Closing a limited company guide UK

Reading Time:

Are you considering closing your limited Company? Understanding all the steps and options available can make the process much smoother.

In this blog, we’ll look at how to close a limited company, discuss how you can do it and explore some important factors to consider.

How to close a solvent company

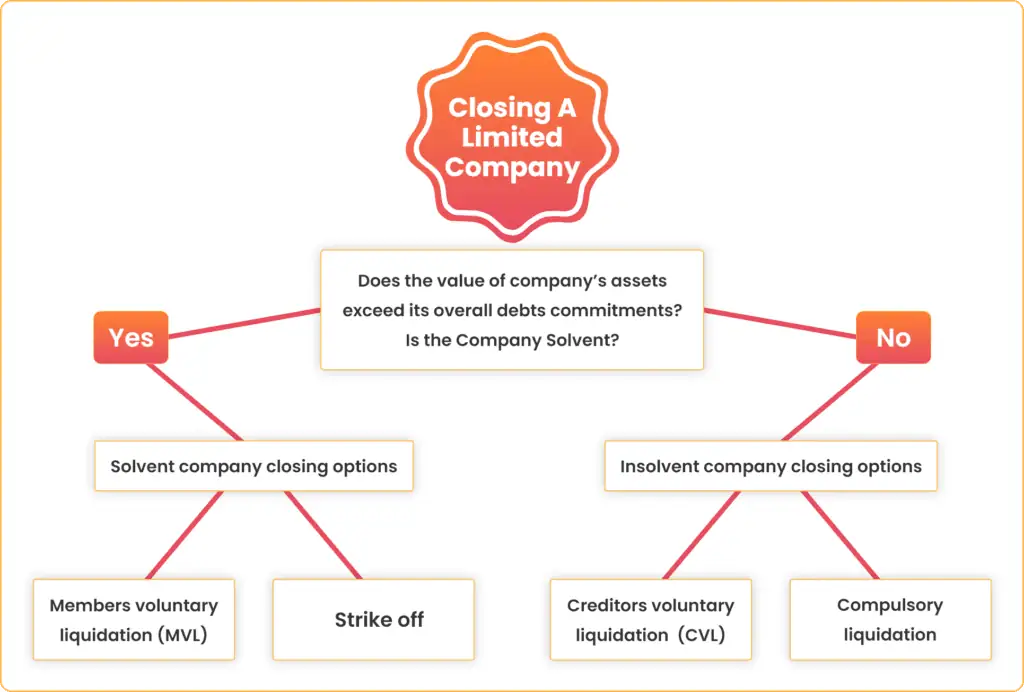

When closing a Limited company you need to determine whether the company is solvent.

Solvent Company

A Company is solvent if:

- The value of a company’s assets exceeds its overall debt commitments, i.e. the company can pay off its liabilities in full.

The easiest way to determine whether a company is a solvent is to look at its net assets (i.e. the difference between its total assets and total liabilities) on the Balance Sheet.

For example:

Total Company assets: £6,000,000

Total Company’s liabilities: £3,000,000

Company’s Net Assets (also known as owners equity): £3,000,000

Due to the balance sheet having positive net assets, the company is solvent.

Method 1: Members Voluntary Liquidation (MVL)

Members’ Voluntary Liquidation (MVL) is the process to close companies that do not have any financial issues.

What is the criteria?

Your company can apply for MVL if:

- It is solvent (has the financial resources to meet its liabilities in full and on time)

- It is has a surplus of ≥ £25,000 cash at bank

You need to appoint and pay a licensed insolvency practitioner (This option may be costly)

What are the benefits of this method?

The benefit of MVL to you will be potentially paying less tax on the money extracted from the company. Money taken out from the company using MVL is treated as capital distribution rather than income (to a maximum of £25,000), thus subjecting it to capital gains tax which has a lower rate than income tax. Furthermore, there is a possibility of entitlement to Business Asset Disposal Relief (BADR).

