Claiming research & development (R&D) tax credits

Rewarding innovation

We will work with you on the claims process.

Supporting businesses of all sizes get money for their innovation to re-invest back into their business.

Our seamless process maximises your chances of securing your tax claim.

Support 100’s of businesses with R&D claims

Dedicated and experienced R&D account team

Submit your claim & liaise directly with HMRC

Competitive pricing packages

What are R&D tax credits?

R&D tax credits are a government incentive to promote innovation and boost the UK economy. Since 2000, R&D tax credits have been available to all businesses. It also helps businesses in the UK develop world-class products, processes, and services.

Profitable businesses can save up to 25% of their eligible costs on taxes. However, with a payable credit worth 33% of qualifying R&D costs, the tax break can be just as valuable for loss-making businesses.

Even if the project is ultimately unsuccessful, over 300,000 claims have been filed, totalling £33.3 billion in tax relief.

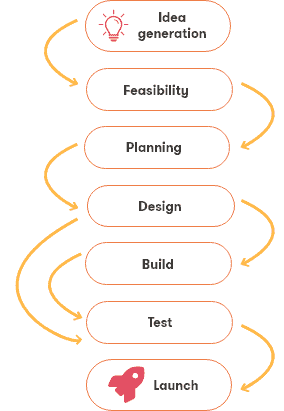

How do companies apply for R&D Tax Credits?

A company can claim R&D tax credits if it invests in new products, processes, or services. Investing in R&D also qualifies for a tax credit in cash or a reduction in corporation tax.

The scope of identifying R&D is vast, including but not limited to IT & telecoms, medical, engineering, construction, packaging, food & beverage.

Your company must be working on a project to advance science or technology. To overcome the uncertainty, you must show that you conducted research, testing, or analysis. An overview of the project’s successes and failures might well be enough.

If you claim R&D for the first time, you can usually claim tax relief for the last two completed accounting periods.

What activities are included in R&D?

- Developing ways of manufacturing new products. Increasing process efficiency/safety that also protects the environment or reduces emissions.

- Improvements to manufacturing processes or machinery (more efficient or improved product quality) use fewer resources and improve safety.

Is my business eligible for R&D tax credits?

- Be the owner of a UK limited company that is subject to Corporation Tax.

- Have carried out qualifying research and development activities.

- Have spent money on these projects.

What costs qualify for R&D tax credits?

- Staff and salaries, employer’s NIC, pension contributions and reimbursed expenses.

- Subcontractors and freelancers.

- Materials and consumables (i.e., heat, light, and power) that are transformed by the R&D process.

- Some software.

- Payments of clinical trials.

Why Choose

Fusion Accountants

Our dedicated R&D account team will work with you to document each R&D activity and guide you through the claims process. We will then submit your claim to HMRC on your behalf.

Partnership with Apogee R&D

Supporting businesses of all sizes get money for their innovation. Founded by four colleagues and friends who wanted to bring an innovative, client-centric approach to the R&D tax credit sector.

With a first-class reputation for maximising R&D tax credits claims for companies in manufacturing & engineering, pharmaceutical, software, supply chain, digital design, immersive technology, food and beverage, and many more, Apogee helps SMEs across all sectors receive millions of pounds.

They provide exceptional service at a reasonable cost, ensuring that all eligible activities and expenditure (and none ineligible) are captured and properly presented to HMRC. Contact us to find out more.

Research and Development examples

A few examples of the type of project that might qualify for R&D tax relief:

Designing new ways of using different materials in construction.

Creating the prototype for an energy-efficient appliance or device.

Researching new medicines and drugs.

Which R&D tax credit incentive

is right for my business?

What incentive you use to make an R&D tax credit claim will largely depend on whether you are a small or medium-sized business (start-ups can also fall into this category) or a large company.

For SME’s:

- With fewer than 500 staff

- Maximum £86 million (€100 million) turnover or £74 million (€86 million) gross assets.

