Starling Bank

Business banking – but not as you know it. Apply for a free digital business account in minutes and join over

300,000 UK businesses who have changed the way they bank.

Starling business bank account

We are delighted to partner with Starling Bank – winners of the best British bank for three consecutive years (2018 – 2021) who are fast becoming the bank of choice for many small business owners, sole traders and limited companies.

Who is Starling Bank?

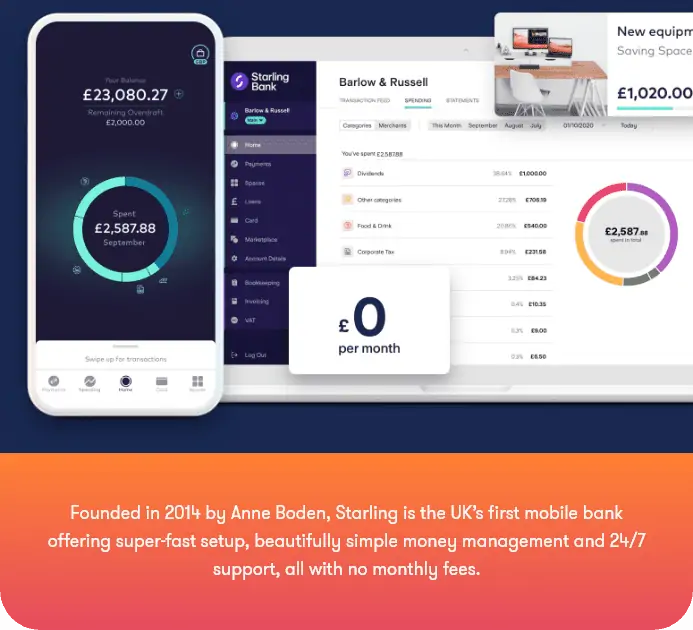

Starling, the UK’s first mobile bank, was founded in 2014 by Anne Boden and offers super-quick setup, simple money management, and 24/7 support, all without any monthly fees.

Starling’s award-winning business bank account centres on entrepreneurial life, making it a little easier for everyone, from small businesses with big dreams to freelancers figuring out tax returns.

- Speedy set-up: the application takes a few minutes to complete, with no paperwork or branch visits required.

- 24/7 customer support: check their help section or contact them via in-app chat, phone or email.

- Cash deposits at over 11,500 Post Offices nationwide..

- Xero, QuickBooks, and FreeAgent integrations: instantly share your transaction feed with your accounting software.

- Manage your cash flow with real-time notifications that appear when money enters or exits your account.

- Spending Insight shows you where your company’s money is going.

- FSCS protection: fully licenced bank, and the FSCS protects eligible customers up to £85,000.

Who’s eligible for a Starling business bank account?

- You’re the owner of a limited company and you’re the only person with significant control (PSC) over it.

- You’re part of a limited company with multiple owners. With our multi-PSC account, you and your fellow PSCs will each get a Mastercard debit card and access to a beautifully simple mobile bank account. For more information, read their blog post titled ‘Introducing: Multi owner mobile business accounts for limited companies.

- You’re self-employed. Our sole trader account is available exclusively to those who already have a Starling Bank personal account.

- Entities engaged in or linked in any way to, certain activities may not be able to open or have a business bank account with Starling. Visit their legal documentation page and select Business Current Account Terms for more information.

Getting started

Apply in minutes

It takes just a few minutes, direct from your mobile. No paperwork or branch visits are required.

- Click on your Accountants application link

- The app is available on the Google

- Play Store and the App Store.

Fill in your personal information. - Upload your identification documents and send us a short video to prove who you are.

- We’ll run some quick checks at a credit reference agency in the United Kingdom.

- Give some information about your company, such as its daily operations and online presence.

- After that, we’ll work to approve your application as quickly as possible.

Link your Accounting Software

(Xero, QuickBooks and FreeAgent)

You can easily integrate your account with Xero, QuickBooks and FreeAgent direct from the Starling app.

- From the ‘Account’ menu, go to the Starling Business Marketplace.

- Click ‘Accounting’ and then find Xero, QuickBooks or FreeAgent.

- Click ‘Add’, authorise access, set up the account on Xero, QuickBooks or FreeAgent – and that’s it!

Fusion Services

We provide a comprehensive range of accounting and tax services to help launch your new venture.

Loans from Starling

Starling is here to support you through the pandemic by participating in the government’s Bounce Back Loan Scheme (BBLS). More information is below:

- They offer Coronavirus Business Interruption Loan Scheme (CBILS) lending to Limited Companies and Limited Liability Partnerships. This scheme provides a government-backed guarantee on loans and overdrafts.

- CBILS loans are offered from £50,001 to £250,000, and overdrafts from £50,001 up to £150,000.

- They are trying to deliver CBILS and BBLS borrowing as quickly as possible to our customers, but are not accepting applications for non-CBILS or non-BBLS Starling business loans or overdrafts.

How does Starling’s business account

compare to other accounts?

In a word, favourably! Their business account measures up against the other banks and e-money issuers when it comes to things like customer support, fees, features, payments, borrowing and more.

Ready to switch to Starling?

With the Current Account Switch Service (CASS), you* can make Starling your main business bank account in just seven working days. However, it’s worth noting that the CASS service is currently only available to Starling business customers with companies with one person of significant control. To find out more, click here.