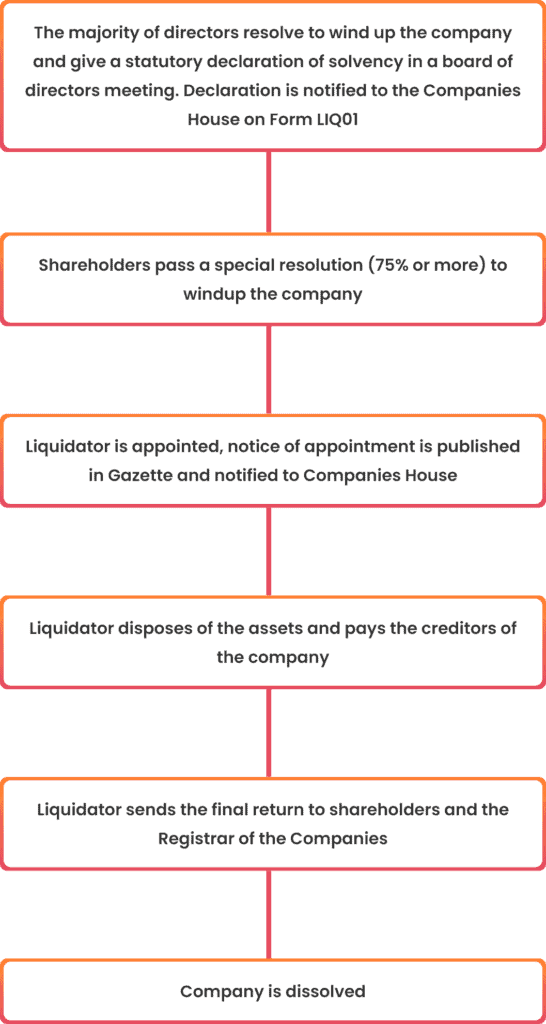

Steps for Members’ Voluntary Liquidation:

Step 1:

You need to get a signed declaration of solvency by at least 75% of the board of directors not more than 5 weeks before shareholders special resolution to wind up the company is passed.

A declaration of solvency is simply a statement to declare that the company is able to pay its debts in full, together with its interest, within 12 months of the commencement of closing the company. LIQ01 Notice of the statutory declaration of solvency is filed with Companies House no later than 15 days after the passing of the special resolution.

You can get this notice template by clicking here

Step 2:

Pass a Special Resolution by the shareholders, i.e. by at least 75% of the shareholders. This special resolution has a 14-day deadline for publication in The Gazette.

Step 3:

Appointment of a liquidator is made by shareholders by passing an ordinary resolution (50%). Once the liquidator is appointed, they will control the Company. You must notify the Companies House of the resolution of the appointment of a liquidator within 15 days.

Step 4:

The liquidator will dispose of the assets and pay off the creditors.

Step 5:

After paying all the creditors and distributing the assets in the order of priority, the liquidator will produce the last Statutory Accounts to the shareholders and Registrar of the Companies. The company will stand dissolved 3 months after filing the final return.

Typically, MVL will take six months to 1 year.

Method 2: Getting the Company Struck Off

Submitting a “Striking-off” application (DS01 form) to the Companies House is the quickest and most straightforward method to close or dissolve a limited company.

What is the criteria?

- It hasn’t done any kind of business or trade in the last three months

- It hasn’t changed its name in the previous three months

- It has not been or is not currently the subject of any legal proceedings

- It hasn’t done anything to get rid of property or rights

What are the benefits of this method?

- Striking off a ltd company is less costly as compared to other options as you will not require the services of expensive insolvency practitioner.

- The process can be initiated quickly without any formalities like meeting with creditors.

