Xero Chart of Accounts set up

Reading Time:

Overview of Xero Chart of Accounts

The Chart of Accounts (COA) lists all accounts you can use to record your transactions in Xero. It helps you categorise your transactions correctly, and similar group accounts to generate reports about your organisation. Use the Chart of Accounts in Xero to record and categorise your transactions and generate reports.

Xero has a default chart of accounts you can use, or you can import your own to use in Xero.

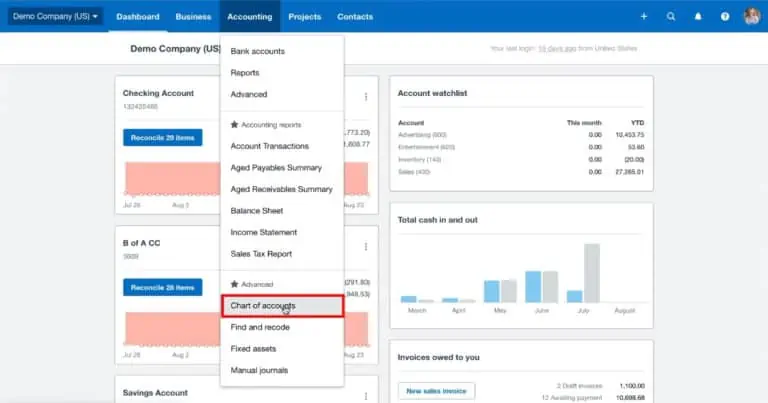

To view your Chart of accounts, in the Accounting menu, select Advanced, then click Chart of Accounts. From here, you can:

- Click an account to view details

- Click an account balance to see a list of transactions that use that account

- Add, edit or delete accounts to best suit your organisation’s needs

- Print or export your chart of accounts

How to set up the Chart of Accounts in Xero

Finding the COA in Xero is fairly straight forward but keep in mind that Xero often updates its systems and moves things around so this might have changed by the time you read this. If this is the case, give us a call, and we can talk you through the latest procedure.

We have put together a step-by-step guide below, or if you prefer you can watch this video from Xero Central’s tips and advice library on how to customise your Chart of Accounts.

