VAT guide for small businesses

Reading Time:

What is VAT?

In simplest terms, VAT is the Value Added Tax that a consumer or buyer needs to pay for the services and products they buy.

VAT affects everyone, be they a business, a high street buyer, or an online buyer. For consumers in the UK, VAT is an indirect tax. It is a part of the price of the product. Businesses need to account for it following the guidelines set by the Government.

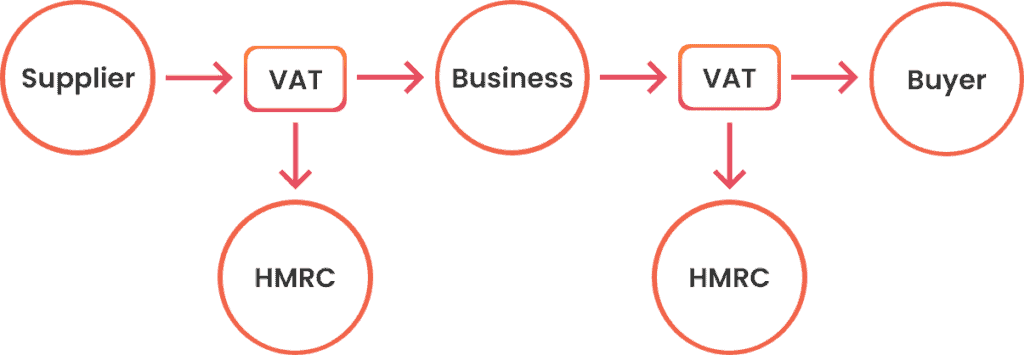

Registration for VAT is required when your taxable turnover crosses the VAT registration threshold. Businesses registered for VAT need to add VAT to the prices of the services or products they sell and then remit it to the HMRC after deducting the VAT paid by them to their suppliers and service providers.

Having a business in the UK means that generally every three months you are required to submit a VAT Return to HMRC. You may do it yourself or hire an accountant to do it for you. Let us help you understand VAT in-depth and why it is wise to hire an accountant for your VAT Returns.

Fusion Accountants can streamline your VAT return by ensuring accurate records, timely submissions, and maximizing eligible VAT deductions, minimizing compliance stress.

How much VAT is charged in the UK?

VAT rates change depending on the type of service or commodity. The standard rate on most products and services is 20%, but for certain products such as child car seats or domestic energy, the rate is decreased to 5%. On necessities such as food and clothing, the VAT rate is 0%. VAT rates and categories are given in the table below.

| Items | VAT Rate | Category |

|---|---|---|

| Most products/Services | 20% | Standard |

| Some services and essentials like household fuel, car seats protective and safety equipment, etc | 5% | Regular |

| Food and drink except catering, beverages, hot drinks, soft drinks, public transport, books and newspapers etc | 0% | Zero |

| Insurance, postage stamps, health services, financial services, education and training, subscription to membership, betting and gaming | Nil | Exempt |

| Donations, fines, MOT, wages and salaries, taxes, etc | Nil | Out of scope of VAT |

To check if there is VAT to be charged on your product or service, please see here.

Who should register for VAT?

In the UK, a business is required to register for VAT if it has a taxable turnover of more than £85000 in a period of 12 months on a rolling basis. It can voluntarily register for VAT even if its taxable turnover is less than £85000. It may help a business to reclaim VAT for expenses related to its business.

For the purpose of calculating taxable turnover to determine if VAT registration is compulsory, include standard-rated supplies, zero-rated supplies, and reduced-rate supplies but exclude exempt supplies.

When to register for VAT?

Businesses need to keep an eye on their turnover on a rolling 12-month basis so that they know exactly the date when it surpasses the VAT registration threshold of £85,000. It needs to tell HMRC within 30 days from the end of the month when the threshold is breached and would be registered by the first day of the following month.

Example of VAT registration

A business exceeded the VAT registration threshold in May 2023. The business was required to inform HMRC by the end of 30 June 2023 and its effective registration date would be 1 July 2023.

When should the VAT return be submitted to HMRC?

