The new Health and Social Care Levy

Reading Time:

In 2019, the Conservatives promised not to raise National Insurance as part of their election manifesto. However, having been severely impacted by the pandemic, the question about how Boris Johnson was now going to support the NHS and care system was left hanging in the air until now.

Fast forward to 2021, and after much speculation, an extra tax has been announced to provide additional social care funding in England and help the NHS recover from the impact of Covid-19. Younger people and the lower-paid will be possibly hit the hardest by the new taxation rules, as well as those above pension age who will be still working when the change comes into force will also be included.

This article will delve deeper into the details, outlining the increases commencing with effect from 6th April 2022 and how this may affect your income.

Who will pay the Health and Social Care levy from 6th April 2022?

The government has essentially introduced a two-part plan to get the NHS and social care system back on track post-pandemic. Firstly, employees, employers, and the self-employed will pay 1.25% more in the National Insurance (NI) pound from April 2022. While employees pay NI on their wages, employers pay extra NI contributions for staff.

The self-employed pay NI on their profits, too, meaning many people will be impacted by the tax hikes.

NI was first introduced in 1911 to provide funds for workers who had lost their jobs or required medical treatment. One hundred years later, it is now used to pay for the NHS, benefits and state pension. The government can also borrow from this fund to pay for other projects.

In April 2023, NI payments will return to their current rate, but the extra tax will be collected as part of a new Health and Social Care Levy.

At this stage, we are not entirely sure how this will work, but we are guessing that payslips will show the standard rate of NI (12% for employees and 13.8% for employers) and then it will show a separate ‘Health and Social Care levy’ of 1.25% for both employees and employers.

Unlike NI, this will also be paid by state pensioners who are still working. The tax increases are expected to put an extra £12 billion in the government’s pot per year used to take pressure off the NHS.

Over the next three years, a proportion of that money will improve the social care system to help the elderly and those with additional high-level care needs. With an ageing population, the care system is under additional strain from staff shortages and a lack of government spending. The NHS is also impacted as they cannot discharge patients unless they have somewhere suitable for their care that needs to be addressed.

The government has laid out some very specific aims and its goals are to ensure that:

- People in England pay no more than £86,000 in care costs from October 2023 (not including accommodation and food).

- Anyone with assets less than £20,000 will have their care fully covered by the state.

- Those who have assets worth between £20,000 and £100,000 will have their care costs subsidised.

As it stands, care is not paid for by the local council unless you have a very high level of need. You must also have savings and assets worth less than £23,250 in England. Below that level, the amount you pay reduces until you have less than £14,250, at which point the council pays for your care if you qualify.

How will my earnings be affected?

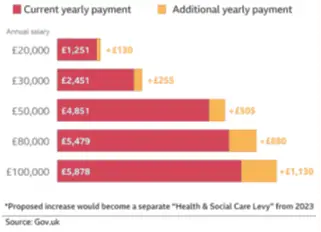

The question on everyone’s lips is how much more tax will I need to pay? The answer depends very much on how much you earn. For example, someone earning £20,000 a year will pay an extra £120 while someone earning £50,000 will pay an extra £505. The graph below makes things more straightforward so you can identify your current yearly payment and what your potential tax increase will be.

Those earning under £9,564 a year or £797 a month do not have to pay National Insurance and will not be affected by the new Health and Social Care Levy.

Worried about the National Insurance tax increase?

It is reasonably easy to see why the tax increase is needed on paper. The NHS has been through incredibly tough times, and the government is trying to ease the strain on the health system and reduce the financial burden of costs associated with providing care. But the plans have been heavily criticised, even by members of the Conservative Party itself. So, what are the main concerns?

The new tax levy will have a high impact on the lower-paid, many of whom are already struggling, having been furloughed or lost their job. In addition, food price increases following Brexit – not to mention increased gas and electricity tariffs, have put a lot of pressure on those on a lower salary.

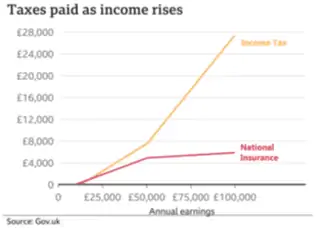

Currently, workers pay 12% of National Insurance on earnings between £9,564 and £50,268. Earnings above this amount are charged at a rate of just 2%, meaning as your income rises above £50,000, NI becomes a smaller and smaller proportion of your wage packet. The exact rate will apply to the Health and Social Care Levy in 2023.

Concerns about how the tax will impact those on lower incomes have been voiced, but it seems as if the new tax plans are already set in stone.

If you are interested in reading more about the tax changes and how the reform plans will affect social care in England, here is a link to the Government’s paper Build Back Better. Our plan for health and social care.

What tax-efficient options are available to Employers?

Employers should consider share option plans rather than bonuses to reward higher earners’ tax efficiently, given the increase in NICs payable on salary.

The employment allowance and existing NIC reliefs will apply to the new levy.

Salary sacrifice may become a more tax-efficient way to contribute to a pension. This lowers the salary on which NICs are paid, saving both employee and employer money. However, we are still awaiting further information as to how the new tax will affect salary sacrifice.

Paying Dividends

The real bolt out of the blue came when the tax on dividends was raised, apparently to counter accusations that the widely anticipated increase in NI would unfairly place the burden of funding health and social care on those who receive their income as wages.

Profit-seeking companies should consider accelerating dividend payments before the 1.25% tax increase takes effect in April 2022, as the resulting tax savings could be substantial.

Despite the planned increase in corporation tax to 25% in 2023, dividends will continue to be more attractive than salary as a means of taking profits from companies, especially for higher earners.

Dividend tax rates will remain lower than income tax rates in 2022-23: 8.75% at the introductory rate, 33.75% at the higher rate, and 39.35% at the additional rate.

It’s worth noting that all businesses will be affected by the 1.25% increase in dividend taxes. Furthermore, there is no distinction between dividends paid by owner-managed businesses and those paid by larger corporations – this is a significant change.

If you have any questions regarding this as to how it may affect your small business or would like help with any tax planning needs, please do not hesitate to contact us on 020 8577 0200 or speak with your client manager, who will be happy to talk through how these changes may affect you.