Is Xero accounting software right for your business

Reading Time:

What is Xero?

Xero is a cloud-based accounting software formed in New Zealand created to support small and medium sized businesses.

It has been keeping the other major accounting software companies (like SAGE, Freeagent and QuickBooks) on their toes since 2006. Whether you are a start-up, established chain of businesses or manufacturer, the Xero software has a strong accounting solution proposition with numerous accounting features, reports, over 800 app integrations and offers unlimited usage. It offers SME’s the ability to transform the way they do business by having more ownership and control over their finances, reducing paperwork and streamlining processes.

The software has over two million subscribers (over 500,000 in the UK) and is the primary accounting solution for accounting firms (in comparison, QuickBooks has over three million users in the US, and over one million internationally, and SAGE has six million customers).

It recently introduced two project management packages which allow you to plan projects, capture time and costs, send invoices, or monitor progress: Xero Projects or WorkflowMax. The former is for smaller businesses from sole practitioner to mid-size companies, the latter is for any size business with more advanced needs.

In this review we will explore the numerous features and tools Xero has to offer small businesses, accountants, and bookkeepers to help you decided whether this online software is the right fit for your business.

Fusion Accountants is a Xero Platinum Partner which means that we can get your business set up on Xero easily and efficiently, provide you with training and ongoing support with a programme designed to both simplify and add value to your business.

Who does Xero suit best?

Xero is probably best suited for mid-to-large-sized businesses. The software is well-developed and is a powerful all-in-one tool offering numerous automating, invoicing, and reporting features. The ability to work in real-time with your accountant, bookkeeper, or team members, as well as syncing financial information with banking apps and other third-party suppliers (like GoCardless and Shopify). Xero also supports unlimited users for every plan, and you can set multiple levels of user permissions and access controls as well.

Small businesses would probably benefit most from the standard or premium plans, especially if unlimited users are needed, but if you trade internationally, and need multi-currency support, you could see quite a jump in your monthly subscription. Also, the starter plan limits users to only 20 invoices and only 5 bills in one batch (schedule bill payments and pay suppliers).

Business owners with multiple companies will have to purchase a separate subscription for each business. Xero’s primary market is the US and is now available in over 180 countries.

While the price may rule out the software for small businesses, Xero still has a lot to offer for medium and large businesses or those in need of multiple users.

Xero Pricing

Rating – Fair: 3/5

Xero used to offer incredibly scalable pricing. The other appeal of the software was that each plan came with unlimited users, access to every Xero feature, and payroll. Payroll was subsequently changed to an optional add-on in November 2018, and it also has limited some features (such as expenses and multi-currency support) to its most expensive plan. Each plan still offers unlimited users and live bank feeds, so businesses can download, categorise, and reconcile their transactions as usual.

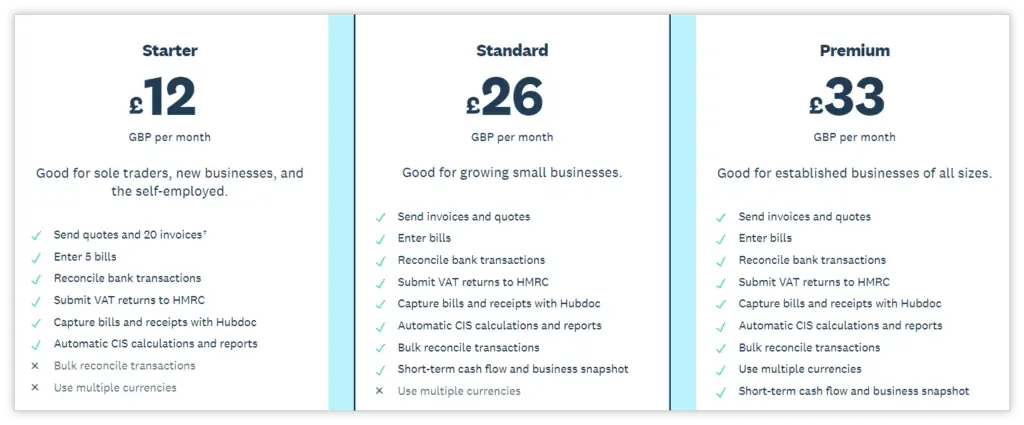

Xero offers three different pricing plans: Starter, Standard and Premium which we go into more detail below.

Payments are made monthly and there are no annual contracts, so you can cancel your subscription at any time (providing you give 30-days’ notice). Xero offers a free 30-day trial and even has a demo company set up, so you can “try before you buy”.

Xero offers discounts for non-profits and owners of multiple companies. It also does from time to time offer enticements, and at the time of writing (Feb 2021), is offering several rewards to new subscribers.

