IR35 changes – Guide for Businesses & Contractors

Reading Time:

April 2021 saw one of the biggest shake-ups of the use of contractors in the private sector. The change fundamentally altered how companies must choose, appoint, and manage their contractors.

Contractors’ responsibility for determining IR35 status and paying applicable taxes will be transferred to private enterprises that hire them, just as in the public sector. These businesses will be held accountable if HMRC determines that their status was improperly assessed.

However, the IR35 changes in the private sector exclude small businesses, meaning that contractors working for them will continue setting their IR35 status after April 2021.

Companies that get this wrong could find themselves with much larger employment costs than they expected and potential penalties and interest applied. By the same token, Agencies and Contractors who mis-apply the rules could find themselves in hot water, so it is important that you get it right.

This post covers questions frequently asked by our contractor clients regarding IR35, such as ‘what is IR35?’, ‘how does IR35 work?’ and ‘will I be affected by IR35?’ as well as how these changes could also affect you as a Limited Company. We have tried to cover as many of the essential questions as possible, but bear in mind that this is a vast subject, so if you are unsure, please do speak to us.

Brief background on IR35

The Intermediaries Legislation (also known as IR35) became law in 2000 created to address the problem of people charging businesses for their services via a Personal Service Company when they were permanent employees. IR35 was a well-intentioned attempt to ensure that employees did not evade paying their fair share of taxes.

At the time of inception, there was an increase in contracting in the UK as more IT, Finance, Marketing sector workers moved to a flexible working model.

Although many have complained that IR35 is both overly complex and a blunt instrument that reduced the incentive for entrepreneurship, in general terms, it seemed to have worked well.

The reforms came into force in April 2020, a year later than planned due to Covid-19.

Brief background on IR35

The Intermediaries Legislation (also known as IR35) became law in 2000 created to address the problem of people charging businesses for their services via a Personal Service Company when they were permanent employees. IR35 was a well-intentioned attempt to ensure that employees did not evade paying their fair share of taxes.

At the time of inception, there was an increase in contracting in the UK as more IT, Finance, Marketing sector workers moved to a flexible working model.

Although many have complained that IR35 is both overly complex and a blunt instrument that reduced the incentive for entrepreneurship, in general terms, it seemed to have worked well.

The reforms came into force in April 2020, a year later than planned due to Covid-19.

IR35 and working as a contractor

Contracting and IR35 laws are inextricably linked. For example, if you work as a contractor through a limited company, you can pay 20% Corporation Tax on your income, deduct business expenses from your tax bill, and avoid NICs by paying yourself dividends.

Contracting is, therefore, typically more tax-efficient than working through an umbrella company or as an employee. Many contractors who operate like employees can enjoy a tax advantage by doing so.

IR35 has been implemented by the government to eliminate this unfair benefit whilst increasing tax collection overall.

How does IR35 affect small to medium-sized businesses?

If your company is large or medium-sized business, then you will be responsible for making sure that you assess the income tax status of all your temporary staff and then evidencing that.

This means that you will need to look at the rules and assess each contractor individually (blanket determinations are not allowed) and then provide a written summary of your determination. You will also need to have a formal appeal process in place.

Put simply, if you get it wrong you could be investigated by HMRC and have penalties and backdated NICs applied or sued by an unhappy contractor.

It is distinctly likely that the number of good contractors will also reduce as the benefits of working in this way will be diminished and many will just opt for PAYE permanent roles.

In any case, if you use contractors then you needed to make sure you had your systems and processes set up by April 2021.

How does it affect agencies or intermediaries?

As an agency, you will either be an introducer or an intermediary. The party that pays the contractor (which in some cases may be recruitment agencies), bears responsibility.

So, employers will now have to make an immediate determination on the contractor’s employment status to see if they are under IR35 and inform the contractor and the respective agency of the decision and the reason behind it.

The main issue for recruiters under the legislation is that they will be in charge of making what can be a difficult decision. Still, they will also become liable for tax and NICs that have not been paid where this decision proves to be incorrect.

There are four main consequences for an intermediary:

- You will have to operate PAYE for workers inside IR35

- You will have to carry out determinations and have an appeal’s process in place

- Finding contractors may become more difficult

- Some clients may refuse to use anyone unless they are on a Fixed Term Contract (FTC)

It is distinctly possible that some agencies may simply refuse to take on roles where the client specifies that they want to engage a limited company contractor.