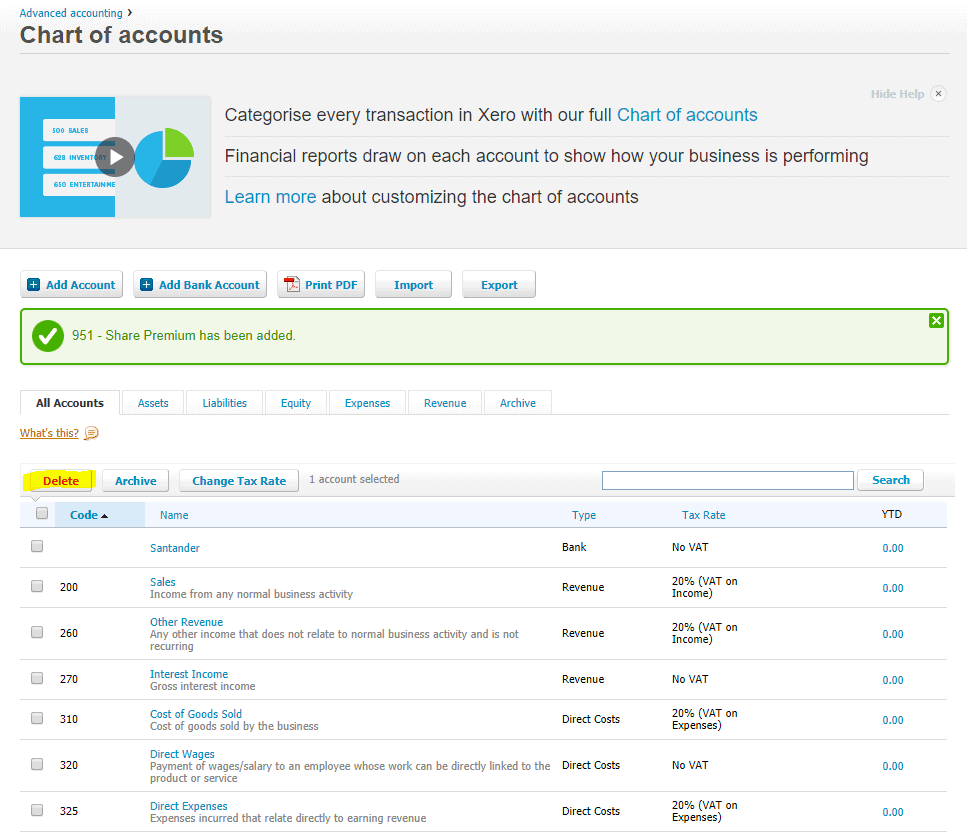

First, you will need to have logged into Xero. Then check the top of your screen for a tab that says ‘Accounting.’ Click on this to see a drop-down menu and click on the ‘Chart of Accounts’ option.

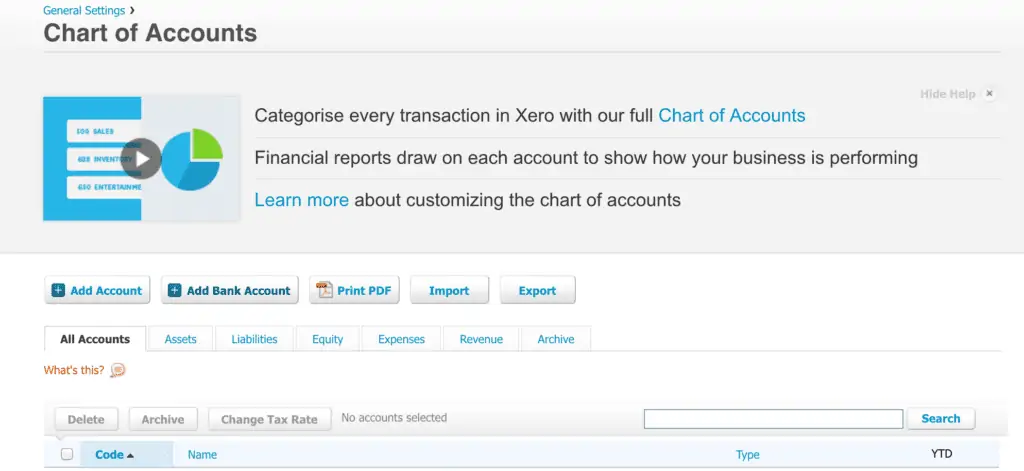

You are now in your Chart of Accounts

Adding an account to the Chart of Accounts

Now that you have landed in your chart of accounts, you can now add an account.

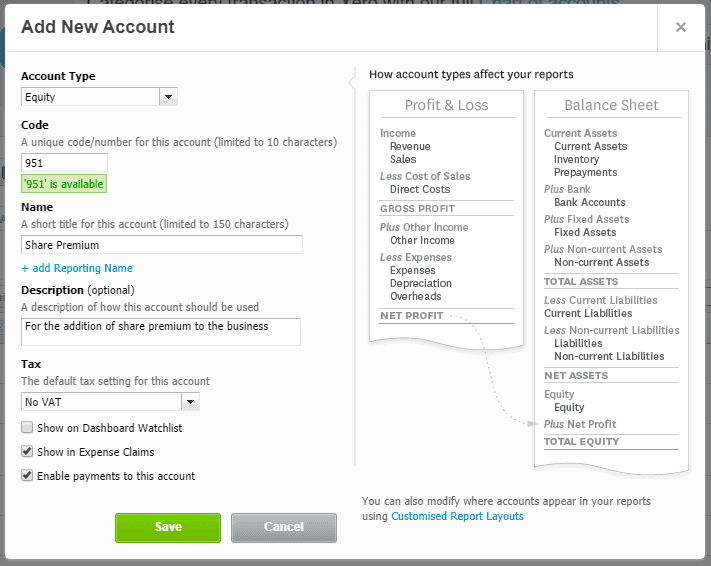

Firstly, click on the button highlighted in the screenshot above to ‘Add Account’. This will open up the ‘Add New Account’ screen (see below).