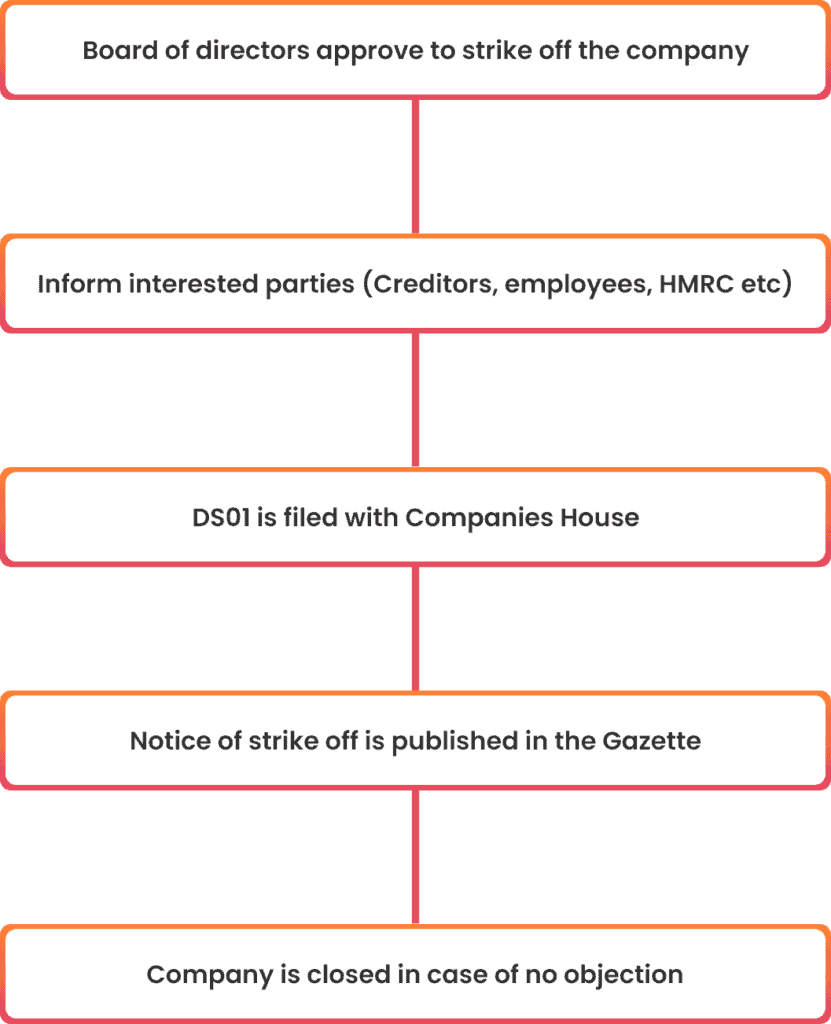

Steps for Strike-off:

If your business satisfies above requirements, you must obtain and complete Companies House Form DS01. The form must be completed, signed by majority of the directors, and sent to Companies House through email or postal delivery. This can be done online as well on Companies House website.

Send copies of DS01 form to the following within seven days of its submission:

- Creditors/suppliers

- Employees

- Company shareholders

- Pension managers/ trustees

- All directors of the Company

If Companies House approves the application, the information will be added to the public record. A “Notice” will also be printed in the Gazette, depending on where your Company is registered with Companies House, to confirm that you want to close the business.

The formal notice will give interested parties a chance to voice their opposition to the planned striking off. If no further action is required within three months, the Companies House will publish a second notice in the Gazette to indicate that the company has been dissolved and removed from the registry.

Normally, this process will take 1 to 3 months. It is very important to complete the process carefully as any undistributed assets will go the Crown.

How to close an insolvent company

What is an insolvent company?

Insolvency occurs when a firm cannot pay its debts in full.

For example:

Company assets: £6,000,000

Company’s liabilities: £7,000,000

Company’s owners’ equity: -£1,000,000

Shortfall: -£1,000,000

Due to the company’s negative owners’ equity, it is insolvent.

There are two ways to close an insolvent company:

- Creditors Voluntary Liquidation (CVL)

- Compulsory Liquidation

Method 1: Creditors Voluntary Liquidation (CVL)

When a corporation reaches a point where it cannot pay its debts and has chosen to dissolve to settle its obligations, the firm may voluntarily submit to creditors’ voluntary liquidation, this process is initiated by the directors.

What is the criteria?

The resolution to wind up the company must be passed by at least 75% of the shareholders

What are the benefits of this method?

- The company is saved against legal proceedings.

- Employees can claim redundancy pay from National Insurance Fund if the company does not realise enough funds from disposing off its assets.

