Management Accounts

Improving business

profitability and growth

“The real value of accounting cannot be understood without Management Accounts which unlocks the story behind your business” Jahan Aslam

Industry & business specific customised reporting

Dedicated qualified Accountant

Complete Bookkeeping service

And much more

What are management accounts and

do statutory accounts include?

Every month or every quarter, a set of customised or standard financial reports is prepared by your company’s accounting department to assist you in tracking the progress of your business.

Unlike Statutory Accounts (which are required by the Government and are prepared after the year-end), Management Accounts focus on your business requirements, such as KPI’s, Balance sheets, Profit and Loss, and an Executive summary.

Business owners and managers use them to track key performance indicators and make daily and strategic decisions about their financial health.

These reports could help play an essential role in planning for growth and help secure a loan if you require one.

Further information about management accounts

Management accounts are vital in running and monitoring your small business or organisation and highlight several critical indicators regarding performance and whether you are achieving your goals within the required timeframes.

You can access:

- You have a turnover lower than £632,000

- Your balance sheet shows a maximum of £316,000 or less

- You have 10 employees or less

In summary, this can be a powerful tool to help you run your small business to its full potential and determine your business successes and where you may need to make improvements or new financial decisions.

Using Xero for your management

accountants

As well as helping you run your business finances on a day-to-day basis, Xero also provides a platform for making critical business decisions – holding the data and reports you need to produce regular management accounts. In addition, we can help interpret the data and map out the process of evaluating your financial health.

If you are currently using Xero Accounting software and think this would be beneficial to your business, please do contact us & we will be glad to help.

Difference between management accounts

and financial statutory accounts

| Statutory accounts | Management accounts | |

|---|---|---|

| Aggregation | Consider the entire business | Consider the specifics of the business, such as the profits earned by a product |

| Efficiency | Consider the efficiency of the business as the report is about profitability | Take into account the specifics in order to help understand the root of the problem and find its solution. |

| Proven Information | Require precise records | Work on actual, estimates and approximation |

| Reporting Focus | Reports for within and outside the company focused on finances | Reports mainly for within the company focused on operations |

| Standards | Need to meet certain standards set by Companies House | Do not have to comply with any standards |

| Time | Take into account everything that the business has achieved | Have a future orientation |

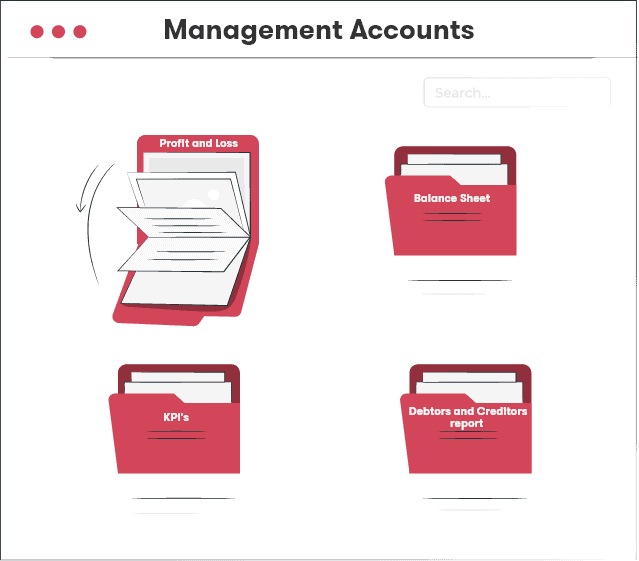

What goes in management reporting packs

1. Profit & Loss (P&L) Account

Profit & Loss (P&L) shows the performance of a business in a given period. It would typically show a summary of Income received and types of expenses incurred.Every business is unique, so that the reporting pack will differ from business to business. For example, a retailer with multiple stores may want to see Income & Expenses split by each store. In contrast, a construction business may want to see the profitability of each project it undertakes.Therefore, P&L produced for management should be tailor-made, keeping in mind the nature of business, the level of detail required, the frequency, and the layout.

2. Balance Sheet

A Balance Sheet shows the financial position at any given point in time. It should be prepared with notes to help indicate key business ratios, such as liquidity ratios, debtor days, inventory days etc., to highlight areas of risk to help with advanced cash flow planning.

