Buy-to-let tax guide for UK landlords & property investors

Reading Time:

What is buy-to-let property

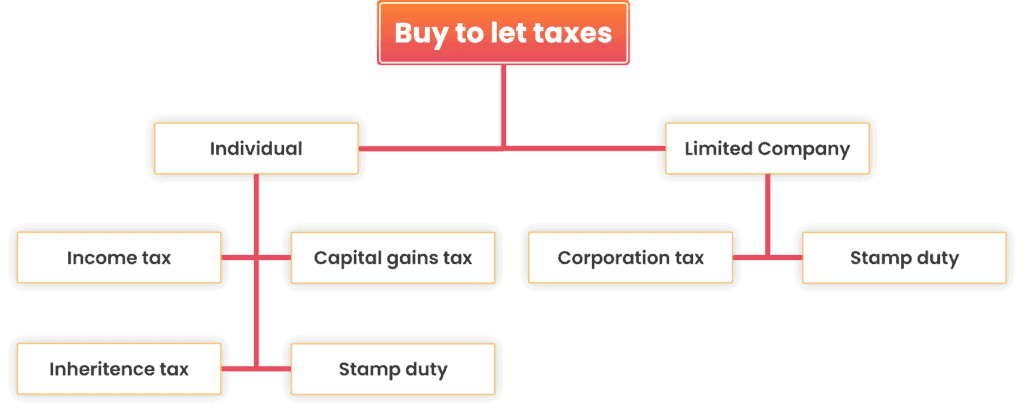

“Buy to let” is a type of investment in property. In this type of investment, the property is purchased via mortgage not for personal use but for the purpose of letting it out and earning rental income from it. Mortgage is paid from the rent received from the property. Usually, for investors, buy to let is a way of increasing their property portfolio. Buy to let mortgage is normally more costly than the traditional one with more initial investment in the form of deposit starting from 25%. A number of tax implications apply to buy to let properties, which are explained below.

If you are an investor in a buy to let property, please “click here” to read our guide on how to manage a buy to let portfolio.

What are buy to let tax implications and tips to save incidental taxes

Income Tax

Income tax becomes applicable when you as a landlord receive rent as income. A landlord is required to declare the rent he/she receives in his self-assessment tax returns. Depending on whether you are a basic rate, higher rate, or additional rate taxpayer, the tax on your rental income will be charged as 20%, 40%, or 45% respectively.

The good news is that it is possible to reduce the amount of tax you have to pay on your rental income by making use of the option of deducting the “allowable expenses” from your rental income.

Mortgage interest payments, maintenance costs, and letting agent fees come under “allowable expenses”.

If you are looking to maximise your deductions against taxable rental profits, please click here to read our guide on allowable expenses.

Though since April 2020, mortgage interest payments as allowable expenses apply only to the basic rate taxpayers by way of a tax credit. However, this limitation on allowability of mortgage interest applies to individual landlords and not on corporate bodies i.e limited companies. This why, some landlords/property investors decide to hold/own their property through a limited company to avail 100% tax relief on mortgage interest.

Capital gains tax

Usually, one of the main motives behind investing in buy to let property is the expectation of making big profits from increase in the market value of the property. However, you will not be able to keep all of the profits from the eventual sale of the property and will have to pay capital gains tax when you sell a second home or buy to let property and gain a profit i.e sell it more than its allowable costs.

Allowable costs include the purchase price, stamp duty land tax, cost of any improvements and other legal and professional expenses incidental to the sale of property.

Capital gains tax does not apply if you make a profit on the sale of your main residence. Furthermore, there is no capital gain tax payable on a gain of upto £6,000 on selling your property other than your main residence. This is called annual capital gains tax allowance/exemption. This was reduced with effect from 1 April 2023 from £12,300 to £6,000.

The rate of applicable capital gain tax on profit on disposal will depend on your income tax band. If you are a basic rate tax payer, then you will need to pay capital gain tax of 18%. If you are a higher or additional rate payer of income tax then you will need to pay capital gain tax of 28%. You will need to report and pay any capital gains made to HMRC within 60 days of date of sale.