- By voluntarily liquidating the company, the company avoid being called by the Court.

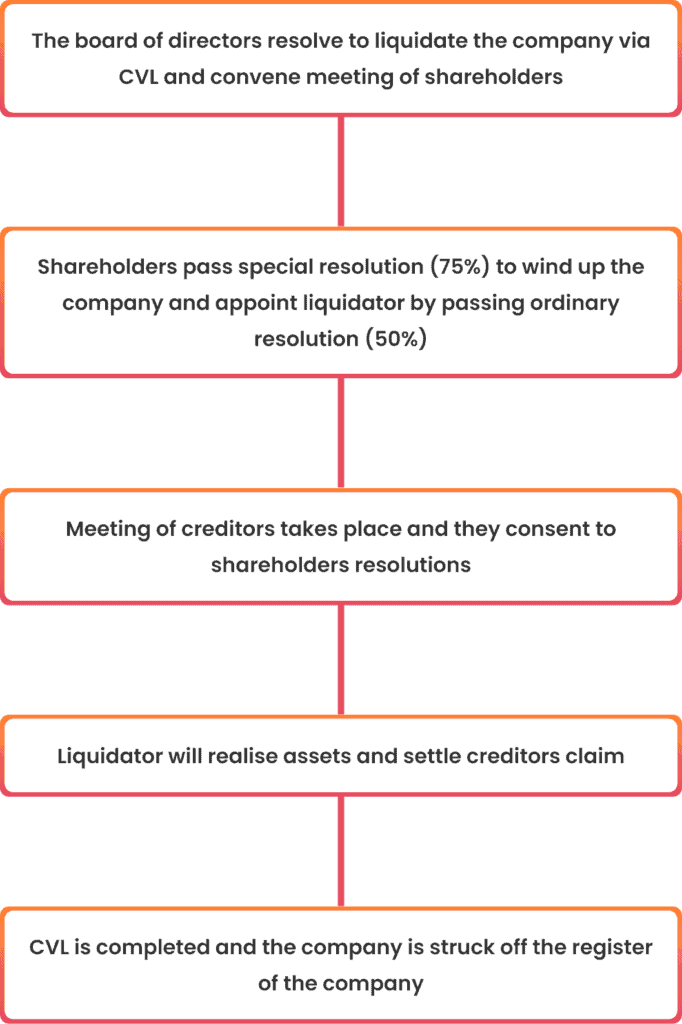

Steps for Creditors Voluntary Liquidation:

To initiate liquidation, the board of directors follow these steps:

1. Find and appoint a “liquidator.” i.e Insolvency Practitioner.

2. On initiation of the process of liquidation, creditors and shareholders will be informed about the decision (date of liquidation) date and general meeting.

3. In the general meeting of the shareholders, a special resolution (more than 75% votes) must be passed to windup the company via CVL. The Company’s House must receive the special resolution regarding winding up no later than 15 days after the meeting. Shareholders also appoint an insolvency practitioner as liquidator by passing an ordinary resolution (50%).

4. Before decision date, creditors will be provided with a statement of financial status of the company i.e its assets and liabilities, estimated realisable amount of company’s assets and estimated shortfall to creditors.

5. Publish the resolution in the relevant Gazette (i.e., London, Edinburgh, or Belfast) within 14 days.

6. The liquidation process will be over when all assets, if any, have been turned into cash and given to creditors in the order of their priority. After the liquidator holds a final meeting, the Company will be taken off the list in about three months.

Method 2: Compulsory Liquidation

When the courts mandate the closure of a corporation, it is called compulsory liquidation.

A company’s forced liquidation is usually the culmination of a lengthy procedure initiated by an outraged creditor or the HMRC seeking to collect debts owed.

