Accounting for start-ups

The perfect accounting solution

and support for your start-up

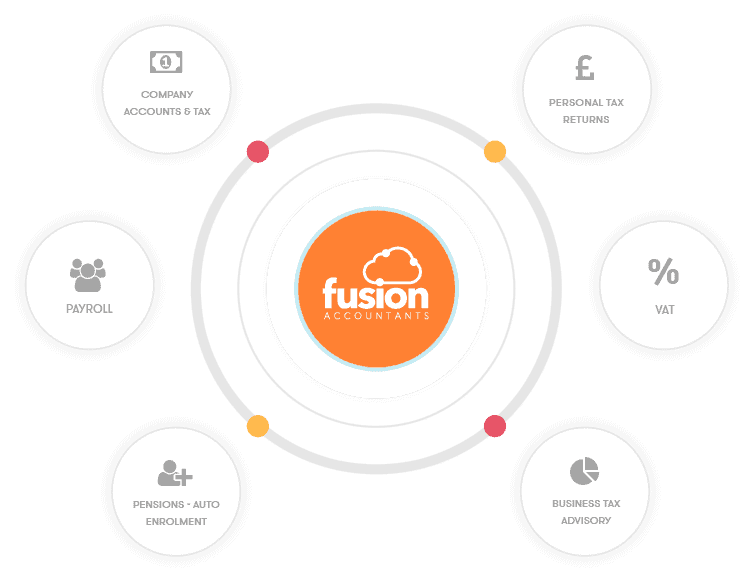

We love helping new start-up businesses succeed. We provide comprehensive services from Company formation, supporting with raising finance, opening bank accounts, developing business plans to monthly management accounts to help make key business decisions and much more.

Company formation to filing

Develop business plans

VAT, Payroll, CIS and Pensions registration

Xero, Quickbooks, FreeAgent

Start your business journey with us

Starting a new business can change your life. Of course, there are risks, but the benefits of being your own boss, earning potential, and work-life balance can be gratifying. Starting a small business is likely to be difficult at first, but it is also the start of an exciting journey.

We love hearing about your great commercial idea, vision, and long-term goals.

Of course, there is a lot to consider, from a business plan and strategy to cash flow management.

Having helped hundreds of clients start businesses, we are excited to be a part of your success!

We provide very comprehensive service packages starting from £99 + VAT per month that include VAT preparation and filing, Corporation Tax and a quarterly bookkeeping review to help you make key business decisions, and so much more besides.

Form your company

One of the most important factors to consider when starting a business is the company type. It is vital because the taxes and liabilities you owe depend on your business structure. We will help you decide whether being a sole trader or running a limited company is best for you, reducing your tax liability, and we will handle all the paperwork..

We can also provide bank reference letters to help you open your business bank account.

Get set up & registered

Once you have decided your business structure, you will need to get registered for things like VAT, Payroll, CIS Pensions, etc. We will carry out the relevant registrations and keep you in the loop until the process is completed.

Need to raise finance or require a business plan?

We know a lot of new businesses require funding when starting up. Therefore, we have partnered with several banks and funding providers to help you get that crucial financial boost to help kick start your business.

In addition, our dedicated accountant will work closely with you to understand and develop a great business plan for you.

Get your business off

to the best start.

We have helped thousands of UK businesses with their accounting needs. We seem to be doing a good job

as our clients are always happy to tell us.

Why our clients

love us

Tailor made premium service with your

own dedicated accountant

We offer exceptional customer service. Every client has a dedicated accountant who will help them understand their business and manage their accounts and books tax-effectively.

Set up your accounting software

Drawing on our years of experience dealing with hundreds of companies, we can help you select the best accounting system that fits your company’s needs the best which could vary significantly on your product or service or if you trade just in the UK or internationally. Drawing on our years of experience dealing with hundreds of companies.As a result, we add value and real peace of mind to our clients’ lives.

We are modern accountants that help businesses grow

Dalia Sreideriene at DS Eco Cleaning Services Limited says:

“Fusion Accountants tax advice helped grow my start-up cleaning business. We started from very simple things like annual tax returns and later on, we added on VAT returns and year-end accounts, Corporation tax, monthly payroll. We use cloud software and my client manager can be on the accounts at the same time and manage together. Fusion is up to date with changes and laws if something applies to my company.”

Complete accounting & tax service

Once you are up and running, we take over all of your accounting & tax compliances – from bookkeeping to running payroll, submitting VAT returns, and filing your Statutory Accounts. You will be kept fully updated with how the business is doing through our Management Accounts service. We will use real-time award-winning accounting software (standard in all our packages), taking the stress from bookkeeping and tax processes.

EIS /SIES

During a period of growth, businesses will often need lots of additional funding. You can do this in many ways, such as; EIS (Enterprise Investment Schemes) or SEIS (Seed Enterprise Investment Schemes). The tax benefits of these can make it significantly easier to obtain funding for your business. Again, we can provide advice on this and cover any necessary paperwork.

Customer service reviews

I have found Fusion accountant on the web while looking for an accountant and i am very glad I found them. Their services are very efficient. They answer all your queries and questions. They give you great advice to manage efficiently your business. Their technology made it so easy for me to start up my business and very pleased with their level of expertise. Many thanks