What is non-resident landlord scheme?

Reading Time:

Non resident landlord scheme

What does it mean to be a non-resident landlord?

A non-resident landlord is someone who owns rental property in UK but resides somewhere outside the UK. According to the government of UK non-resident landlord may be:

- A Company

- An individual

- A partnership

- A trustee

What is the non-resident landlord scheme?

The NRLS or non-resident landlord scheme is a tax scheme devised by the government of UK for non-resident landlords.

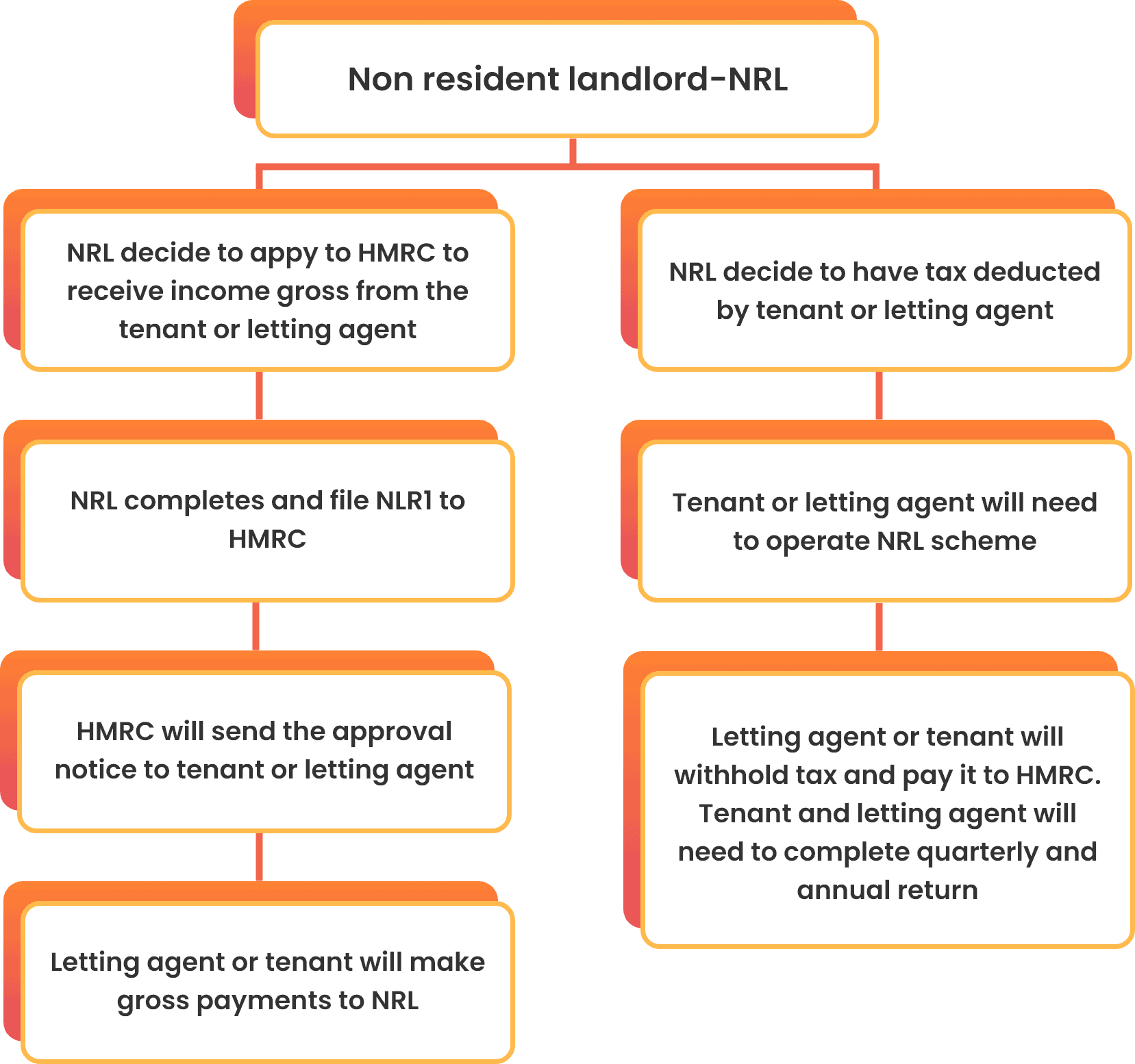

Tax is applied to the rental income whether you live in the UK or overseas. In cases where the landlord is not residing in the UK, HMRC collects tax on the rental income through NRLS. This scheme puts a legal obligation on the tenants or the letting agents to subtract tax from the rental income before giving it to the non-resident landlord. The tax deducted in this case is usually the basic rate tax.

Would I be treated as a non-resident landlord if I am not in the UK for more than 6 months?

Yes. Though it is not written in the law under the NRLS, HMRC regards any landlord who has not been living in the UK for six months or more to be a non-resident landlord.

Who is required to use this scheme?

In cases where the landlord of a rental property is living outside the UK then the tax will be deducted from the rental income by:

- The tenant who pays a rent exceeding 100 pounds per week or

- The letting agent.

Who is considered a letting agent?

A letting agent is one who helps the landlord in running their rental business in UK. Letting agents are the ones who receive the rent or manage where the rent needs to go.

According to the government of UK a letting agent can be:

- A solicitor

- An estate agent

- An accountant

- A friend of the landlord

Would I be considered a letting agent if I give legal advice to a non-resident landlord?

