicated accountant

Your accounting issues are handled by a single point of contact who gets to know your business and offer tax saving solutions.

Accredited accountant

Fully accredited accountants by our partners (Xero, Quickbooks & FreeAgent)

ICAEW & ATT registered

You can put your trust in us because we are guided by the Institute of Chartered Accountants in England and Wales (ICAEW) and the Association of Taxation Technicians (ATT).

Transparency

All-inclusive fixed monthly packages tailor-made for you with no hidden fees or surprise bills.

Forward thinking

Tech-savvy accountants focused on helping you save time using integrated systems for your business.

Value add service

We are proactive accountants that will help you save tax and processing time by regular reviews and planning throughout the year.

Our 3 step process

Building a workplace pension plan can be difficult and costly for even small businesses. But, with our experts, you will have a seamless solution. This guide will help you enrol your employees. Our specialist pensions team will walk you through the process, assess the impact on your business and recommend the best course of action.

01. Planning

Ideally, businesses should start planning as early as possible to ensure a smooth implementation.

Your dedicated client accountant will work closely with you to understand your staging date (the date when you are obliged to comply with the auto-enrolment of your qualified staff legally). We will also identify your eligible or entitled employees to establish who needs to be enrolled.

You can find more advice and support on The Pension Regular website.

02. Select your pension provider & assess costs

You will need to choose a pension scheme set up for automatic enrolment that is suitable for you and your staff, and you will both pay money into this scheme to help boost your staff retirement pots.

When choosing a provider, consider charges or set up costs, whether it works with your payroll software and any tax implications for your staff.

You may want to choose a scheme yourself or, as your accountant, we can discuss auto-enrolment packages and help you select a scheme that is most suitable for your business.

03. Implementation

We will carry out the final stages of the process. This will help you as an employer keep track of who is entitled to join, manage pension payments and data, and communicate with your pension provider and staff.

By this stage we will have:

- Set up your pension scheme

- Registered all eligible employees

- All relevant contributions are calculation through your payroll.

- Set up any integrations of your payroll with the Pension provider

- Submit the required information to your Pension provider.

You will need to pay, and we will walk you through your options.

The final implementation stage is to submit the Declaration of Compliance (which needs to be done within six months of the staging date).

The declaration confirms that the company has met all auto-enrolment obligations.

This is required to ensure full compliance.

Looking for a complete retirement planning service for your business?

Speak to one of our specialist!

020-8577-0200

Meet your auto enrolment pension specialist

Jawaad Hussain

Client Accountant

I joined the Fusion team in 2015, and as an ACCA qualified Client Accountant, I work closely with SME’s providing tax, accounts, and business advice.

I am also certified with Xero, QuickBooks & FreeAgent. I particularly enjoy using technology and smart apps to support the business’s needs and growth.

I like playing football (BIG Liverpool fan – YNWA!), cycling and trekking. I also enjoy travelling and visiting new places. My favourites destination so far would have to be Istanbul.

Follow Us:

FAQ ‘s

Do I have to enrol in workplace pension?

Your employer will automatically enrol you into a pension scheme and make contributions to your pension if you’re eligible for automatic enrolment. If your employer does not have to enrol you by law, you can still join their pension scheme if you want to.

Can I opt out of my workplace pension?

Yes, you can leave (often referred to as ‘opting out’) if you want to. If you do opt out within a month of your employer adding you to the scheme, you’ll get back any money you’ve already paid in. You may not be able to get your payments refunded if you opt out later – they’ll usually stay in your pension until you retire.

What happens to my pension when I die?

If no money is taken from your pension when you die, your beneficiaries can usually receive the money as a lump sum and set up an annuity. They may also be able to set up a flexible retirement income (known as pension drawdown).

What if I am in a workplace pension scheme already?

If you are an existing member of a workplace pension scheme and it meets certain minimum standards (ie a ‘qualifying scheme’), you will not be affected by automatic enrolment. However, if contribution levels fall below the minimum contributions for an automatic enrolment scheme, you and/or your employer may need to start to make, or increase contributions.

What if I have more than one job?

For people with more than one job, each job is treated separately for automatic enrolment purposes. You can still opt out of individual schemes if you want. Each of your employers will check whether you’re eligible to join their pension scheme. If you are, then you’ll be automatically enrolled in that employer’s workplace pension scheme.

Does auto-enrolment apply to me if I’m self-employed?

Self-employed workers aren’t automatically enrolled on a pension scheme, therefore it is sensible for you to plan for your retirement and start paying into a pension plan.

When did pension contributions increase?

In April 2019 the minimum contributions for a qualifying pension scheme rose to 8% (on a band of earnings). There are no planned increases in April 2022 (currently £6,240 – lower limit qualifying earnings band & £50,270 – upper limit qualifying earnings band), so the increase in the estimate of contribution costs this year, relative to the previous year, will be driven by growth in your earnings.