Freeagent accounting software review

Reading Time:

This review will delve into Freeagent’s most popular features and tools it offers small businesses, freelancers, accountants, and bookkeepers. We will also evaluate its pricing and summarise the pros and cons to help you weigh up whether this accounting software is the perfect fit for your business.

This review will delve into Freeagent’s most popular features and tools it offers small businesses, freelancers, accountants, and bookkeepers. We will also evaluate its pricing and summarise the pros and cons to help you weigh up whether this accounting software is the perfect fit for your business.

Fusion Accountants is one of the largest Freeagent partners and an accredited Freeagent Premium Partner and VAT Practitioner supporting 100’s small business and contractor clients, so they get the maximum benefit from the online accounting software both from a technical and accounting perspective. If you are new to the online platform, we will provide training!

What is Freeagent software?

FreeAgent launched in 2007 and is cloud-based so that you can access it from any browser. Like the best accounting software on the market, it comes with mobile apps for both Apple and Android devices.

FreeAgent has all the features you have expected from online accounting software – from sending quotations, invoices and payment reminders, recording expenses and mileage, and project management to time tracking. In addition, it has three pricing packages to choose from (which we go into a bit more detail below), including unlimited user access and usage of its features.

Who is Freeagent aimed at?

Over 100,000 small businesses use it. It is especially great for small business owners, contractors, or freelancers working in the service sectors or as project-based businesses helping them find a better way to deal with their business expenses, invoices, spreadsheets, and receipts.

You can also invite us as your accountant or bookkeeper, which will give us direct access to all your data and any reports – from running payroll, filing RTI, Self-assessment & VAT returns directly to HMRC and performing tasks on your behalf to help your business excel.

FreeAgent does automate many basic bookkeeping tasks, which will give your accountant more time to focus their expertise on your business’s performance. In addition, information is updated in real-time, making any potential problems easier to spot and fix.

Pricing

Rating – Excellent: 2.5/5

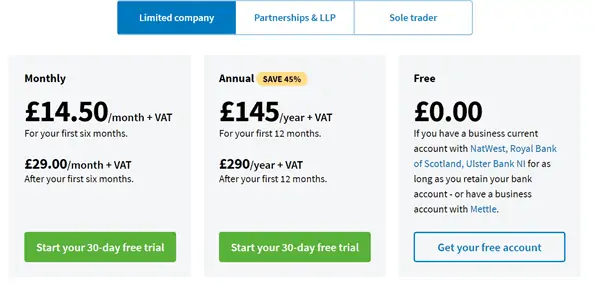

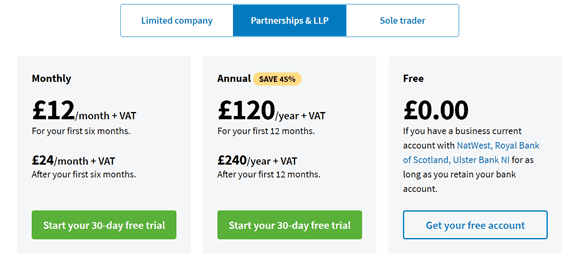

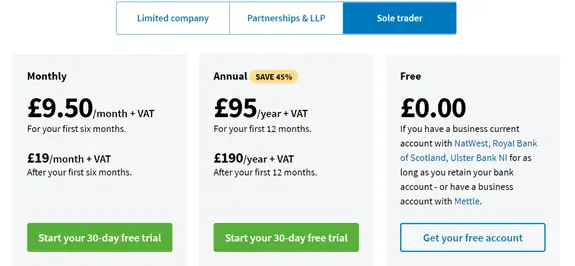

Freeagent offers three different price packages with unlimited usage. You can also have as many users, clients, and projects as possible at no extra cost. In addition, there are no contract or setup fees, and you can easily cancel your account from within FreeAgent.

The software has a 30-day free trial, so you have ample time to try out the platform before signing up. If you decide this is not the right accounting software for you, you can close your account at any time without incurring any cancellation fees.

FreeAgent for free with NatWest

If you are a NatWest, Royal Bank of Scotland, or Ulster Bank NI business current account holder, you can get full access to FreeAgent for free, as long as you retain your bank account.

If you sign up with us as a client, not only will we manage the free set-up on FreeAgent’s platform, but we will also give you a reduced monthly fee of 10% on any of our price packages.

Features and benefits

Rating – Good: 3.5/5

FreeAgent has several friendly interfaces and time-saving features, making setting up an account relatively easy. Once you add your business details, you will be guided through the various set-up steps to sync up your bank account, set the time zone and date format, and select your currency and sales tax details. Once created, you will now have the perfect snapshot of your business performance.

Visit the settings screen to access email and invoice templates that you can personalise with your company logo, create an inventory price list, and invite additional users to the software. You can also set up the software to automatically send your customers a thank-you email after receiving their payments.

After putting in your details, you are presented with a home screen to create your profile so you can send invoices, record an expense, link your bank account, and start your first project.

The ‘Contacts’ section allows you to input the details of any of your customers and clients so they are stored in one place, meaning that you can easily set up a bill or an invoice and send it to your customer. You can set up these contacts manually or import them from your email list.