Businesses registered for VAT are required to submit VAT returns to HMRC generally on a quarterly basis. These returns contain a detailed quarterly account of the VAT that was collected and paid by the businesses during a certain period. The returns will show the amount of VAT that is refundable or payable from or to the HMRC by the business.

Depending on the size of the business and its taxable turnover, VAT returns can be filed on a quarterly, monthly, or annual basis.

Quarterly filing is the standard filing frequency in the UK, which means you need to file your VAT Returns every three months i.e., March 31st, June 30th, September 30th, and December 31st.

Annual filing is for smaller businesses with a lower turnover of less than £1.35 million.

Monthly filing is for certain types of businesses or for those having very high turnovers with VAT liability of more than £2.3 million.

You will need your HMRC VAT login to file your VAT return online by yourself. However, if you have an accountant, you do not need to worry about the logins and your accountant will file your VAT return online using accounting software.

What is the penalty for submitting VAT late?

Late submission penalties are calculated using a point system.

You will incur a penalty point for each late return you submit until you reach the penalty point threshold. When you hit the threshold, you will be fined £200. You will additionally be fined £200 for each subsequent late submission while you are on the threshold. Your accounting period determines the penalty point threshold as under;

| Accounting period | Penalty points threshold |

|---|---|

| Annually | 2 |

| Quarterly | 4 |

| Monthly | 5 |

What are the different VAT schemes in the UK?

Several special schemes are available for businesses to simplify the processes of reporting and payment of VAT. Some of the main special schemes are:

Flat Rate Scheme (FRS)

Mostly suitable for small businesses that do not have much input VAT to claim and that can pay HMRC a fixed percentage of their turnover.

Cash Accounting Scheme

In this scheme, Businesses are not required to account for VAT on invoice date. Instead, they can do this when they make payments to suppliers or when they receive payments from their customers.

Annual Accounting Scheme

In this scheme, businesses file VAT returns per year. However, they need to make monthly or quarterly payments towards their annual liability based on their last return. You can opt for this scheme if your turnover is £1.35 million or less.

Margin Scheme for Second-Hand Goods

It applies to second-hand goods like collector’s items or antiques. In this scheme, VAT is paid on the difference between the purchase price and the sale price.

Retail Scheme

In this scheme, VAT is calculated as a percentage of retail sales. The purpose of this scheme is to make the VAT process simple for retailers who sell a variety of products each with a different VAT rate.

Tour Operator’s Margin Scheme (TOMS)

This scheme is for travel agents and tour operators.

VAT Margin Scheme for Cars

It applies to car dealers when they sell second-hand cars.

What are the common mistakes made in VAT return?

Let us discuss some of the mistakes made in the VAT Returns.

- Not charging VAT on some non-standard supplies like recharging to third parties, supplies to staff, disposal of business assets, and intercompany management charges.

- Claiming VAT without a valid tax invoice.

- Not charging VAT on deposits received prior to issuance of the invoice. Receipt of deposit creates a tax point.

- Claiming the full amount of VAT on motor cars having an element of private use.

- Claiming VAT on fuel without accounting for scale charge to account for private use.

- Claiming 20% instead of 100% input VAT on the import VAT invoice sent by clearing and forwarding agents.

- Claiming VAT on client entertainment.

- Claiming VAT on non-vatable supplies assuming payment of VAT on every expense by the business e.g., postage and travel.

- Claiming foreign VAT paid.

- Non-payment of input VAT claimed from HMRC for creditors’ invoices that are outstanding for more than 6 months.

- Not claiming VAT on capital items under the flat rate scheme

- Not accounting for reverse charges on services bought from outside of the UK.

- Not claiming VAT on discounts and bad debts

- Not claiming VAT for pre-trading expenses

Also Read: Contractor Startup Guide

What happens if you make a mistake on a VAT return?

It is normal to make errors and mistakes in the VAT return. HMRC is cognizant of this reality and has therefore set some rules and procedures to rectify mistakes in the VAT return.

Generally, if the value of the error does not exceed £10,000, or if it does, the value of the error is between £10,000 to £50,000 and it does not exceed 1% of total sales as per Box 6 of the next VAT return, you do not need to report it to HMRC and simply make a correction in your next VAT return. The procedure to make corrections in the VAT return is provided in (VAT Notice 700/45).