Next steps: If you fall into this category for R&D tax credit purposes, you can claim the SME R&D tax incentive. Under this incentive, the relief rate can be as high as 230%. In addition, Lossmaking SMEs do have the option to surrender some of their losses for a payable cash credit from HMRC.

Large company:

- 500 staff or more

- More than €100 million turnovers or €86 million gross assets

Next steps: If you are in this category, you can claim via the Research and Development Expenditure Credit (RDEC). Some SMEs may need to claim under the RDEC scheme in certain circumstances.

The RDEC scheme?

Small and medium-sized businesses (SMEs) can still claim the RDEC if they have been subcontracted to carry out R&D work by a large company or have received a grant or subsidy for their R&D project.

The credit is taxable at 13% of your company’s qualifying R&D expenditures after April 1, 2020. Whether or not your business is profitable, credit can be used to pay off debts.

The different types of costs you can claim:

- SMEs can often claim for subcontractors

- Chemicals, materials, batteries.

- Software bought for project management purposes, or to report upon R&D projects.

- If large companies fund independent research carried out by charities, the health service or education authorities.

- Volunteers who take part in any clinical trials.

Can we help your business with advice or help with innovation or R&D Tax credit claim?

Speak to one of our experts today!

020-8577-0200

Choose how you receive your R&D tax credit

If you use the SME R&D tax credit scheme there are several options (which are listed below) on how you could receive your benefit. How you choose will depend on whether you were profit-making or loss-making.

Cash rebate

Tax credits for R&D can be claimed for two accounting periods. If you claim for a period you already paid corporation tax, HMRC will amend your return and refund you.

Corporation tax saving

Your corporation may be eligible for an R&D corporation tax relief if you claim your R&D tax credit at the same time. You must be profitable to do this. This reduces or eliminates your owed corporation tax.

Loss reliefs

HMRC will grant losses-making companies R&D tax credits. The company’s regulations determine the credit’s value. SMEs can also carry R&D losses forward or backwards in their profits.

A cash credit

This is the alternative for a losing company. HMRC will pay you cash if you choose to surrender your R&D enhanced losses. This option can generate up to 33p profit for every £1 spent on R&D, which can help with cash flow.

Our corporation tax services

Generally, Limited Companies must file their Corporation Tax Return (CT600 form) with HMRC within 12 months. Therefore, even if you made a loss during the Accounting Period, you must still do one.

We know the ups and downs of running a small company. We help with Accounts and tax preparation for sole traders, small businesses, start-ups and limited companies.

The benefits of using our accounting services include competitive monthly pricing (with no hidden fees), dedicated client accountant support, and a selection of industry-leading accounting systems (Xero, Quickbooks, and Freeagent) and apps.

FAQ ‘s

Are there any requirement if I have more than one R&D project on the go?

- If you have one to three projects running at the same time you must include details of all projects

- 4 or more projects, you must include detailed descriptions of at least 3 projects (up to a maximum of 10), which between them cover 50% or more of your total qualifying R&D costs

Further requirements if you have more than one R&D project

- The start and end dates of the accounting period relating to the R&D activity – these should be the same dates as the period covered by your CT600 return

- Your Unique Taxpayer Reference (UTR) number

- Details of your qualifying R&D costs

How much can I claim back?

This depends on the size of your business. If you are an SME you can claim up to 33% of your total R&D costs. If your business is profit-making this is seen as a Corporation Tax reduction, or if the business is loss-making then this is in payable cash credit and is not taxable. A large company is able to apply for 13% back through the RDEC scheme and this is awarded in the same way as SMEs.

Can charities or sole traders claim for R&D tax relief?

No – Only companies liable for Corporation Tax can claim through the scheme (limited companies).

How often can I file an R&D tax credit application?

You can file one R&D tax credit application for each financial period in which you trade, provided eligible research and development activity continues to be undertaken by your company. Submissions can be revised alongside your CT600 for the two prior fiscal years, should you believe qualifying expenditure has been omitted.

When can I submit an application?

You can submit an R&D tax credit application after one period of trading. Following this, a claim can be submitted each financial period.