Qonto banking

for small business

Qonto online bank for freelancers, start-ups, and SME’s

Qonto’s ambition is evident: building the best business banking service by using technology and design with fair and transparent pricing. They feel entrepreneurs should have a banking experience tailored to their needs. Business banking should be efficient and affordable.

With over 120,000 business customers, the Neo bank offers an ‘all-in-one’ account so you can easily manage your corporate finances as well as integrate with Quickbooks accounting software, so you streamline and stay on top of your core business financials.

Why Qonto for business is best!

Qonto provides all the necessary tools to oversee your organisation’s day to day finances, including transfers, debits, and card payments. You can also automate VAT reconciliation, sort your expenses and track all your financials and accounting in one place.

If you are a Qonto customer and you would like to sign up for one of the price packages, we will handle the sign-up process to Quickbooks accounting software, connecting all your personal or business transactions in no time at all. In addition, we can offer you free training and support so the day to day management of your business is firing on all cylinders as soon as possible .

Small business account benefits

The business account is open to companies with 1 to 250 employees. Whether sorting through receipts, figuring out how much VAT you owe, or keeping track of invoices – juggling all this additional admin can feel a bit overwhelming when you are your boss or managing a team.

The account can help small business entrepreneurs receive and schedule payments to improve cash flow management with their accounting needs. Here are the main benefits available:

- Automate the collection of VAT data: Take a picture of your receipts following each payment. The amounts and the VAT will be automatically detected.

- Ease the communication with your accountant: The bank will grant us, as your accountant, viewer access to your account.

- Connect your accounting app to Qonto: All your operations, receipts and information will appear on your accounting tool, Quickbooks, after each expense enabling you to streamline all your processes.

- Stay in control of your expenses: Set transaction limits for each of your employee cards and keep track of all related expenses in real-time.

Mid-sized business account benefits

Manage your overheads. Automate your expense report process and stay in control using Mastercard Qonto cards for your team members. Set transaction limits for each card and keep track of everyone’s expenses in real-time.

- Accessible for your accountant: As your accountant, you can give us access to all required information in viewer mode

- No more missing receipts: Your teams will just have to take a picture of their receipts and attach them to their purchase. Amounts and VAT will be auto-detected.

- Finances and accounting connected: Expenses, tickets, VAT, all information are synchronized in real-time on your accounting tool.

Account benefits for freelancers

Your accounting tasks are now connected and automated. Over 1,000 freelancers use the all-in-one business account.

- Link transactions and receipts after each payment: Take a picture of your receipts after each payment. Set your VAT rate to streamline your accounting processes.

- Connect your business finances and accounting: Expenses, receipts, VAT, all information are synchronized in real-time in your Quickbooks accounting tool.

- Unlimited transaction history, updated in real-time

- Receive real-time notifications or emails after each payment.

How Fusion Accountants helps its clients

We have three decades of experience providing comprehensive Accounting and Tax services to Small Businesses, Freelancers, Start-Ups & Individuals. We offer clients transparent pricing and accounting expertise that offers the latest online accounting software and banking apps that will boost business growth.

Once you join us as a client, we will allocate you a qualified client manager to work alongside you to ensure your financial operations run smoothly.

We are friendly, trustworthy & precise and are always on the end of the phone if you need us. Every month, we will drop you a courtesy call to ensure everything is going well.

Our team will ensure you hold onto as much of your hard-earned cash in the most tax-efficient way possible, following HMRC requirements, of course.

Our accounting software partners

We offer many fixed priced packages and continuous accountancy support, and online software packages as and when you need them. We want to make your busy life as an entrepreneur as hassle-free as possible!

As Platinum ProAdvisers with QuickBooks, we can advise you so you keep one step ahead of your accounting records and bookkeeping requirements, getting a real-time view of your accounts and how much tax you owe (if any) – 24/7.

If you are also VAT registered, the software makes submitting VAT returns to HMRC a breeze and MTD ready! We will also be in touch well in advance of your VAT deadlines, so everything is filed on time, and you avoid any penalties.

Customer service reviews

We’ve been with Fusion for almost three years now and they’ve been extremely supportive and helpful throughout. I couldn’t feel more confident knowing that my company is being looked after by Fusion. I highly recommend their professional, friendly service.

Campbell Allan

Qonto customers

Don’t forget – If you are a Qonto customer, you can sign up for one of our price packages. We will also manage the signup process to free Xero, Freeagent or Quickbooks accounting software. In addition, we will provide training and any additional support to make sure you are up and running successfully syncing up all your personal or business transactions in no time at all.