There is a time limit of 4 years for correcting and amending VAT returns.

What are the benefits of hiring a professional accountant for VAT Returns?

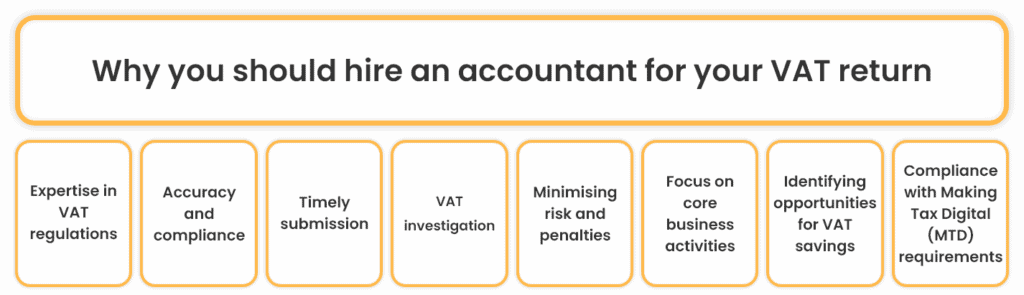

An important thing to consider is that VAT is an area of taxation that is not only complex in nature but is also prone to changes. That is why it may cause costly errors in calculations which may lead to financial difficulties consequently. Using an accountant for your VAT Returns provides you with several benefits and saves you a lot of headaches, stress, and possibly penalties.

Expertise in VAT regulations:

Being well versed with the process and rules and regulations, an accountant can give you expert advice concerning your VAT Returns.

Accuracy and compliance:

An accountant can help save you from overpayment or underpayment of taxes.

Timely submissions:

Having an accountant to file your VAT Returns ensures timely submissions.

Minimizing risks of penalties:

Hiring an accountant ensures a correct as well as timely submission of VAT Returns. This will save you from penalties and make the whole process smooth.

VAT investigation:

An accountant can help you devise an efficient system for record-keeping for VAT and audits that can help you avoid fines and penalties in the case of HMRC VAT investigations.

Focus on core business activities:

Running a business requires a lot of hard work and commitment. Having an accountant gives you more time to focus on your business.

Identifying opportunities for VAT savings:

Accountants being experts in the field are better able to identify opportunities that can help you save tax.

Managing cash flow effectively:

Accountants keep track of your business expenditures and thus can manage the cash flow more effectively.

Compliance with Making Tax Digital (MTD) requirements:

Accountants have a deeper understanding of MTD requirements and possess skilful knowledge of how to fulfil these requirements.

With years of experience in VAT, Fusion Accountants helped many clients maximize their VAT claims and minimize VAT liability.

How to Choose the right accountant?

Choosing an accountant that is right for you is an important decision. Let us help you in figuring out how to select the right accountant for your specific needs and requirements.

Qualifications and experience

The first thing to consider in hiring an accountant is to ensure that they are Chartered or Certified. In the UK, there are professional bodies like the Institute of Chartered Accountants in England and Wales (ICAEW) and the Association of Chartered Certified Accountants (ACCA).

Industry specialization

You should look for an accountant who specializes in your business area. Hiring an accountant who has experience and a deeper understanding of the type of tax requirements specific to your business interests helps you deal successfully with your financial challenges.

Availability and communication

Time is crucial in business as well as tax liabilities and that is why an accountant needs to be readily available when you need him. You must be able to communicate with your accountant. Clear and open communication with your accountant is of extreme importance.

Conclusion

Having a business registered for VAT in the UK means that every three months you are required to submit a VAT Return to HMRC. You may do it yourself or hire an accountant to do it for you.

There are several reasons to hire an accountant for your VAT Returns. Considering the benefits of having an accountant, it may be the best decision you have ever made.

Fusion Accountants are experts in VAT. If you need help with your VAT return, please do not hesitate to contact us. We will make sure you do not pay more VAT than you should be paying.

Also Read: Pensions For Contractors