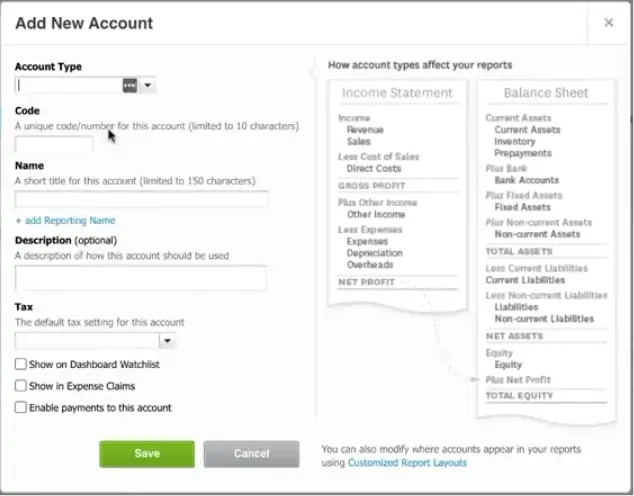

This is where you might want to add your ‘share premium’ account but you will need to allocate a code. Scroll through the Chart of Accounts to find an appropriate place to put it.

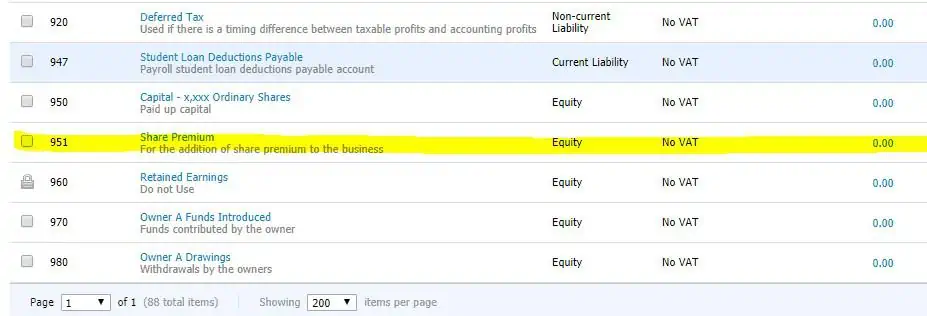

In the above example, this is an equity-type account and the capital shares account is on code 950, so we have added the corresponding share premium account to code 951 as it has not been used. You will need to fill in the corresponding boxes accordingly.

Notice that we have ticked the ‘show in expense claims’ and ‘enable payments to this account’ boxes. While not strictly needed for this account, the selection of these two tick boxes enables the Xero system to show this account as an option for selection when creating an out-of-pocket expense or when adding/reconciling a bank transaction in the banking section.

