Self-assessment tax return services

Our one-stop-shop

for all your self-assessment needs

Maximise your income!

As expert self-assessment accountants we crunch the numbers and prepare your return, quickly and easily.

Completed and filed with HMRC on time, every time.

Exceptional customer service

Minimise your tax liability

Xero, Quickbooks & Freeagent

Deal with HMRC on your behalf

Professional tax advice

We do not just do your self-assessment tax returns; our qualified accountants will provide you with the necessary advice and guidance on how to minimise your tax liability. This is because we believe in providing a value-add service, not just number crunching.

We make sure that our clients stay on top of their taxes and financial situations so that they can make well-informed business and investment decisions.

Dedicated accountant

You will have a dedicated point of contact based in the UK who can break down any tax jargon into a simple and easy to understand way and oversee all your tax affairs.

Deal with all your tax affairs

As a complete service, we will act as your tax agents with HMRC, which means we will deal with HMRC on your behalf regarding any tax matters, so you can relax and let us take care of your tax affairs.

Our comprehensive tax return service

Completing and submitting your personal tax return, we follow this 9-step process:

- Supply you with a Tax Return checklist making it easier to gather all the relevant information

- We then use the information you give us to complete your Personal Tax Return.

- To avoid penalties and interest, we calculate your tax bills and payments on the account.

- We will advise you on possible claims and elections to reduce your tax bills except for tax credits. We will make the HM Revenue & Customs required claims and elections (HMRC) if you instruct us.

- Once we have your written approval, we will submit your Personal Tax Return to HMRC.

- We will file your tax return electronically, which means you will know when HMRC has received it, and if you are entitled to a tax refund, you will get it much faster.

- We will check HMRC’s calculation of your tax bills and initiate repayment claims if you have overpaid.

- We will ask you for your bank account details to transfer any refunds electronically.

- We will deal with all communications relating to your Tax Return from HMRC directly or forwarded to us by you.

Our self-assessment tax return service from just £12.50+vat per month

Speak to one of our specialist!

020-8577-0200

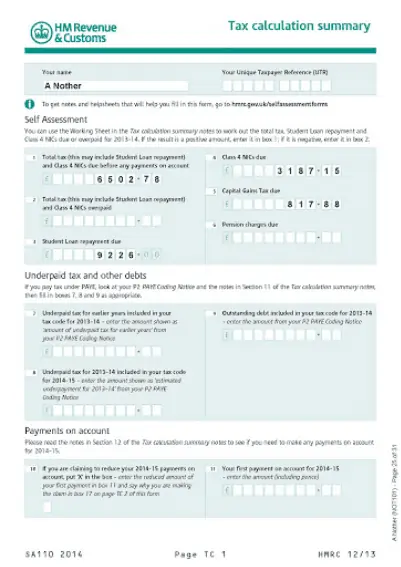

What is a self-assessment tax return

A self-assessment tax return, also known as “Personal Tax Return”, is the process in which individuals can declare their annual tax on income received or gains/profits made on their capital investments.

Some taxes, like PAYE, are collected at source, i.e. employees’ taxes are deducted before pay, and banks tax savings income when paying interest. However, income is not taxed at source in other cases, such as rental property, sole trader business, or sale of an asset that increased in value (e.g. Buy-to-let property). Instead, it must be declared, and any additional taxes paid.

Similarly, a tax return may be done to claim any overpaid taxes, e.g. the wrong tax code was entered by your employer and you were overcharged.

Who needs to do a PTR (personal tax return)

You will need to do a tax return during the financial year ending 5th April:

- Self-employed sole traders who are running their own business or service

- Partner in a partnership

- Received more than £2,500 in untaxed income (e.g. you received rental income from property)

- Investors with dividend income

- Your savings income or investment income was more than or equal to £10,000 before taxes

- You realised profits from selling assets such as buy to let property or shares

- Received child benefit when your income was over £50,000

- Received income from abroad on which you need to pay UK tax on

- You lived abroad but received income from the UK

- You are a trustee

There may be other reasons you may need to do a PTR. For example, YOu may need to do a personal tax return to declare additional payable or reclaimable taxes.