3. Key Performance Indicators

Depending on the industry or nature of your business, we can work with the management team to determine key performance indicators. These will then be benchmarked against the industry and regularly reviewed to see your company’s health.

4. Aged Debtors & Creditors Report

Aged Debtors report summarises all your business debtors (i.e. the people who owe you money). It shows how much is owed and how long the money has been outstanding. It is a vital report as it shows your cash flow and how to reduce any bad debts risks.Aged Creditors report summarises creditors (i.e. the people to whom you owe money). When effectively managed, this can provide essential financial information to help you determine how much and when to pay your suppliers.

Why choose us?

Our management accountants are fully qualified and have extensive experience advising small businesses. One of our core values is customer service. We believe a good management accountant should provide reports on-demand and recommend which reports you should generate to help inform and drive future investment, cash flow, and strategic decisions.

We will also add value by improving the informative business tools (particularly those produced using real-time data from Xero) is, therefore, key to keeping a good eye on your finances. If you have an accountancy or tax issue, please do talk it through with us on 020 8577 0200 as there is a good chance we have assisted with this issue before and will be able to help you.

“One size doesn’t fit all” – It is essential to plan and determine what information will be helpful to help your business succeed. Our accountant will work closely with you to identify your business requirements and develop an effective reporting plan. We can provide monthly or quarterly reports.

“A profitable business requires more than traditional accounting”. We are modern accountants who take pride in being one of the leading accounting firms in the UK for business process automation and systems integrations. We believe this knowledge plays a vital role in helping businesses develop better reporting.

We support your business

at each growth stage

Start-up stage

If your business is an ‘early shoots’ start-up, a simple and basic set of reporting would be enough as there probably isn’t much data to evaluate at this stage. Analysing the following will do the job for you:

- Summary of accounts

- Profit and Loss

- Balance Sheet

Covering these areas will give you a good insight into the basics of your business so you can make informed decisions based on your current financial standing. As a result, you will move towards growth much faster. Moreover, when it is time for you to make a significant investment, you can change the indicators to be covered in the reporting pack.

Growing stage

As your business grows and develops, you may consider making some investments. As a result, you will need to be aware of your cash flow. Generating management accounts reports can help you assess your income and outgoing expenditure so you have a better understanding of the money you need to pay out and receive.

The reporting may need to move to the next level as you will need to include factors that will enable you to understand better the money being spent. The following will do the job at this stage:

- Payables

- Receivables

- Budget

- Cashflow

Start-up stage

This is the stage where you need to include more targeted and complex detailed reports and must include the following:

- Key Performance Indicators (KPIs)

- Shareholders Loans Transactions

- Accruals and prepayments

- Segmental/departmental analysis

- Profit & Loss actual vs. last year and/or forecast

Meet our client specialist

Jawaad Hussain

Client Accountant

I joined the Fusion team in 2015, and as an ACCA qualified Client Accountant, I work closely with SME’s providing tax, accounts, and business advice.

I am also certified with Xero, QuickBooks & FreeAgent. I particularly enjoy using technology and smart apps to support the business’s needs and growth.

I like playing football (BIG Liverpool fan – YNWA!), cycling and trekking. I also enjoy travelling and visiting new places. My favourites destination so far would have to be Istanbul.

Follow Us:

FAQ ‘s

How often are management accounts prepared?

Management accounts are usually produced more frequently than statutory accounts, often on a monthly or quarterly basis, to enable timely decision-making.

Do small businesses need management accounts?

Yes, management accounts can be beneficial for businesses of all sizes. They offer insights that can aid in managing cash flow, optimizing expenses, and planning for growth.

Are there any legal requirements for management accounts in the UK?

No, management accounts are internal tools and not subject to legal requirements like statutory accounts.

Should management accounts replace statutory accounts?

No, management accounts are complementary to statutory accounts. Statutory accounts are essential for legal compliance and external reporting, while management accounts aid in internal decision-making.

How confidential are management accounts?

Management accounts are meant for internal use and are confidential within the company. They are not publicly accessible like statutory accounts.

Can outsourcing firms help with management accounts preparation?

Yes, many accounting and financial consulting firms offer services to assist in preparing accurate and insightful management accounts.