Xero and Expensify App Integration

Reading Time:

Expensify is a receipt and expense management software designed to replace hard to use expense reports that were commonplace during its inception.

With various functionalities such as ‘one-click’ receipt scanning, company card reconciliation, automatic approval workflows and automatic accounting syncs, keeping track of expenses is easier than ever. If you are looking for software that offers Unlimited receipt tracking and expense management, please visit the Expensify website.

If you already have an Expensify account and are looking for a step-by-step guide on syncing it with your Xero Accounting software, read on!

Here’s also a video from Xero on the benefits of using Expensify.

Expensify + Xero

Tracking and submitting expenses can be a massive job for business travellers who are constantly on the go. As the receipts pile up, so does time spent on tedious administrative tasks and the chance for errors.

How to integrate Expensify with Xero

Step 1

Log into your Expensify account.

Step 2

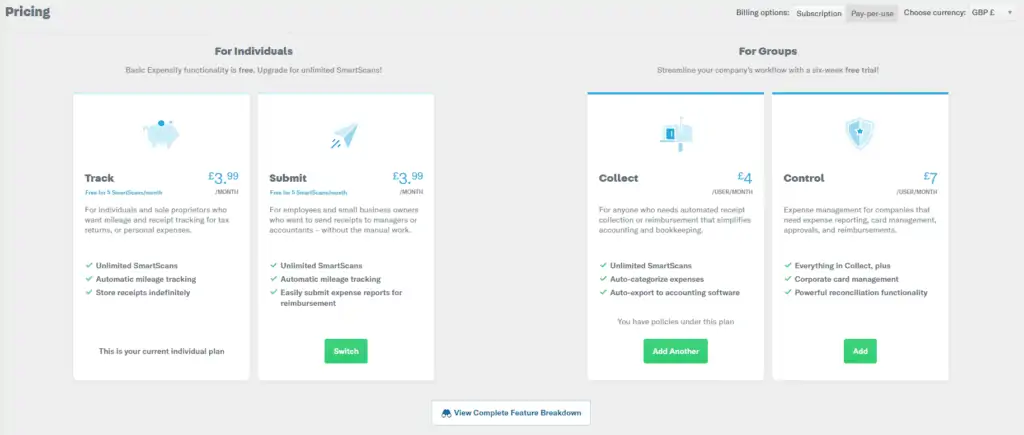

Make sure your pricing plan is a ‘Collect’ or ‘Control’ Pricing plan.

Step 3

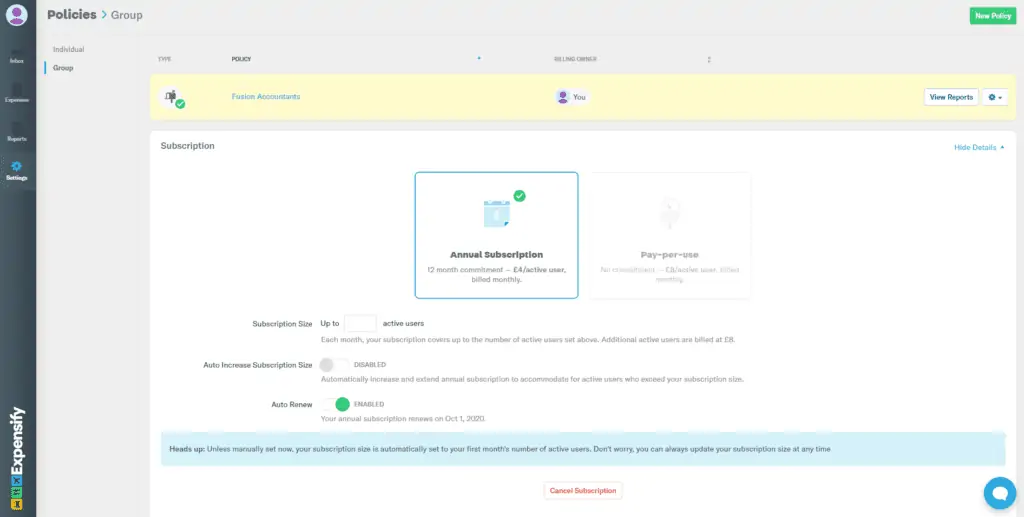

Once selected, you will then be able to enter the Settings/Policies tab and then select your company name under the group Section.