Notification of chargeability

If an individual becomes chargeable to Income tax or Capital Gain Tax for the first time, they must notify HMRC within six months of the end of the tax year in which he becomes chargeable.

For example, an individual who received dividend income on the tax year 2020/21 has until 5 October 2021 to notify HMRC. To file a tax return, you need to be registered for self-assessment and have a UTR or Unique Tax Identifier number. A self-assessment registration form is submitted for a UTR number and can take up to 6 weeks for a UTR number to be issued by HMRC.

Filing deadlines for Tax Returns

| Submission Types | Deadline |

|---|---|

| Paper | 31 October Following Tax Year 3 Months after Notice to File 2 Months if HMRC is to calculate tax |

| Electronic/Normal Filing | 31 January Following Tax Year 3 Months after Notice to File |

| Taxpayers with simple tax affairs can fill in a short tax return which has no self-assessment |

Penalties for late filing of Tax Return

| Late Return | Penalty |

|---|---|

| Initial Penalty | £100 |

| > 3 Months late | Daily penalties (£10/day, max 90 days) |

| 6 Months late | 5% of the liability to tax (or £300 if greater) |

| 12 Months late | Additional 5% of the liability to tax (or £300 if greater) |

| Increased penalties apply if the withholding of information after 12 months is deliberate or deliberate and concealed. |

Payment dates

Two payments on account are made on 31 January and 31 July after the tax year.

These are 50% of the previous year’s tax due but only apply to income tax, not Capital Gains Tax.

Payment on account is not required if:

- Tax due for previous year < £1,000, or

- 80% of tax is collected at source

- Payment due in respect of a simple assessment is due on 31 January after the tax year.

| Late | Penalty |

|---|---|

| > 30 days late | 5% |

| > 5 months after first penalty | Additional 5% |

| > 11 Months after first penalty | Additional 5% |

| Late payments on account do not attract separate penalties. |

Meet our senior partner

Jahan Aslam

Senior partner

I trained as an auditor with top 20 accounting practices in UK and worked in numerous roles before joining Fusion in 2013.

With over 15 years of experience, my specialisms include assisting SME businesses with business advice and to provide support to achieve growth goals, process standardization and model their business plans.

Follow Us:

FAQ ‘s

If I don't owe any taxes, do I still need to file a self-assessment tax return?

If you have received a letter from the HMRC and been asked to file a tax return, then you must file one even if you do not have any income or even have losses. Please check this HMRC tool to see if you are required to file a tax return.

How do I register for self assessment with HMRC?

You need to register online with HMRC by creating a Government Gateway account. It’s best to do this as soon as you start earning income that requires you to pay tax.

What information do I need to provide on my self assessment tax return?

You’ll need to provide details about your income, self-employed earnings, any other sources of income, expenses, pensions, and benefits. You might also need to include information about capital gains or foreign income.

What if I made an error in my tax return? Can I amend it?

An amended tax return can surely be submitted to the HMRC before the deadline for filing an amended tax return. Generally, you can amend a tax return within 12 months of the tax return deadline for that tax year, e.g., for tax year 2022-23, the deadline for amendment will be 31 January 2025.

How can I pay the tax I owe through self assessment?

You can pay your tax bill through various methods including online bank transfer, credit or debit card, direct debit, or by cheque. HMRC provides guidance on the available payment options.

Can I claim expenses against my self-employed income?

Yes, you can claim legitimate business expenses to reduce your taxable income. Common examples include office rent, travel costs, and professional fees. However, the expenses must be directly related to your business.

What records do I need to keep for self assessment?

You should keep records of your income, expenses, bank statements, invoices, receipts, and any other relevant financial documents for at least 5 years after the self assessment deadline.

What is Making Tax Digital for Income Tax?

Making tax digital MTD for income tax is an initiative by the Government to modernize the way income and expenses are reported. Under MTD you will need to maintain your record in digital format and file quarterly returns. MTD for Income Tax starts in April 2026.

Can I get professional help to complete my self assessment tax return?

Absolutely, many people hire accountants or tax professionals to assist with self assessment. They can help ensure accuracy, claim all eligible deductions, and navigate complex tax regulations. Fusion Accountants’ years of expertise in tax planning can help you minimize your taxes.