Xero’s current pricing structure offers this as standard across all its packages:

- 24/7 online support

- Cancel with one month’s notice

- Safe and secure

- Ready for Making Tax Digital

Starter

(Great for Freelancers, Sole traders, and new Start-up businesses).

The Starter plan costs £12/month and includes:

- Send 20 invoices and quotes

- Enter 5 bills

- Reconcile bank transactions

- Submit VAT returns to HMRC

- Automatic CIS calculations and reports

- Capture bills and receipts with Hubdoc

Optional add-ons

Payroll from £5 per month

Claim expenses from £2.50 per user

Track projects from £5 per user

Submit CIS returns for £5 per month

Pay with TransferWise from £3 per month

Standard

(Good for growing small businesses).

Xero’s most popular plan costs £26/month includes everything in the starter plan and optional add-ons, but in addition, offers:

- Unlimited invoices and quotes

- Unlimited bills management

Premium

(Good for established businesses of all sizes).

Xero’s premium plan costs £33/month and includes everything mentioned in the Standard plan, plus:

- Use of multiple currencies

The optional add-ons in a bit more detail:

Payroll

Free for the first three months for up to 5 employees

Explore more about payroll

Claiming expenses

Free for the first three months

Explore more about expense claims

Pay with Transferwise

Get 50% off for the first three months

Explore paying bills with Transferwise

Xero Features

Rating – Excellent: 5/5

Xero often gets praised for its feature selection. Here are some of Xero’s key features:

Dashboard: The dashboard features a sleek UI (user Interface) with graphs labelled bank accounts, outstanding invoices, bills to pay, and total cash flow. You can customise these to show the key areas most important to your business.

The navigation menu reads Dashboard, Business, Accounting, and Contacts, and you can access a quick create button, search button, recent notifications, and an in-software help button along the top right.

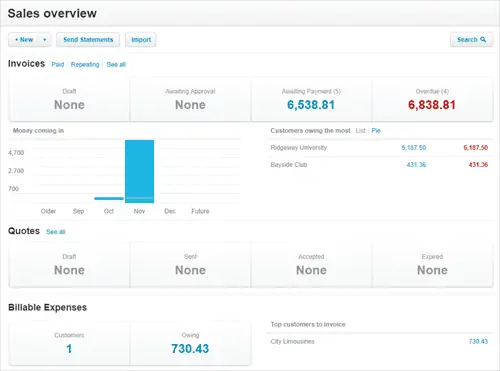

Sales overview: The sales overview has a summary of charts and graphs breaking down the status of your invoices and estimates. You can search for and edit existing transactions, create new ones, or send customer statements. Hover over a bar to see the invoices making up that total. The invoices table shows which five customers owe you the most. Use the status panels to monitor your invoices, quotes, and billable expenses.

Tip: If you are just getting set up, you can import your sales invoices and credit notes in bulk. Alternatively, if you have already entered invoices and quotes in Xero, use ‘search’ to quickly access them.

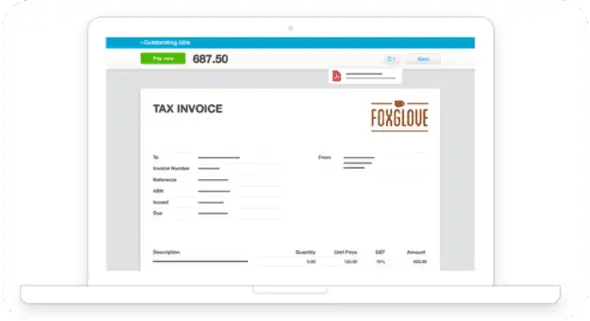

Invoicing: Xero only offers a single invoice template. You can create custom templates including your terms of business and full quote details. Xero offers time-saving tools, including automatic invoicing, automatic invoice reminders, default payment settings, bulk invoicing, and replication of previous invoices. See all your outstanding and overdue sales invoices at a glance.

You can easily create credit notes and send customer statements straight from the invoicing screen. Customers receive estimates and invoices as PDF attachments, and payment gateways are available for invoices. Add your logo to existing invoice templates or generate custom invoices in Microsoft Word with Xero invoicing software.

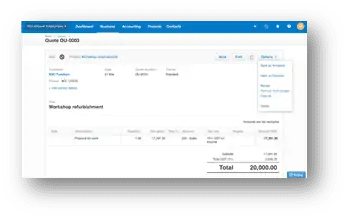

Create quotes: You can personalise your Xero quote using your logo and the details you want and set up several customised versions. You can easily create quotes and convert them to invoices, purchase orders, or bills from your mobile or desktop. You can duplicate past quotes and add notes to quotes as well.