No, you are not a letting agent if you only give legal advice or legal services to a non-resident landlord.

What do I need to do as a tenant?

If you are a tenant and your landlord lives abroad then you need to do the following:

- Register with HMRC for the non-resident landlord scheme.

- Deduct the tax

To register with HMRC for the NRLS, you will be required to provide:

- Your name

- Your address

- Your landlord’s address

What do I need to do as a letting agent?

As a letting agent, you are required to do the following;

- Register with the HMRC for the non-resident landlord scheme

- Complete an annual report

In order to register for the scheme as a letting agent, you will have to fill a NRL4i form. You can do this either online or through the postal service.

How do I calculate the tax that I need to pay as a tenant?

Here is how you can calculate the amount you need to pay as tax.

- Add 3 months’ total rent for the quarter. This includes any amount you paid on behalf of the landlord and any uncleared cheques.

- Subtract the deductible expenses in the 3 months.

- After subtracting the deductibles, multiply the net amount you have by the basic rate income tax of 20%.

The amount you get after this last step is the amount of tax you need to pay.

If you want to know more about how tax is calculated on rental income and what expenses are allowable as deductions, please read our guide to Rental Income and Expenses.

What to do if there is more than one landlord?

In cases where there is more than one landlord who owns the rental property equally then you need to apply the 100 pound threshold to each landlord separately.

What happens if there is more than one tenant?

In such cases, the 100-pound rule will be applied to each tenant separately. If each tenant pays 75 pounds per week as rent then it makes it less than 100 pounds and so neither of the tenants are required to use the NRLS.

When do I need to submit the payments?

You are required to send the payments within 30 days at the end of every tax quarter meaning:

- 30th June

- 30th September,

- 31st December

- 31st March.

When should I send the reports?

You need to use the form Non-resident landlord: annual information return (NRLY) for sending the reports and you must send the reports by 5th July to both the HMRC and the landlord. You also need to give the certificate NRL6 each year to your landlord by the 5th of July.

If you want to know more about how tax is calculated on rental income and what expenses are allowable as deductions, please read our Non-resident landlord annual information return

What is the non-resident landlord’s responsibility under the NRLS?

Since tax is deducted by your tenant or letting agent the NRLS scheme does not require you to do anything. But still, you do need to submit a self-assessment returns form because you get income from UK property. You can deduct the tax paid under the NRLS from your self assessment tax returns.

If you do not have time or find it hard to prepare and file your self assessment, do not worry. Contact Fusion Accountants with confidence who will take care of your compliance worries.

Is it possible for a non-resident landlord to get tax exemption?

Yes. Non-resident landlords can apply to the HMRC to get tax exemption.

On what conditions does HMRC approve no tax deductions for non-resident landlords?

If non resident landlords fulfill the following conditions, HMRC may grant exemption from deduction of tax under the NRLS.

- Record of tax compliance: The non-resident landlord must have a clean tax record. That means that you have a history of filling accurate and timely tax returns.

- No Tax obligations: You will need to prove that you do not have any tax obligations in the UK.

- Application submission: You need to submit an application to HMRC to get their approval for no tax deductions on your rental income.

- Not liable to UK tax for the relevant tax year: You must prove that you are not liable to pay tax in the UK for the year in which you are submitting the application.

Also Read: Pensions For Contractors

If the above mentioned conditions are met, the HMRC will give you the approval to receive rental income with no tax deducted.

Depending on the legal status of the landlord’s business, the application should be made on one of the following forms.

- NRL1i – if the applicant is an individual

- NRL2i – if the applicant is a company

- NRL3i – if the applicant is a trustee (including a corporate trustee)

If a UK resident decides to leave UK and live abroad, the application should be made no more than 3 months before leaving.

Please do not forget to provide your UK tax reference number and their National Insurance number to HMRC.

Am I entitled to personal allowance as a non-resident?

As a non-resident you may be entitled to the personal allowance if you meet the following conditions:

- You have a British passport.

- You have EEA citizenship.

- There is a double taxation agreement between UK and country of your residence.

You can claim a personal allowance of £12500 at the end of each tax year by sending form R43 to HMRC.

Can I get tax exemption if I have sovereign immunity?

Yes, you can. Having sovereign immunity makes you exempt from paying UK tax and so as a non-resident landlord you should apply to HMRC for no tax deductions on your rental income.

Do I need to submit an application for tax exemption if I have sovereign immunity?

There is no need for you to fill an application form if you have a sovereign immunity. You just need to write a letter to the HMRC. It would be best if you could attach a copy of the letter confirming your sovereign status.

How can an accountant help me use the NRLS?

Professional help will make using the NRLS easier. Your accountant will help you in:

- Filling your tax returns

- Submitting your tax return forms in time

- Understanding and navigating the double taxation treaty

- Making use of allowable expenses if applicable

- Registering to the non-resident landlord scheme.

Conclusion

The non-resident landlord scheme NRLS is developed by the HMRC to facilitate tax collection from the rental income of non-resident landlords. It is of extreme importance to follow all the rules and regulations set by the HMRC for the NRLS. It is crucial to calculate correctly the tax that needs to be deducted whether you are a tenant or a letting agent. It is highly recommended to hire a professional to give you expert advice. Your accountant can guide you through the ins and outs of this scheme.

If you need help with NRLS, you are in the right place. Contact us today to find out how Fusion Accountants can help.