Criteria : Reasons for Compulsory Liquidation include:

- An uncollectable debt of £750 or more

- If the court rules that dissolution is necessary and fair

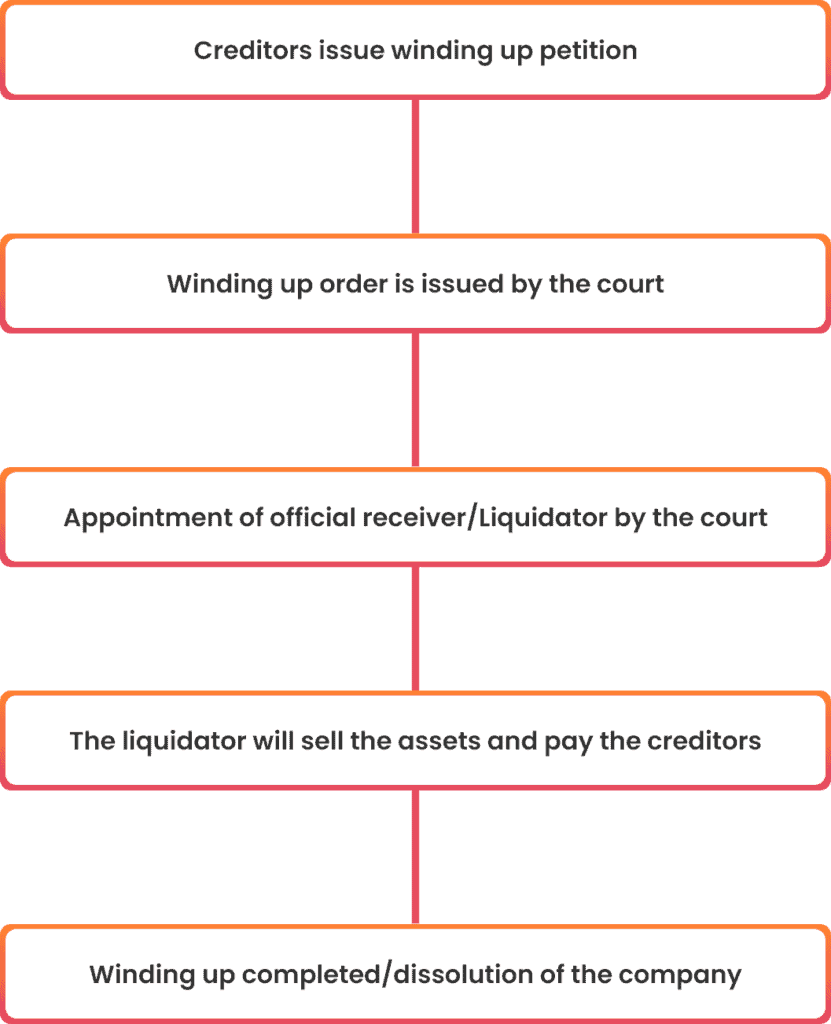

Compulsory Liquidation process

There are five steps to compulsory liquidation.

When the company can not pay its creditors and the creditors approach the Court.

Step One: Winding Up Petition

Compulsory liquidation occurs when a creditor, such as HMRC or supplier, bank etc, issues a Winding Up Petition (WUP) against the firm.

- The petitioner must be owed at least £750 and have waited at least 21 days for payment.

- Seven days must elapse before the debtor company’s WUP is announced in the Gazette.

A company’s bank accounts are usually blocked after the advertising, preventing it from trading.

Step Two: Winding Up Order

After seven days, a judge will review the WUP and decide what to do next.

- Once a court decides that a firm needs to be liquidated, it will issue a Winding Up Order and appoint an Official Receiver.

- It is mandatory to cease trading at this time, but this will likely have occurred before the WUP is issued.

Step Three: Official Receiver

The current directors will have no say in the firm’s day-to-day operations after the appointment of the Official Receiver, also known as a liquidator.

- To aid the Official Receiver in their investigation, the Board of Directors may be asked to provide information on the Company’s clients, shares, and other assets.

Step Four: The sale of assets

The Official Receiver will initiate the sale of the Company’s assets.

- Assets may include shares, cars, property, and equipment.

- The liquidator will put aside as much money as feasible from the sale of assets and the Company’s bank account to pay off the Company’s obligations.

Step Five: Dissolution

The firm will be formally shut down and have its name deleted from the Companies House record after the disposal of its assets.