Email your quotes as a PDF or link to an online version so it is simple for customers to accept or comment. You can also see its status as viewed, revised, accepted, or declined. You can obtain a report showing all the quotes issued and the potential income.

Client portal: Xero has recently added a nice client portal which is free to access. Customers can view, accept, print, and pay invoices directly online. You can use it to securely view, download or e-sign documents, such as tax returns or financial reports, sent to you by your accountant.

Contact management: Xero has some of the best contact management features allowing you to use your lists as a smart marketing tool targeting particular groups of contacts (and suppliers) in a number of ways:

- Set up your software to remind you when it is a good time to make calls or send emails. It can pop up alerts if a customer has not been contacted for some time, and prompt you to get in touch.

- Use the app to track the results of bulk mail advertising or find out which types of marketing campaign work best.

- Identify cross-selling opportunities and potential new leads.

- Create special offers for clients who seem to be drifting away, or to set up and manage events that might increase customer retention.

For applications that integrate with CRM software – such as HubSpot and MailChimp – check out the Xero app marketplace.

Expense tracking: Xero Expenses works seamlessly with Xero accounting, and has all the tools and insights small businesses need to efficiently track and manage expense claims. Capture expenses on the go and keep everyone up to date with push notifications. You can connect your bank and credit card account directly to Xero, or you can manually import your bank statements. You can easily categorise your expenses and split transactions. Assign an expense to a specific customer or project as you enter it. It is automatically added to your customer’s next invoice, so you can make sure you are reimbursed.

Tip: Xero partners with Yodlee, which may violate some banks’ Terms and Conditions, so we suggest you consult with your bank to see whether live bank feeds are the right choice for you.

Bank reconciliation: You can reconcile your accounts daily and run a reconciliation report. You can set up a bank feed so your bank transactions flow into Xero every day and use the Xero app to reconcile transactions on your phone. If your bank does not connect to Xero, you can manually import bank statements instead. Xero will also suggest matches for your transaction history, categorises them and applies any rules you set up, making reconciliation easy.

Chart of accounts: If you are picking up the bookkeeping in a new business, you may have to set up the chart of accounts. The chart of accounts sits just under the five main accounts that make up the general ledger which are: Assets, Liabilities, Equity (balance sheets) and income and expenses (P & L). This allows you to produce detailed reports into specific areas of the business and its finances.

Inventory: Although Xero is much better suited for product-based businesses, you can run reports to find out how well different items are selling. You can add items and record basic information, create internal notes, and add attachments to items. You can also track your inventory and make adjustments. Xero keeps tabs on your stock levels, the value of your stock, average purchase costs, and the number of items committed to quotes. What it does not do, however, is send you a reminder if your stocks are low, and Xero does not allow your tracked items to go into the negative.

Time Tracking (Premium plan only): If you use the premium plan, this app is used for logging time and work hours, so you can invoice all the hours your team works. A monthly Xero Projects subscription includes one active user for £5 per month. You will only pay for extra users who were active that month (at £5 per month).

Reports: Xero offers ample accounting reports. There are 55 reports in total, covering everything from sales and budgeting to cash flow and more. Reports can be customised as needed, and you can save your favourite reports for quick access.

Budgeting: You can use the Budget Manager report to create a three, six, twelve or 24-month budget. You can only have one overall budget per organisation to make sure you hit your financial goals, but you create smaller departmental budgets.

Purchase Orders: Create and send purchase orders online. Then keep track of orders and deliveries so ordering is right every time. You can personalise your templates creating unique purchase order numbers, delivery instructions, and expected delivery dates to purchase orders. If your supplier ships your order in parts, you can record a “part supply” to keep track of how much inventory you have already received.

Multiple Currencies: Xero supports over 160 currencies so long as you have the Premium plan. Currencies are updated hourly and reports can be customised and run-in different currencies.

Using Xero for Making Tax Digital (MTD): MTD is an HMRC service that requires businesses to keep digital records and file VAT returns using compatible software. You can generate, review, and submit VAT returns once you have signed up for MTD via HMRC. Once you connect Xero, you can view VAT return due dates, details and make any adjustments to returns before submitting your VAT returns directly to HMRC. Xero is fully compliant with the MTD programme.

Ease Of Use

Rating – Excellent: 3/5

Xero has been nicely put together and has an attractive, modern UI. While the software is well-organised, you do have to invest quite a bit of time to understand how the software works (not as difficult as QuickBooks though). It takes quite a while to explore all the features it has to offer, but once you get acquainted with the software, Xero is fairly easy to use.

On a positive note, Xero does provide extensive support in its help centre from numerous video tutorials, resource library, business guides (covering starting up, hiring staff to finding investors) and online courses and webinars.