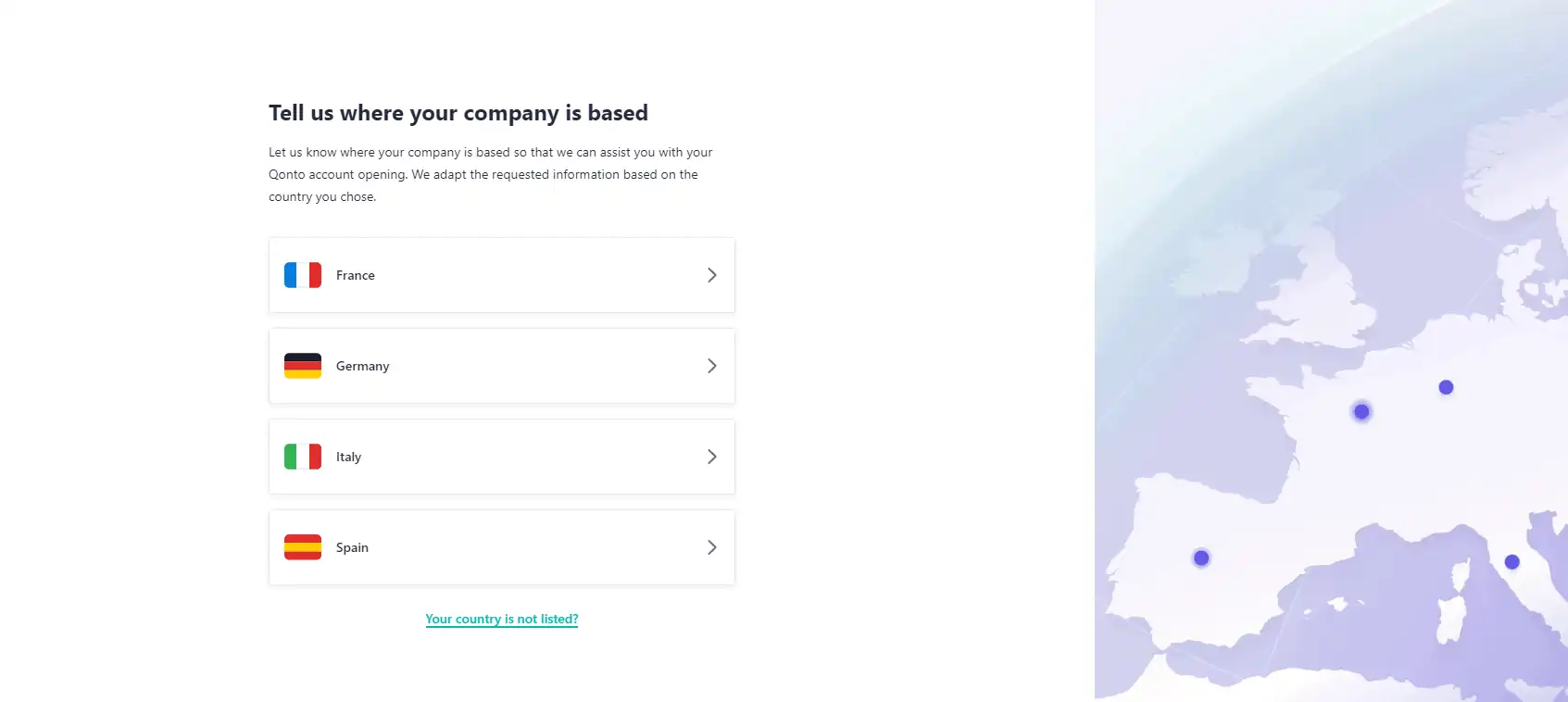

Click on Qonto’s sign up page.

Meet our

Quickbooks accounting software specialist

Allen Musongo

Client accountant

“I joined Fusion team in 2021, and as an ACCA qualified Client Accountant, I work closely with SME’s providing accounts, tax and business advice.

I am also certified with Xero, QuickBooks & FreeAgent.

I enjoy working with passionate entrepreneurs to assist with compliance and support their business growth.

I like playing football (BIG Chelsea FC fan – Mighty Blues). I also enjoy traveling and visiting new places. My favorites destination so far would have to be Lisboa.”

Follow Us:

FAQ ‘s

How do I integrate Qonto into Quickbooks?

You can connect Qonto directly to Quickbooks, to automatically upload your transactions straight into Quickbooks. The set-up is very straightforward. Just follow these steps inside your Quickbooks interface:

- In the main navigation menu, head to the Banking tab

- Click on Add an account in the upper right-hand corner

- Search for “Qonto” in the list of Banks

- Fill in your Qonto credentials. For Quickbooks, they are your email and password

- Cash deposits (through the Post Office): £1

- In the list of bank accounts that appears, pick the one(s) you want to synchronize with Quickbooks

What apps can I connect to my Qonto account?

We use a number of apps used by companies and accountants, that can automatically import your Qonto transactions and keep them synchronised. There are several types of integrations for different needs (accounting, billing, management, etc.) You can find our selection of the best tools and services (and our partner offers) in the Connect section of your Qonto app.

How can I export my transactions?

Here are great time-saving practices you can apply to make us, your accountant very happy:

- Add VAT amounts to your transactions

- VAT amounts are automatically added to all fees Qonto withdraws from your account

- Label your transactions to help classify operations

- You can add up to 3 tags to each of your transactions and find them in your CSV export for easy analysis.

- Grant us a ‘view-only’ access to your Qonto account

- Look at your transactions, request attachments, and download an unlimited export of your transaction history.

How can I export my transactions?

How can I export my transactions? Exporting your transactions is very useful if you want to perform an analysis of your operations or proceed with accounting operations.

What types of formats are available for exporting transactions?

You can use the following: CSV format; Basic accounting data in CSV format (compatible with Excel); Basic accounting data in QIF format: Basic accounting export in OFX format.