Payments on Account Explained

Reading Time:

Payments on accounts are critically important for self-employed individuals to avoid a massive tax burden. To understand this issue better and to provide you with everything you need to prepare yourself – we have put together a comprehensive guide.

What are Payments on Account?

Payments on account are a prepayment of your taxes (including Class 4 National Insurance) for the upcoming tax year. HMRC created it to assist self-employed individuals in keeping on top of tax payments, so you can’t benefit from paying taxes late.

Do you have to pay?

HMRC may tell you to make “payments on account” if you

- Pay less than 80% of your income tax at source

- Your tax bill is above £1,000.

Tax at source: Money is deducted from you and paid to the HMRC before receiving your income.

For example: If you are employed, you are taxed at source via PAYE.

Calculating Payments on Account

Payment to HMRC is divided into two instalments.

First instalment: 31 January

Second instalment: 31 July

Each payment is half last year’s tax bill.

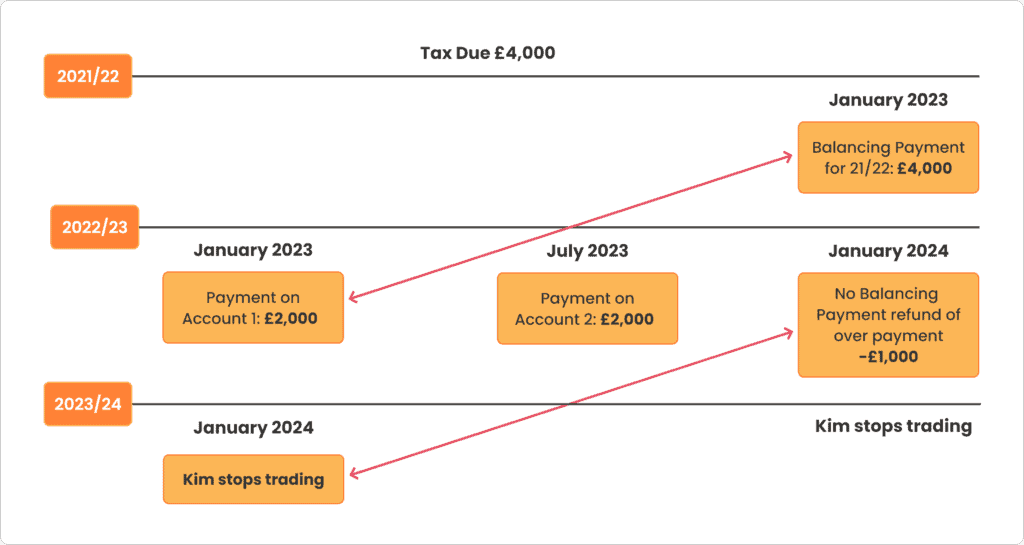

Example 1

Kim is a self–employed pottery maker, and it’s her first year of trading.

Her 2021-2022 tax bill amounted to £4000.

She will need to make the following payments for the 2021-2022 tax year:

Payments on Account: £4000/2 = £2000 + £4000 balancing payment

First payment of £2000 +£4000 on 31st January 2023.

Second payment of £2000 on 31st July 2023.

31st t January 2024 – Refund of £1000 issued for overpayment.

Kim decides to stop trading and should inform the HMRC when submitting her 2022/23 tax return, payment on account will cease to exist as there is no income.

If her 2023-2022 tax bill is higher than £4,000 (the sum of her two payments on account), she will pay a “balancing payment” by 31 January 2024 and will need to include the first instalment for the tax year ahead

