Revolut mobile

business banking

Get more from your business account with powerful tools that give

you total control over your finances.

Revolut bank for business growth

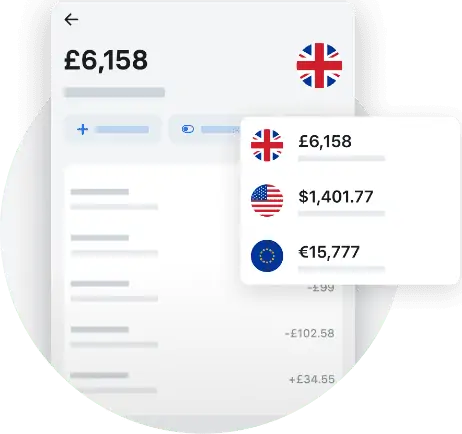

From your everyday spending or mapping your future with investments and savings, Revolut bank already helps over 500,000 businesses worldwide. So, if you are a small business or entrepreneur looking for a bank account to control payments and expenses all hosted in one place, this might be the correct account for you.

Why we love Revolut for business

If as a Revolut customer, you sign up for one of the price packages, we will manage the whole sign up process to the software of your choice and sync up all your personal or business transactions in no time at all. In addition, we offer free training and any additional support to make sure you are up and running successfully.

How Revolut benefits business

Revolut Business offers several features to deliver a better overall experience. They are the only business account that offers end-to-end expense management, allowing businesses to automate bulk payments, regardless of business size or payment amount.

- Optimise your process with custom integrations, including Zapier and Slack.

- Save time and scale quickly by automating your business processes with our Business API.

- Automate your expenses and capture receipts in the app instantly.

- Never overspend again on subscriptions – manage, limit and cancel from one place.

Save time with seamless integrations

- Automate accounting with Xero, Freeagent, and QuickBooks.

- Customise your workflow with Zapier and Slack integrations.

- Our Business API automates business processes saving time and money.

- Automate expenses and receipts in the app

- Manage, limit, and cancel subscriptions in one place.

Fusion Services

We provide a comprehensive range of accounting and tax services to help launch your new venture.

Customer service reviews

Fusion were recommended to me as I had no previous experience of accounting. The staff are professional, helpful and give great advice about how best to use your money. When action needs to be taken they call and remind me, and the accounting software they use is easy to operate and believe they have saved me money I would have otherwise lost without their advice.

Ollie Sundance

Our accounting software partners

Keeping track of your accounting records, expenses, payroll, VAT, and bookkeeping has never been easier thanks to our cloud accounting software partners Xero, Freeagent, and QuickBooks.

You can use the online accounting software to keep track of all your business finances. Create and send invoices, import bank statements, track expenses, and see your tax liabilities in real-time, all the time.

If you are also VAT registered, the software makes submitting VAT returns to HMRC simple – making you MTD ready! We will also be in touch well in advance of your VAT deadlines, so you avoid any late filing and potential penalties.

Fusion Accountants in London

We have been providing comprehensive accounting and tax services to UK businesses and individuals for over 30 years. We provide a stress-free, friendly, and dedicated service to our clients, as well as the most up-to-date accounting software and banking apps that will improve their cash flow and reduce administrative time.

Once onboarded as a client, you will be assigned a qualified client manager who will work with you to understand your concerns and ensure that your financial operations run smoothly.

You can count on us to provide you with leading professional accounting services, and we are only a telephone or video call away if you need us. We will also give you a courtesy call once a month to see how you are doing.

Our team will make sure you keep as much of your hard-earned money as possible while staying in compliance with HMRC requirements.