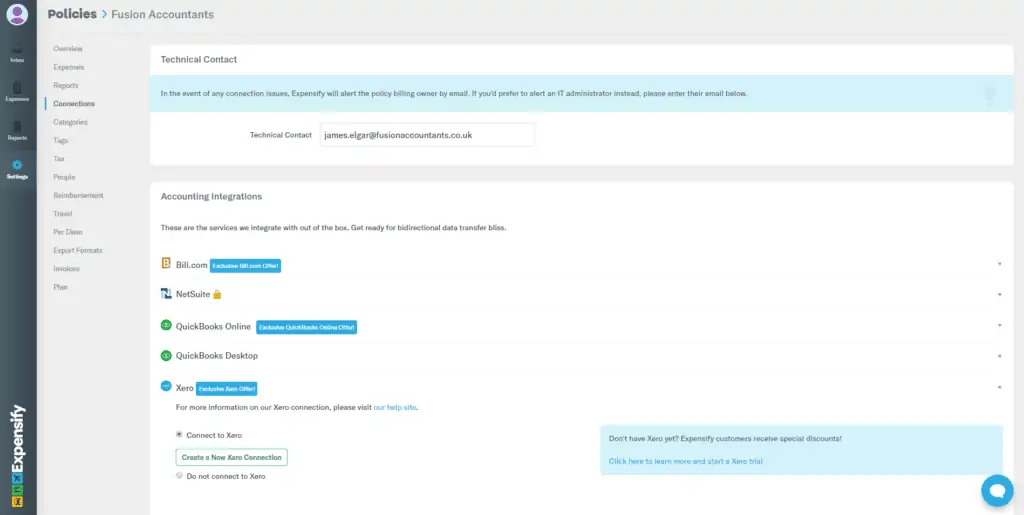

This will open more settings on the left from which you will need to choose the connections option. From here, you will need to select the app you wish to integrate with from the list. In this case, Xero.

