Monzo Business Bank

Monzo business bank

customers

Monzo the app-based bank

Monzo Bank was introduced in 2015. Today it offers a new way of banking; an account managed and run entirely through a mobile app.

You can open a complete UK bank account from your phone for free. So spend, save and manage your money all in one place!

The benefits include better visibility and more control over your money with less time spent on finances meaning more time to build your customers and sales.

However, the account isn’t open to everyone. This includes partnerships (including Limited Liability Partnerships), charities, limited companies by guarantee, community interest companies and trusts and funds.

You can find the complete list on their website and is only open to UK Sole Traders and Limited companies that only pay UK tax with an active Company Director and one other person.

Why we love Monzo for businesses

With our business price packages we can offer you full accounting software support, syncing up your account with Xero, FreeAgent, and QuickBooks, making the tax and accounting process much easier. Businesses can also set up “sub pots” or accounts to save specific costs. In addition, you can export your transactions as CSV, PDF, or QIF files if you do not use accounting software.

You can manage your business account wherever you are, with mobile and web access with in-app invoicing and digital receipts.

Suppose you are a Monzo customer and sign up for one of the price packages; we will manage the whole process of connecting to your preferred accounting software, sync up all your personal or business transactions as well as provide any free training, on request, to make sure you are up and running successfully in no time at all!

How Monzo

benefits business customers

- Fully regulated UK bank

- Regulated by all the same rules as high street banks

- Open an account straight from your phone

- Award-winning customer support, 24/7

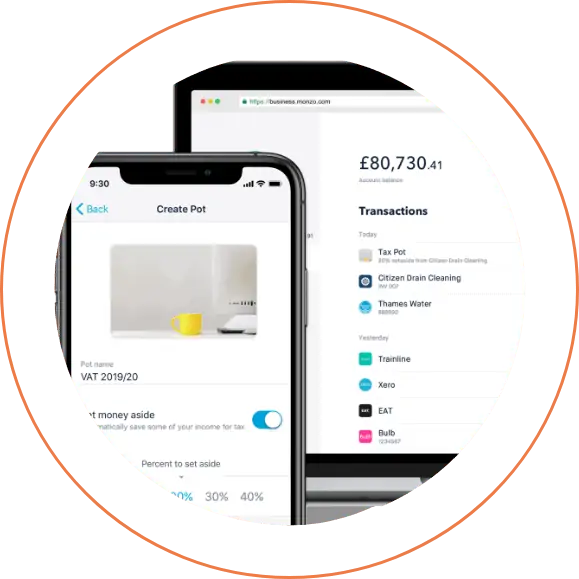

Choose what to set aside for tax, use tax pots to:

- Move money easily with free, instant bank transfers (the UK only)

- Automatically set a percentage of your income aside when you’re paid

- Neatly separate your money, all in one bank account

- Stop worrying about saving, and spend more time on your business

Fusion Services

We provide a comprehensive range of accounting and tax services to help launch your new venture.

Our accounting software partners

Our cloud accounting software partners, Xero, Freeagent, and QuickBooks, make keeping track of your accounting records and bookkeeping effortless.

Send invoices, import bank statements and record expenses straight from your Monzo account and get a real-time view of your account and how much tax you owe.

If you are VAT registered, the software will submit your VAT returns to HMRC a much easier process – so you are MTD compliant!

We will contact you well in advance of your VAT deadlines to avoid late filing penalties.

How Fusion Accountants helps its business clients

We understand that clients want a simple, friendly, and transparent service that offers them the latest exciting accounting software and apps to enhance their business without losing that personal touch.

Once on board as a client, you are allocated a dedicated and qualified client manager who will work closely with you to help ensure your financial operations run smoothly.

We are dependable, trustworthy & precise and are always on the end of the phone if you need us, and once a month, we will drop you a courtesy call too, just to make sure you are OK.

Our dedicated team of Accountants in Harrow will ensure you hold onto as much of your hard-earned cash in the most tax-efficient way possible, following HMRC requirements. Of course.