Hardware & Software Requirements

Rating – Good: 4/5

As cloud-based software goes, Xero is compatible with any device (i.e., iPhone, Android, and iPad) so long as you have internet access and use one of the following browsers:

- Google Chrome

- Microsoft Edge

- Mozilla Firefox

- Safari

Xero recommends the most recent version or the previous version of each browser.

Xero Customer Service & Support

Rating – Fair: 3/5

Though Xero offers free, unlimited support 24/7 from our customer support team or access to resources via Xero Central under its support tab on their contact us page. Getting in touch and speaking with an actual representative proves to be far more difficult, relying much more on email support. On a more positive note, they will arrange a phone call (eventually), if the issue cannot be resolved via email communication – so telephone support is available as a last resort.

As customer numbers have increased Xero’s turnaround on replying to emails can now take a day or two. The lack of any phone support has been a longstanding issue, and we are afraid there does not seem to be any short-term solution to getting a quick answer from Xero any time soon! There is a lively community area that boosts the overall useability of the Xero experience.

An overview of all Xero’s support tools:

- Email: Contact Xero with any questions.

- Live Chat: A live chat feature is available on the actual Xero website. Though it is mainly there to field sales enquiries, they will not turn you away if you have a question about its features.

- Help Centre: As mentioned above, Xero Central has numerous ‘how-to’ articles, training modules and infographics to help troubleshoot the most common questions or issues.

- Guides: There is a wide variety of business guides, covering everything from running your practice to boosting or expanding your business, and more.

- Training: Choose a topic you want to learn more about. Do courses online, join a webinar, or go to a live event.

- Blog: It features business news, advice articles, ideas for success, and more.

- Xero TV: A library of hundreds of visually enjoyable videos with easy ‘step by step’ guides on how to use the software. In our opinion it is one of the best support resources offered by any of the accounting software providers.

- Podcasts Innovative ideas and surprising insights from people who know business inside out featuring digital marketing strategy advice and talks from Xero CEO.

- Social Media: Covers most of the social media bases, with visibility on Facebook, Twitter, YouTube/Vimeo, and LinkedIn.

Negative reviews & complaints

Overall, Xero has received positive customer reviews, but in recent years there has been an increase in negative feedback. The most common complains seem to be:

Price – too expensive: Some users have already found Xero a bit on the expensive side, but many more users are starting to complain about the price increase, the change in payroll from free to a paid add-on, and some of the features such as project management and multi-currencies only available to the most expensive plan.

Mobile issues: Some of the biggest problems has been mobile access, or automatic application updates not happening, in comparison to the desktop version. There have also been reports of bugs and crashes.

Xero Integrations & Add-Ons

Rating – Excellent: 5/5

Xero offers over 800 integrations to choose from. Xero also integrates with Zapier, connecting the software to hundreds of additional add-ons. Some Xero integrations are country-specific, so make sure they are compatible before you make any additions or purchases. Xero also offers API for developers.

Security

Rating – Excellent: 5/5

Xero has a reputation for some of the strongest cloud security out there. Security measures include data encryption, two-step authentication, and 24/7 monitoring at multiple locations. Data is backed up daily across various servers, and regular security audits are performed. Xero also boasts an impressive record of 99.97% uptime.

Final Verdict: Xero accounting software summary

Xero is a powerful cloud-based software tool with strong accounting and finance features, with a raft of integrations and automation that help to save time and streamline your processes and therefore reduce your costs available to an unlimited number of users. Giving your accountant access to your accounts can speed up the preparation of reports and tax submissions which should also see a reduction in this service cost.

Top-line positives of using Xero

- Unlimited users

- Numerous integrations

- Suited for large businesses

- Advanced features

- Double-entry accounting

Room for improvement

- Steep learning curve

- Poor customer support

- Pricing for small business and start-ups

The software does have its drawbacks with limited customer service support. It is much more focused on growing or established businesses, rather than sole traders or start-ups, an expensive pricing structure and has a steep learning curve. One of the things that had set Xero apart was having payroll included in the packages and the fact that all features were accessible on all plans. However, since making payroll an add-on service, Xero lost its great tax support, and the customer service performance has taken a turn for the worst.

If you run a small business, we recommend you explore all your options by checking out Xero’s plans as well as the other top alternatives software providers (such as Quickbooks, Freeagent, SAGE etc). If you are not sure which online provider to use, we have put together a blog on the best accounting software that explores usability and pricing.

In the end, Xero is a good solution for mid-to-large-sized businesses in need of strong accounting features and multiple users. We recommend you take advantage of Xero’s free trial and see if this accounting software is the right fit for you.

Also Read: The Pros & Cons of Xero Bookkeeping software