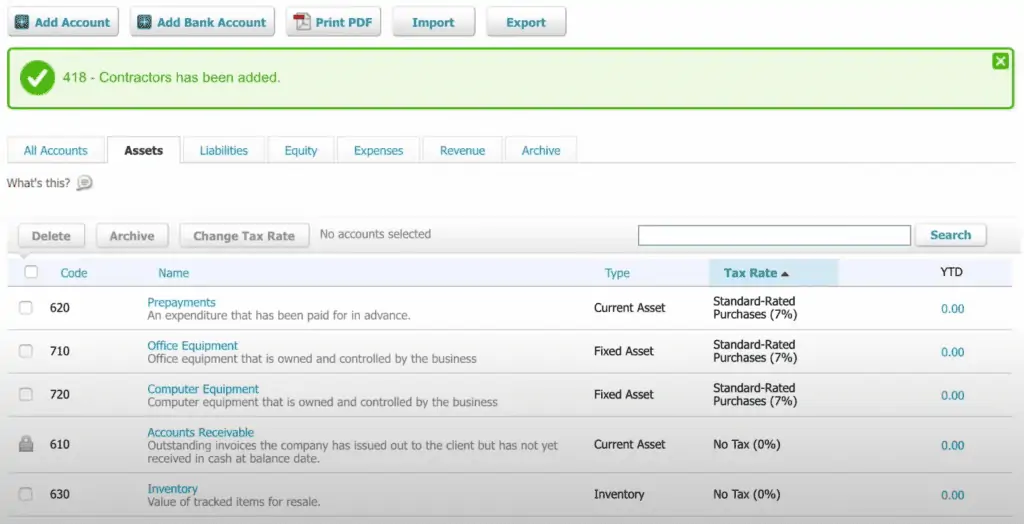

Click save now, and you should see the account added to the COA beneath the capital shares account.

Try adding the accommodation and meals account and dividends paid account. I recommend using codes 495 and 955 respectively. Which type of account will you use?

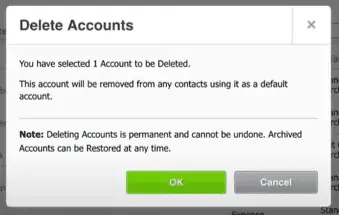

Should you make a mistake, you can delete it providing no transactions have been explained against it. To do this tick the box on the row detailing that account and then scroll up to the top of the chart of accounts and click the ‘Delete’ button.

You will then see this prompt.

Click OK, and the account is now deleted.

Why do I need a tailored chart of accounts?

It’s not essential, but with any growing business, you will likely want to pay close attention to your incomings and outgoings to make sure profits are maximised. Tailoring your chart of accounts will make it that much easier to do this.

The same could apply to IT contractors as well. They might want to use it to keep track of how much is spent on travel and consider whether they can work from home to combat travel cost or keep track of assets, so they know which hardware they have in the business to derive future profits with.

Recommended accounts

I’ve mentioned above a couple of examples of accounts that may interest-specific service sectors. There are some accounts though that all businesses should add to their COA if they are not already included:

Dividends Paid – keep track of the dividends you payout in any given year. Remember to net these off annually against the retained earnings account once the year-end passes.

Accommodation and Meals – Usually these are included under the travel account, but it doesn’t hurt to see how much you eat!

Share Premium – This will pop up when you start selling shares in your business. Beyond the nominal price of your shares, any income garnered from selling shares will go to this account.

You can have a great Chart Of Accounts suitable for a particular business, but it will be of little use if the bookkeeping behind it is not done properly. It is essential to make sure that the data going in is properly posted in order to make most of the reports. If you want to discuss anything related to COA for your small business, please feel free to give us a call on 020 8577 0200.

Double-entry bookkeeping in Xero

Are you taking on the responsibility of bookkeeping in a new business? If so, you may be required to create a Chart of Accounts. You must acknowledge both sides of each transaction and reflect them in your records, which requires an additional entry — therefore, double-entry bookkeeping.

Double-entry accounting is the method by which your business records its financial transactions in which each transaction affects at least two accounts, and the debits and credits must always balance.

For example, You pay for a rail ticket using your corporate bank account; this would credit your bank account and debit your travel fund. This is a hypothetical account that exists only to track your trip expenses.

At the end of the year, subtract your sales from your expenses to get your operating profit, from which you can calculate your company tax and record your transactions. It also aids in obtaining further information necessary by law.

When balancing your books, this strategy makes it easier to spot problems. Xero’s Chart of Accounts is where you can find and edit these accounts. Your reports will be more accurate if you categorise your transactions correctly.

Fusion Accountants is a Xero award winner of mid-sized firm of the year, and Platinum Advisor, so you are in safe hands when it comes to any accounting challenges and using online software to help your business streamline its processes and grow.

Our team are qualified to help with the initial set up of accounts to integrate with Xero software packages.

Also Read: The Pros & Cons of Xero Bookkeeping software