- Unless the director has a personal guarantee, any obligations still owed at this stage will be written off.

- If a personal guarantee takes effect, the director is personally liable for any debts secured in this manner.

Implication of insolvent company liquidation on directors

The directors are responsible for running the affairs of the company in the best interest of the shareholders. The directors should always keep a close eye on the financial health of the company and monitor its solvency. They should be really careful about doing business as usual with a company in financial distress.

When a company goes into creditors voluntary liquidation or compulsory liquidation, the liquidator/official receiver will investigate the directors and the company.

If the directors were found guilty of trading the company while the company was actually insolvent, they will potentially face disqualification for up to 15 years and other fines and penalties. This becomes really serious when the directors are found guilty of taking loans and dividends (if the director is shareholder too) from the company while they knew the company was actually insolvent. The directors may be asked to return the loan and dividend so taken to the company to pay the aggrieved creditors.

Also Read: How to keep your office party tax free

Difference between liquidation and dissolution

Dissolution and liquidation do not mean the same thing.

Dissolution occurs when a company no longer exists as a legal entity. It is the end of a company and would happen when the Companies House will strike it off the companies register.

On the other hand, in liquidation, the company still exist and is only paying off its debts by selling off its assets.

Note: Liquidation precedes dissolution.

What method should I use?

It is usually recommended to use members voluntary liquidation for a solvent company while creditors voluntary liquidation for an insolvent company being out of court settlement.

How Do I Close a Limited Dormant Company?

HMRC considers a ” dormant ” company to be “inactive.” This means that the business is not open for business right now.

If a business isn’t profitable, it won’t have any taxable income to report and hence won’t owe any taxes at the end of the fiscal year.

Should you be able to demonstrate that your limited company has not earned any income or engaged in any kind of trading, you will not be required to pay any taxes upon the closing of the company.

Limited dormant company closure process

The closing process of a dormant company is the same as striking a company off the register of the Companies House as explained above.

The cost of dissolving a Limited company

The Company’s dissolution will determine the final sum you’ll have to pay

| Type of dissolution | Cost |

|---|---|

| Members’ Voluntary Liquidation (MVL) | Costly method due to appointing an independent practitioner. About £4,000 in fees for the liquidator plus the costs of notices etc |

| Getting the Company Struck Off | £10 You cannot use a bank cheque from the company you’re dissolving. |

| Creditors Voluntary Liquidation (CVL) | In most cases, this is the most costly option for shutting down a business. The liquidator’s fee is determined by the time and effort necessary to complete the liquidation. Average costs range from £3000 to £7000 -If the corporation doesn’t have enough money to pay these bills, the directors might be held personally responsible. |

| Compulsory Liquidation | This is a type of closing that is forced by creditors or HMRC. The creditor, not the Company, also pays for the “winding-up petition,” but the Company’s assets and money will be taken by a “liquidator” and used to pay the creditors. |

| Limited Dormant Company closure | A £10 filing fee must be paid to Companies House in addition to filling out and submitting form DS01. |

Can I reopen a firm that was previously dissolved

You can restore your company by making an application (form RT01) to the companies House. This is called administrative restoration. Following conditions apply;

- The application is to be made by an ex-director or shareholder of the company

- The company was struck off and dissolved in the last 6 years

- It was not a dormant company meaning it was a trading company at the time it was dissolved

If above conditions are not met, then you will need a court order to restore the company. Administrative restoration cost £100.

Conclusion

There are a few different ways to close or dissolve a limited company, and the path you take will depend on whether your business is insolvent or solvent. If your company is still in good standing, you may be able to simply have it struck off the register. But if your business faces bankruptcy, you’ll likely need to go through compulsory liquidation.

The cost of dissolving your business also varies depending on your route and other factors, such as professional expenses. It’s important to note that even after dissolving your business, it’s possible to restart it down the line under certain conditions.

Fusion Accountants are a team of specialists that offer advice and services to limited companies. If you are thinking to close your limited company, get in touch today to find out the best possible route.

Also Read: Paperless Office Tips