Also Read: How to prepare Year-end accounts for limited companies

The difference between inside and outside IR35

| What does being Inside IR35 mean? | What does being outside IR35 mean? |

|---|---|

| To be functioning ‘within IR35,’ you must pay the same tax as an employee under the IR35 legislation. However, as an employee or worker, this could mean that you have additional employee rights (e.g., minimum wage, maternity pay). If you work within IR35, you will typically have to pay income tax at the end of the tax year to account for any tax deductions or National Insurance contributions that an employee would have made. | To be operating ‘outside IR35’ means that the IR35 legislation does not prevent you from paying tax on the private contractor basis described above. This means you can pay yourself a salary and withdraw further income as dividends (which are not subject to NIC), whilst your limited company pays tax only on its profits at the corporate 20 per cent rate. Things that show you are outside of IR35 and running a business include:

|

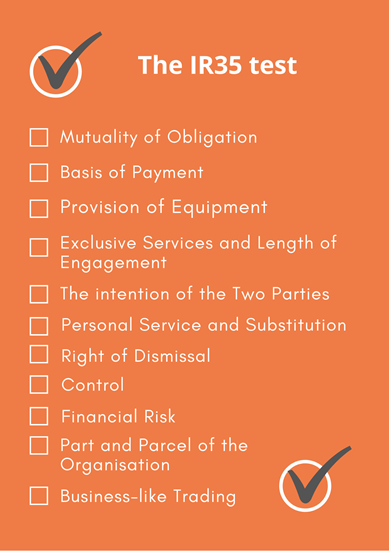

The IR35 test

The following is a compliance checklist of some factors that can indicate whether you are inside or outside IR35.

Mutuality of Obligation: Does the employer have an obligation to provide more work for the contractor, and is the contractor obligated to do it?

Basis of Payment: Does the person get paid a salary or hourly rate?

Provision of Equipment: Does the client provide all, or a substantial part, of the equipment needed to do the job?

Exclusive Services and Length of Engagement: Is the client justified in expecting the contractor to only work for them? Will the contract last for more than two years?

The intention of the Two Parties: Is the intention of the two parties to create an employer/employee relationship?

Personal Service and Substitution: Can the client refuse to accept a substitute contractor?

Right of Dismissal: Does the client have the right to dismiss the contractor?

Control: Is the contractor under the direct control of the client manager?

Financial Risk: Does the client accept the financial risk of the contract?

Part and Parcel of the Organisation: Is the contractor acting like they are part and parcel of the organisation?

Business-like Trading: Is the contractor acting as a business?

You work inside IR35 if you:

- Work for your own limited company, but receive employment benefits such as paid leave or sick pay

- Are paid on a time basis

- Carry out all the work that your company is contracted to do personally

- You are supplied with the equipment by a client and work at their premises

You work outside of IR35 if you:

- Are paid on a project-by-project basis or at an agreed fixed price

- Can delegate or substitute work contracted to another person

- Have your own limited company and do not take paid leave or receive sick pay

- Supply the appropriate equipment and occasionally work from your home/premises

New IR35 rules for the Private sector

For the contractor

If your client is a small company, your limited company will be responsible for assessing whether IR35 applies. The Companies Act 2006 defines a small business as a business with two or more of the following features:

- Turnover does not exceed £ 10.2m

- A balance sheet total of no more than £5.1m

- 50 employees or fewer

Companies that are part of a group will be treated at an aggregate level. For example, a company might only have 5 employees but own a subsidiary that has 45, in which case it is in scope.

The rules will apply from the start of the tax year after the point where the organisation breaches the limits. This means that companies need to consider where they will be during the year and ensure that their contracting arrangements are compliant.

When two or more of these conditions are met for two years, the small business exemption applies, and the intermediary is still responsible for following the IR35 rules.

If the requirements are no longer met, the business must start using the IR35 rules at the beginning of the tax year that starts after the filing date for the second financial year. The amount of time a business has to start following the rules depends on when its accounting year starts.

Find out whether you or a worker on a certain engagement should be considered an employee or an independent contractor by using the HMRC CEST tool.

Need an IR35 contract review?

A full IR35 Contract Review assesses your contract and working practices, ensuring you are compliant and providing the relevant evidence. It will also show HMRC that you have taken reasonable steps to establish your status outside IR35.

We work with a market-leading third party to provide you with a heavily discounted IR35 assessment for just £74.50 that could save you both money and keep you outside of IR35.

Take advice from a specialist Contractor accountant.

Fusion Accountants has been serving Contractors for over 30 years. If you are a contractor, then you need to make sure you are compliant with the legislation before you accept a contract or you could find it is significantly less lucrative than you thought.

We offer the perfect mix of software, tax planning and accounting support – get the most out of your accounts with prices starting at just £69 + VAT per month. Please contact us on 020 8577 0200 or schedule a meeting with us.

If you are a company then you need to take advice about setting up your determination process, which we can also help with this & if you are an agency, then you need to talk to us and get your systems in place sooner rather than later.

Also Read: Freelancer Guide to Managing Cash Flow