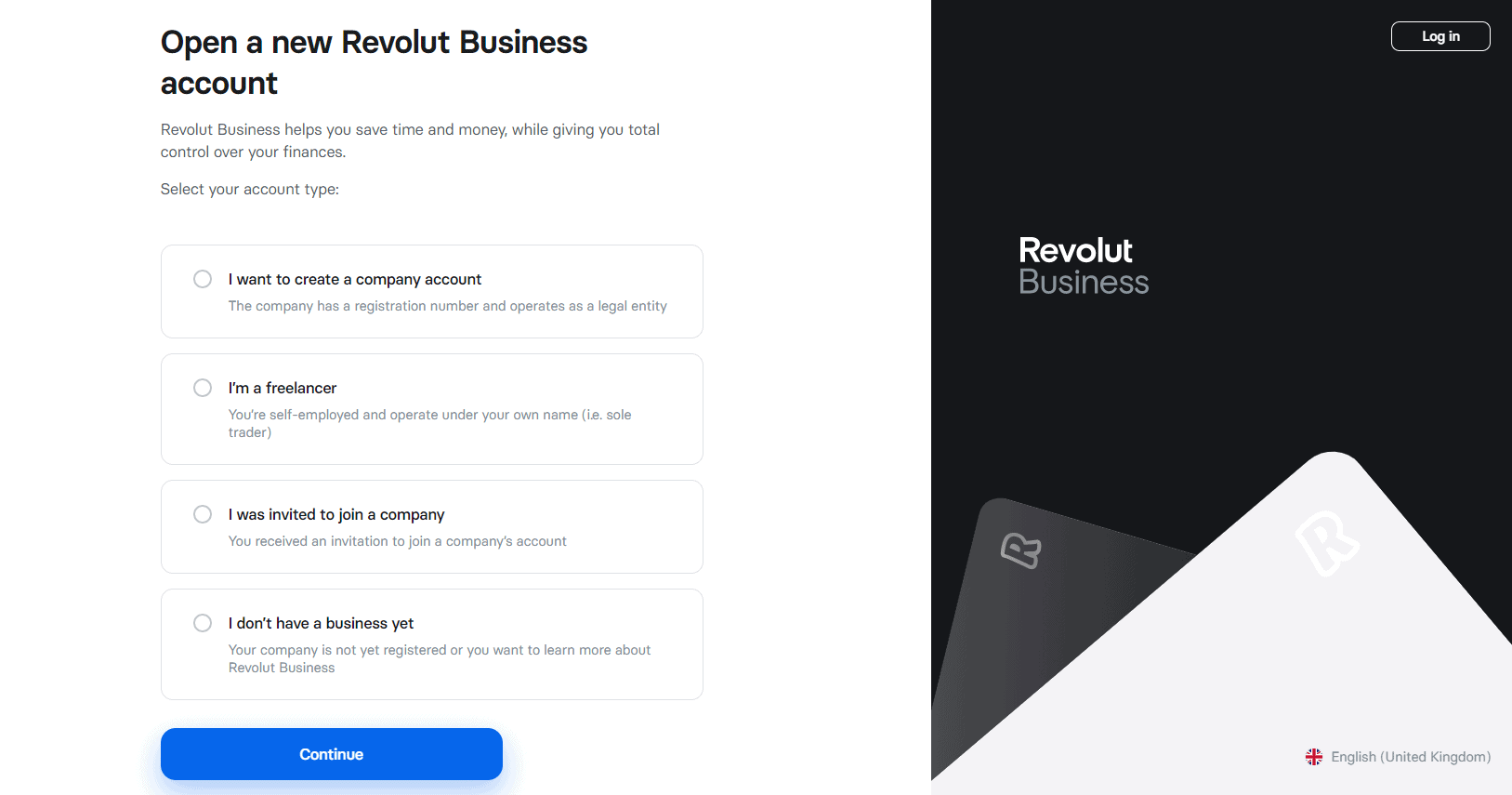

Sign up to Revolut

We will handle the sign-up process with the software of your choice. We will also help you get started quickly, synchronising all of your personal and business transactions with a single click. Once onboard you will have access to a number of their free features such as payment approval, user permissions and bulk payments

Meet our accounting software specialist

Khalid Sayal

Client accountant

“I joined Fusion Accountants in 2020. I work as a client accountant. I am accredited as Xero advisor, Xero payroll certified, QuickBooks certified Basic and Advanced ProAdvisor. I deal with small to medium-sized entities, contractors, Landlords, sole traders and freelancers.

I like weightlifting and in my spare time, I like reading books, especially non-fictional ones.”

Follow Us:

FAQ ‘s

How do I add my bank account to Revolut?

- Tap on ‘Accounts’ tab.

- Click the ‘Add money’ button.

- Input your debit card or bank account information and tap ‘Continue’

- Enter the amount of money you want to add and then tap the ‘Add money’ button.

You can find more information here

What are the accounting software integrations available on Revolut Business?

The bank offer integrations to the leading accounting software partners – such as FreeAgent, Xero, and Quickbooks which we can help sync up for you to streamline your processes.

How do I integrate my accounting software?

Click on “Connect” on the left panel on your mobile app, select your accounting software and follow the instructions. Please get in touch with us, or use the in-app support chat in case you have any questions.

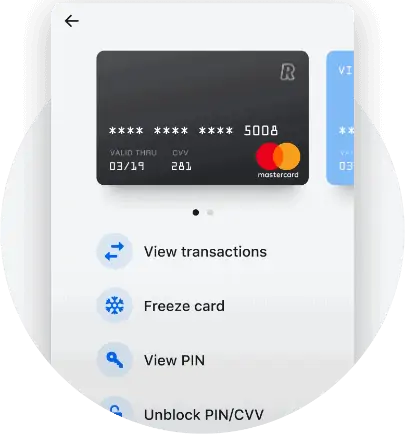

Is Revolut a credit or debit card?

The Revolut card is a prepaid debit card so you won’t receive an account number or sort code but you will be able to make transactions online. … As you load up the card with the money from your bank account, your card will simply be declined if there is no balance there to use on your transaction.

Can I withdraw money from Revolut?

You can withdraw cash from any cash machine in your home country or overseas that supports Visa or Mastercard, but please look out for any fees that are applied by some ATM operators. As a rule of thumb, you should always opt to be charged in the local currency of the country you’re in!

How much can I withdraw Revolut?

With Revolut, you can withdraw $300 for free each month (on standard) via our network of 55,000+ surcharge-free ATMs.

Can you put cash on a Revolut card?

You can have wages paid into your Revolut as your account comes with BIC and IBAN numbers, but the company has no physical presence, so you obviously can’t make cash deposits or log cheques at your local branch.