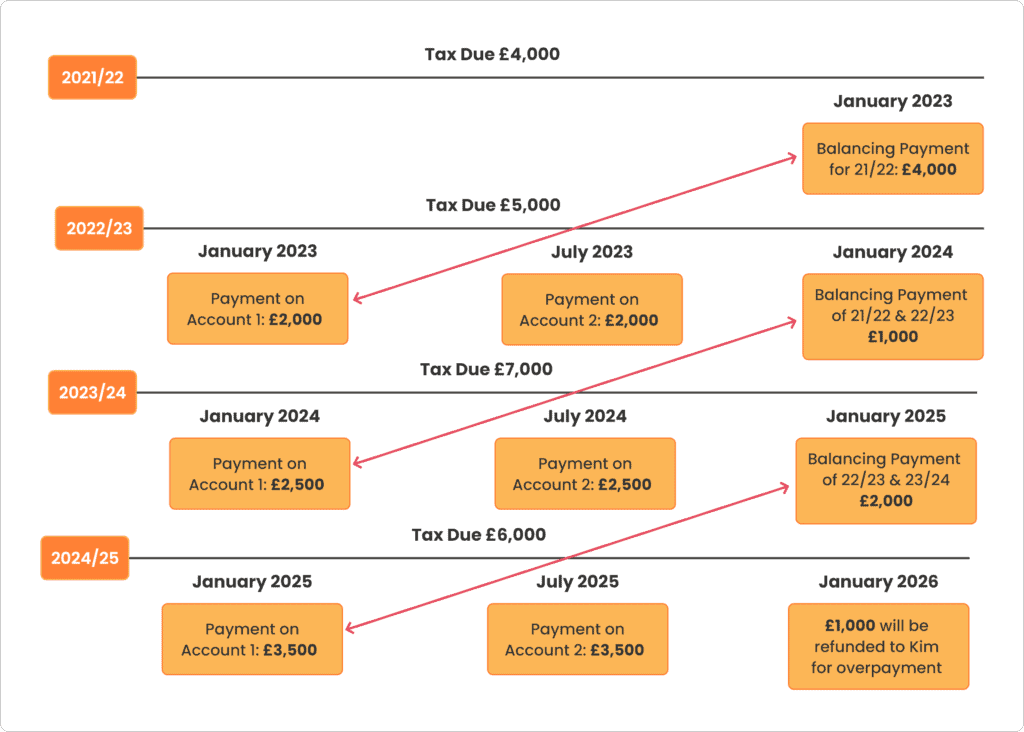

Example 2

Kim is a self–employed pottery maker and it’s her first year of trading.

Her 2021-2022 tax bill amounted to £4000.

She will need to make the following payments for the 2021-2022 tax year:

Payments on Account: £4000/2 = £2000 + £4000 balancing payment

First payment of £2000 +£4000 on 31st January 2023.

Second payment of £2000 on 31st July 2023.

Her 2022-2023 tax bill amounted to £5000.

Payments on Account: £5000/2 = £2500 + £1000 balancing payment

First payment of £2500 +£1000 on 31st January 2024.

(Her 2023-2022 tax bill is higher than the previous year, she will pay a “balancing payment” by 31 January 2024 and will need to include the first instalment for the tax year ahead)

Second payment of £2500 on 31st July 2024

Her 2023-2024 tax bill amounted to £7000

Payments on Account: £7000/2 = £3500 + £2000 balancing payment

First payment of £3500 +£2000 on 31st January 2025

Second payment of £3500 on 31st July 2025

Her 2024-2025 tax bill amounted to £6000

Payments on Account: £6000/2 = £3000 + £0 balancing payment

(Her tax bill is not higher than the previous year, therefore no balancing payment needed)

First payment of £3500 +£2000 on 31st January 2025

Second payment of £3500 on 31st July 2025

£1000 will be refunded to Kim for overpayment

How to view your payments on the account

Step one

Log in online using your Government Gateway user ID and password

Step two

Select-View your latest Self-Assessment return.

Step three

Select ‘View statements.

You’ll see:

- Your past payments

- Upcoming tax payments

Methods of Payment

You will need your payment reference when making a payment. This is your UTR (Unique Taxpayer Reference) number, followed by the letter “k.”

Our table below shows how long you must pay for each method to avoid any penalties.

How to pay your Self-Assessment payment on account

| Same or next day | 3 working days | 5 working days |

|---|---|---|

| Debit or corporate credit card online | Cheque through the post | Direct debit -Allow five working days the first time you set up a Direct Debit, |

| Bank transfer (online or mobile banking) | Direct debit -Allow three days the following time you pay using the exact bank details. | |

| Bank or building society (if you receive paper HMRC statements or a paying-in slip) | Bacs | |

| CHAPS |

Reduce your payments on account

Your prior tax bill determines the size of your payment on account. HMRC expects you’ll earn the same amount next year and pay the same amount of tax. If you think your tax bill will be less, contact HMRC to reduce your payments on account.

- By post (SA303 Form)

- Online

If you earned more than expected, you must submit a “balanced payment” by 31 January or risk interest and penalties

Late payment penalty

People who have never used Self-Assessment aren’t familiar with payment on account. If you’re anticipating a tax bill of £8,000, finding an additional £4,000 for your first instalment may be challenging.

There are penalties for late payments, our table below Illustrates the three late payment penalties imposed by the HMRC

| First late payment penalty |

|---|

| 5% of unpaid tax after 30 days If a balancing payment or payment on account is overdue more than 30 days after the due date for that year’s balancing payment, Some taxpayers will always plan to pay on time but don’t. The 30-day grace period assures these taxpayers don’t face a late payment penalty. After calculating their total liabilities for a tax year, some taxpayers may realise they lack the cash to pay the remainder owing on time. These taxpayers have 30 days to contact HMRC to negotiate a payment plan. |

| Second late payment penalty |

|---|

| 5% of unpaid tax five months after the penalty date Any tax that has not been paid within 5 months of the penalty date will incur another late payment penalty |

| The third late payment penalty |

|---|

| 5% of any unpaid tax 11 months after the deadline. If any tax is still owed 11 months after the penalty date, another late payment penalty will be imposed. |

To learn more about penalties and how to request a waiver or reduction, please visit GOV.UK.

What should I do if I overpaid?

HMRC will reimburse overpayments.

The SA303 form can be used to lower payments or obtain a refund. Overpayments are credited to your self-assessment account; you can request an HMRC refund online or by phone.

Conclusion

Self-employment comes with several responsibilities; you must ensure that your taxes are paid to date. Fusion accountants specialise in tax consulting and self-assessments. Get in touch to find out more.