Also Read: Choosing A Business Structure

You can save and reduce your Capital Gains Tax (CGT) by;

- It will be wiser to have the asset in your spouse’s name if they have a lower tax bracket. In general, capital gains tax is not paid on the transfer of assets between the spouses and so this gives you an opportunity to save tax by taking advantage of a lower tax bracket. Similarly, having a partner who jointly owns the property with you can combine your allowances and raise the limit from £6,000 to £12,000.

- Making sure you claim relief for all allowable expenses as mentioned above

- Owing the property through a limited company. A limited company will pay corporation tax on any CGT made at a rate of 19% to 25%. However, with effect from 1 April 2023, the attractiveness of this measure has been greatly reduced with increase in corporate tax rates from 19% to 25%, depending on profits.

- Making sure to avail any private residence or letting relief available. You will be able to claim private residence relief if your buy to let property was being used as your main residence before being sold. Similarly, you can claim letting relief of upto £40,000 if you let the property at some point of your ownership to the tenant.

- Making use of business asset rollover relief if available. This relief will basically defer the payment of any capital gains made on the sale of your buy to let property until its replacement. You will need to use the sale proceeds to buy another business asset/property to be eligible for this relief. You will not be required to pay CGT until you hold this new property. However, please note that this relief will only apply if your property is classified as furnished holiday letting. This relief is not available for ordinary residential letting as HMRC does not regard ordinary residential letting as a trade as opposed to furnished holiday letting which is regarded as a trade.

If you want to know more about furnished holiday letting (FHL), please click here to read our guide on FHL.

Stamp Duty Tax

This type of tax applies when you purchase a property unless you are a first-time buyer and the price of property is under £300,000. It will be highly unlikely for a buy to let property investor to be first time buyer. Stamp duty tax rates depend on the price of the property. A 3% surcharge in stamp duty tax is applicable on the purchase of a second property.

You may be able to get a refund for the surcharge if you sell your original property with 18 months.

You can also save yourself paying stamp duty on your second property if you let your children owing the title to the property.

Inheritance Tax

When the sole owner of a buy to let property dies then the property is included in the owner’s estate. 40% Inheritance tax is applicable on this property if its value is more than £325,000. This limit can increase to £650,000 when the individual limits of a couple, married or civil partners, are combined. Inheritance tax can be saved by exercising some of the following options;

- Transfer the property to your kids in your lifetime will reduce your estate value and hence inheritance bill. You will need to live for at least 7 years to not having to pay inheritance tax on the property.

- Create a trust to hold the property for your kids. You do not have to keep any beneficial interest in the property. After 7 years of living, there will be no tax to pay.

- Incorporate your portfolio. This will enable you to transfer shares to your kids gradually without CGT by keeping gains with in your capital gain tax annual allowance. Furthermore, you can keep your monthly income from the property in the form of salary from the company.

Corporation Tax

In the case where a buy to let property is owned by a limited company then instead of income tax, corporation tax is applied to the income generated through the rent. From April 2023, corporation tax rate has been increased from 19% to 25% depending on the level of a company’s profit.

However, you can reduce your corporate profit by claiming allowable expenses like repair and maintenance, utilities, insurance, estate agents fee, accountants fee etc. One of the major advantages of owing a buy to let property through your company is the availability of 100% relief on interest payments on mortgage. You can further reduce your taxable profits of the company by claiming capital allowances for eligible capital expenditure i.e on plant and machinery. Please note that you will not be able to claim capital allowances on ordinary buy to let residential property. However, you can claim capital allowances if the buy to let property is regarded as furnished holiday let.

Conclusion

Buy to let property is an investment property financed through mortgage and earning rental income for the investor. There are many tax implications associated with the decision to go for a buy to let property. The tax you will need to pay also depends on the way you will own the property i.e individually or through a limited company. Furthermore, the nature of your income generating activity will also determine the type of taxes you will need to pay like if you are involved in ordinary residential letting or furnished holiday letting. The good news is that there are ways to reduce your tax bill. If you have a buy to let property or thinking to invest in one and need advice on how to save taxes associated with your buy to let property, you are at the right place. We at Fusion Accountants, have helped many of our clients to understand and save the taxes behind buy to let arrangements.

Also Read: Guide To Creating Contractor Invoices