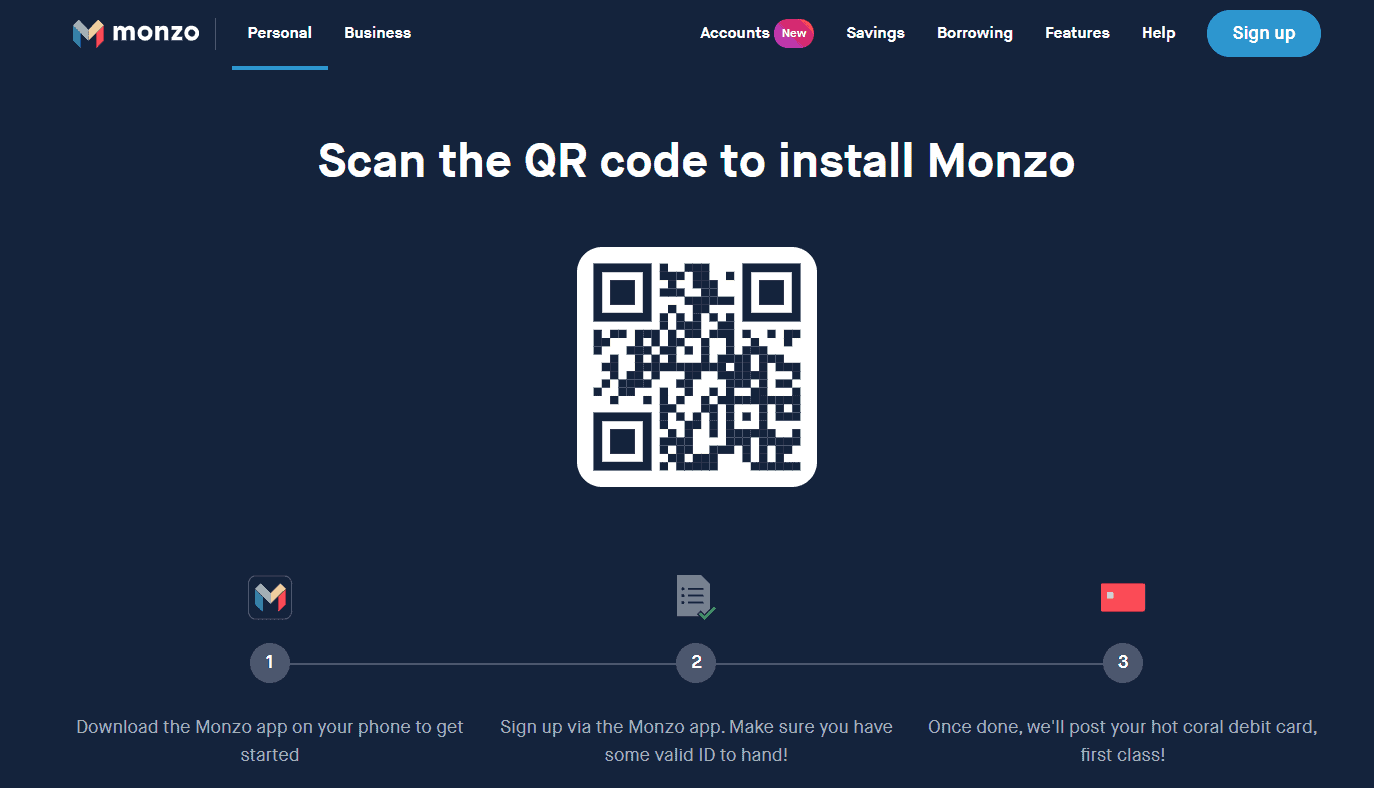

Get started with Monzo Business

Thousands of business owners have already changed the way they do business banking. Sign up from your phone to set up an account, or click on the image below to take you straight there.

Step 1:

Download the Monzo app on your phone to get started

Step 2:

Sign up via the Monzo app. Make sure you have some valid ID to hand!

Step 3:

Once done, we’ll post your hot coral debit card, first-class!

Get in touch with one of our bank specialists

Got an accountancy question or looking for tax advice?

Monzo customers

Don’t forget: If you are a Monzo customer and you sign up to one of our price packages, we will also manage the signup process to Xero, Freeagent or Quickbooks accounting software for free, provide training and any additional support to make sure you are up and running successfully syncing up all your personal or business transactions in no time at all.

Customer service reviews

Our accountant Khalid Sayal has been excellent. Efficient, accurate, speedy, great to work with. The onboarding process has been excellent and there's no indication that the service would be any less in the future. I actually chose Fusion on the back of all the positive google reviews - which they clearly right deserved.

Emma Clark

Meet our bank specialist

Khalid Sayal

Client accountant

“I joined Fusion Accountants in 2020. I work as a client accountant. I am accredited as Xero advisor, Xero payroll certified, QuickBooks certified Basic and Advanced ProAdvisor. I deal with small to medium-sized entities, contractors, Landlords, sole traders and freelancers.

I like weightlifting and in my spare time, I like reading books, especially non-fictional ones.”

Follow Us:

FAQ ‘s

Which accounting software can I connect to my Monzo business account?

Integrating accounting tools has become an essential part of any bank account package. You can sync up your Monzo Business Account with Xero, Quickbooks or FreeAgent. Remember, if you sign up as a client we will synchronise the process between your bank and software packages.

What do I need to open a Monzo account?

To get started, you will need your phone and any of the following ID:

- Passport.

- Driving licence (your provisional is fine)

- National ID card.

- Biometric residency permit.

- Firearm or shotgun certificate.

- Electoral Identity Card issued by the

- Electoral Office for Northern Ireland.

Why can't I open a Monzo business account?

To apply for a Monzo Business account, you will need to have a personal current account with them first. If you meet this criteria you can apply for a Monzo Business Account, but it doesn’t guarantee that you’ll get an account. Check to see if you are eligible to open one of their business accounts.

Can I have an account if I am a Sole Trader?

You can use your personal bank account for all business transactions. This is because as a sole trader, your personal and business income is treated as one and the same by HMRC for tax purposes. Check their website for more information.

Do I need a business bank account as a Sole Trader?

As a sole trader, you are not legally required to have a business bank account. You can use your personal bank account for all business transactions. This is because as a sole trader, your personal and business income is treated as one and the same by HMRC for tax purposes.

Is it possible to have two Monzo business accounts?

At the moment, you can only open one Monzo Business account.