Step 4

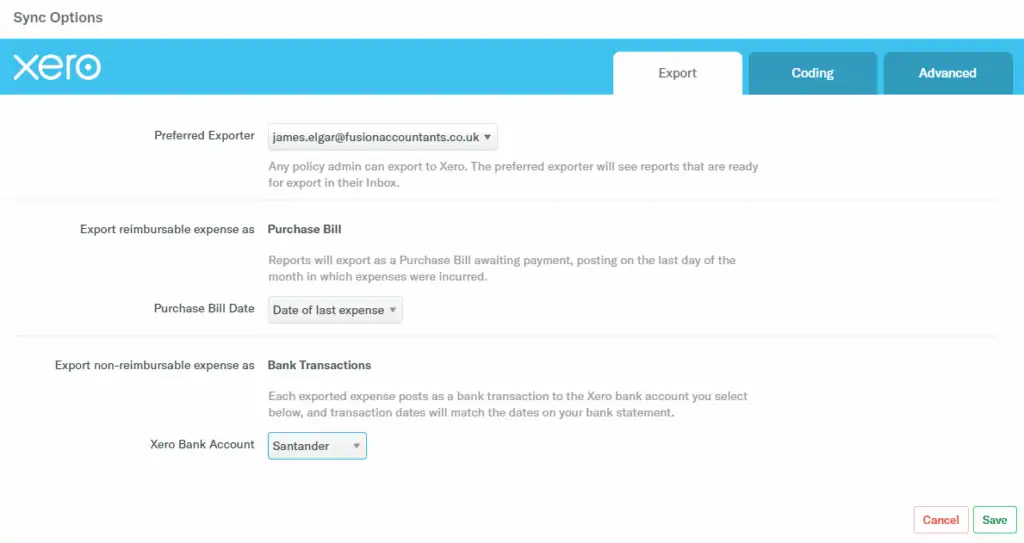

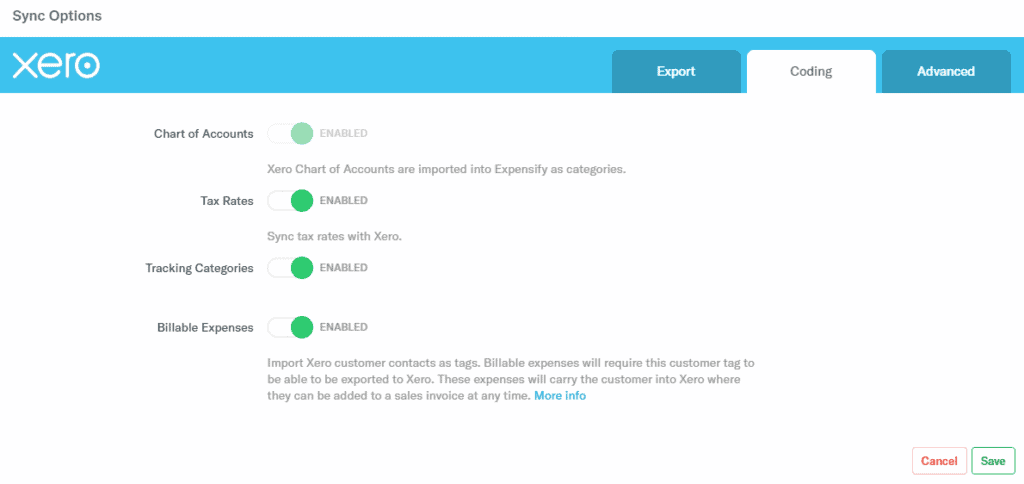

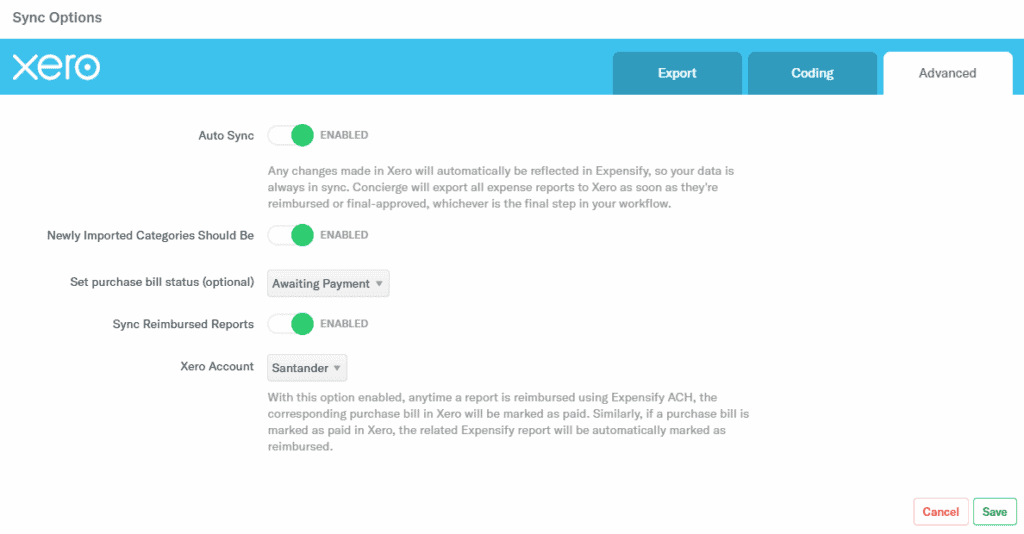

Clicking the ‘Create a New Xero Connection’ link will open the Xero Login Page where you will need to log in. Once logged in, Expensify will automatically connect to Xero and will then open the sync options.

Step 5

Clicking saves will finish off the connection process.

Step 6

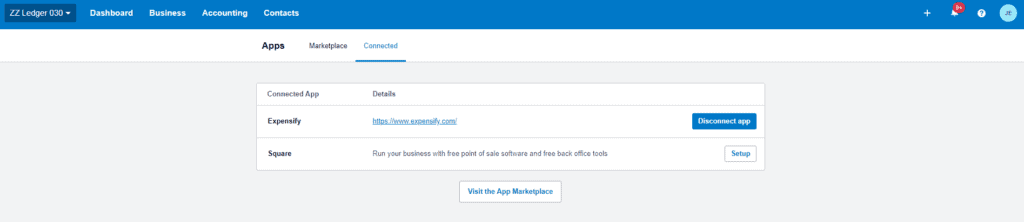

You now need to check if the connection is showing in Xero. Log back into your account and go to the Now check to make sure the connection is showing in Xero. Log back into your account and go to the settings menu, under which you can find the ‘Connected Apps’ option. Clicking this will open a page showing all of the apps connected to Xero. Congratulations, you have now integrated Expensify into Xero. You can also disconnect the app from here, at any time.

How Xero is affected by the integration and the double entries involved

Expensify lists the changes it will make in Xero as the following adjustments.

1. Export Reimbursable expense as – Purchase Bill

This will create a purchase bill in Xero that is awaiting payment. The double entry is;

- DR Expense

- DR VAT

- CR Liability Account

2. Export non-reimbursable expenses as – Bank Transactions

- DR Expense

- DR VAT

- CR Bank Account

Also Read: Vend Xero integration

Xero Accountants in London

We are a Xero Platinum Partner making it so much easier for you to keep on top of your accounting records, bookkeeping, payroll, and VAT to reduce your admin time and increase the profitability of your business.

Available on mobile and desktop, get your business into great shape with day-to-day financials and cash flow projections to avoid cash shortages.

We also provide free training and set-up if you are using this accounting software for the first time or need a bit of a refresher!

If you need help in setting up your Xero with Expensify, or looking for a Specialist Xero Accountant, then give us a call to speak to one of our advisors on 0208 577 0200.

Also Read: The Biggest Problem with Xero Integrations, And How You Can Fix It