Main timesaving features

Invoicing: Your invoice timeline instantly shows the status of recent invoices and lets you see what has been paid, due, and overdue. In addition, your clients can view your invoices online and pay you by credit/debit card, Direct Debit or PayPal.

Set default payment terms for different contacts and receive periodic insights into your fastest and slowest-paying customers.

The templates include all the information HMRC needs, so your invoices will meet all legal requirements.

Create estimates: Send estimates to clients and track whether they are approved or rejected. When the work is complete, convert your estimate into an invoice. You can generate estimates in more than 25 different languages and any currency if you do international business.

Accounts payable:

- Manage and create bills.

- Set recurrent bills.

- Add bills to projects you are working on and create attachments for your existing bills.

Expense tracking: Snap and track all expense receipts you incur whilst running your business and upload them to your account from your phone. You can follow bank payments and out-of-pocket expenses, so there is no reason to forget to re-record an expense.

You can also set up recurring expenses automatically EG: magazine subscriptions or monthly rail card purchases), so you do not have to worry about entering them again and again.

Inventory/Stock: Manage your stock and inventory, as you buy and sell goods.

Integrations: eCommerce and payment solutions through third-party relationships with PayPal, GoCardless, Shopify and Stripe. Set up your account to allow your customers to pay their invoices online with a credit card, helping you get paid faster. Transactions are automatically downloaded each day.

Projects: See everything you need for anyone project in one place, including invoices, estimates, expenses, and tasks. It also helps you manage monetary budgets, track deadlines against project tasks, and track billable expenses.

Customer support

Rating – Excellent: 5/5

Freeagent has some pretty good support in place when it comes to resources and advice.

There is also dedicated phone and email support for freelancers, accountants, bookkeepers and small businesses.

You can also book a 20-minute call with their support team. Just click the ‘Help’ button, and ‘Ruby the robot’ will either suggest some answers from their Knowledge Base or pass your query onto our support team to contact you directly.

They have a library of short tutorial videos, from connecting your bank account and tracking your expenses to managing your first project. You can also join weekly webinars based on its most popular features.

Freeagent’s overall rating – Average 3.5/5

The Advantages

Freeagent is a nicely designed online platform that is easy to navigate, and the accounting software they have created is pretty bang on as well.

It has been specifically designed to accommodate small businesses and help them reduce their accounting paperwork. The software is also an excellent fit for contractors and freelancers due to increased flexibility in working or becoming an entrepreneur.

Another benefit of FreeAgent (the same applies to its main competitors, Xero & Quickbooks) is being cloud-based. So, take care of invoices, expenses, and cash flow anywhere – all you need is an excellent internet connection!

The sign-up process is straightforward. It takes a few minutes to add your details and company information. Still, after you input your information, you are presented with a home screen that offers a step-by-step guide to setting up your profile, including sending an invoice, recording an expense, linking your bank account, and starting your first project. FreeAgent seems very keen to make the sign-up process as stress-free as possible.

There are many features such as project management, customisable invoices, reoccurring invoices, multi-currency, upload receipts, time tracking, bank feeds/imports, and tax estimations.

Support: Telephone, email, webinars, knowledge base and plenty of videos – excellent all-round tips and advice tools.

It also offers unlimited users, international invoicing, and time tracking in a straightforward and customisable UI and dashboard.

The Disadvantages

One of the main sticking points for FreeAgent is its pricing which is quite expensive compared to its main rivals, Quickbooks and Xero, particularly if you will be a light user of the software. However, they offer new customers significant discounts (currently 50%) and offer FreeAgent for free if you have an active NatWest or RBS bank account.

Also, the price packages seem limited by not allowing a more ‘pick and mix’ approach to choosing the features businesses prefer over others and in line with their budgets.

When you start the initial sign-up process, be aware that there are many question prompts, which you may find frustrating. Don’t give up! Remember to engage with your Accountant as they will be very familiar with the process and should be able to manage the set-up on your behalf.

Though based in Edinburgh (but expanded into the American market in 2012) and aimed predominantly at UK businesses, it does feature some American terminology, and the date fields are not in a UK friendly format.

Most complaints regarding the software seem to be bank-related, from entering transactions to bank feeds being relatively slow and problems filing VAT and self-assessment returns and manually doing it instead.

Despite a small number of negative reviews, Freeagent has a Trustpilot approval rating of 82%, and we are happy to recommend FreeAgent as a great online platform for your small business or as a Contractor.

Start with the 30-day free trial and decide if this is the accounting solution for you or give us a call to discuss which software option might be the best for you based on need and budget.

Your FreeAgent Experts – Accountants You Can Trust

We bring over thirty years of experience bringing comprehensive Accounting and tax services to helping UK Businesses & Individuals and are one of the largest FreeAgent accounting partners in the UK. We know clients want an easy to understand and friendly service that offers them a choice of market-leading cloud accounting software and apps that will enhance their business without losing that personal touch.

Looking to switch accountants? Our simple process requires little time, effort, or disruption to your business. So, join us and enjoy our services and our transparent price packages in no time! Call our Switching Hotline on 020 8577 0200 for help and guidance.