Stripe Xero Integration

Reading Time:

Stripe and Xero are two of the most well-known companies in their respective fields. Xero is, without a doubt, one of the most popular accounting programmes, with a sizable market share. Stripe is a popular payment option for both start-ups and eCommerce sites.

In this article, we will be looking at the Stripe payment system and how to set it up and integrate it with Xero to accept online invoice payments via credit card, debit card, or Apple Pay to keep your cash flowing in without spending time and energy chasing up payments.

You will be joining millions of small businesses worldwide that have selected Stripe to process hundreds of pounds in transactions each year.

Who and What is Stripe?

Stripe is a tech company that builds economic infrastructure for the internet.

They bring together everything you need to build websites and apps that accept payments and automate pay-outs globally for online and in-person retailers, subscriptions businesses, software platforms and marketplaces – and everything else in between!

If you want to look into this a bit more before deciding to go ahead with the software, visit their website & pricing packages here

How do you integrate Stripe with Xero?

Xero has teamed up with Stripe so you can easily accept credit and debit card payments from your online invoices, so your customers can pay you quickly and securely.

To set up Stripe to your Xero account, watch this two-minute video or follow our quick step-by-step guide below.

To connect with Stripe, you will need to do this via your Xero Account. You can start in two places via the ‘Payment Services’ option in your Xero settings or straight from an approved invoice.

Via your approved invoice

Go to invoice options and then online payments. From there, you can sign up for a Stripe account in Xero.

Choose ‘get started’ on the credit card option and it will guide you through the process to set up a Stripe account. If you already have a Stripe account, there is an option at the bottom to connect your pre-existing Stripe Account to Xero instead. If not, just enter information when prompted and Xero will then create transactions automatically for the Stripe fees too.

Let Xero create an account for these or click ‘edit’ when asked where Stripe fees should appear in Xero to choose an existing account. Finally, click ‘Connect Stripe to Xero’. You will then receive an email from Stripe to activate your account and complete your setup with them.

Via Stripe payment settings

If you have chosen to set up the Stripe connection via the payment settings instead, don’t forget to add it to ‘manage themes’ labelled as a credit card. You are now ready to receive payments from the online invoices you send customers.

When your customer receives the invoice, they click ‘pay now’ following the prompts entering their credit or debit card information. The invoice will then be automatically marked as paid, and it will create the corresponding fee transaction in Stripes’ software, so reconciliation is easy.

You will receive the amount paid for your invoice in your bank account minus the Stripe fee. You need to match the incoming money against the invoice and make the Stripe fee adjustment as you reconcile the incoming money.

That’s it. Your Stripe account is now set up with Xero!

We can also help you integrate Stripe with a number of market-leading eCommerce platforms such as Amazon and Shopify. Check out our eCommerce accountants page for more information.

How Stripe & Xero to double entries work

If you are not familiar with the term ‘double entry’, it simply means transactions and movements of money are recorded in your business. So, for every business transaction, amounts must be recorded in a minimum of two accounts. In addition, the double-entry system requires that all transactions are entered as debits and credits, and the amounts must match.

For example, say you make a payment from your business bank account for a train ticket. This would credit (come out of) your business bank account and debit (go into) your travel account. This travel account is a theoretical account and doesn’t exist beyond allowing you to record what money was spent. The same goes for receiving money from a sale to one of your clients. It will debit your bank account and credit your sales account.

We have included some steps below to help you understand how the Stripe integration process works in the background of Xero. The double entries for each stage have been included as well.

Step 1:

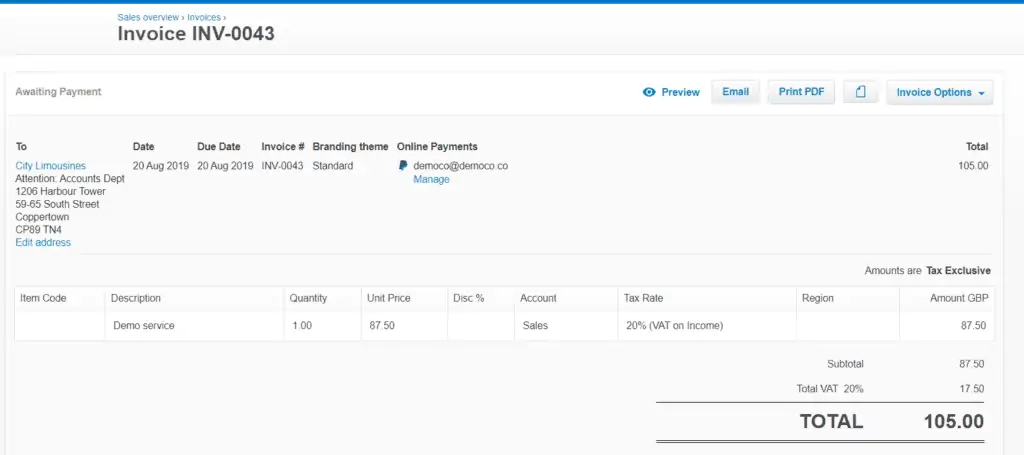

Raise a sales invoice and enable the option for a Stripe payment to be made. Once done, this will show under the ‘Online Payments’ section of this invoice.

Double Entry 1:

- Cr Sales £87.50

- Cr Vat £17.50

- Dr Accounts Receivable £105

Step 2:

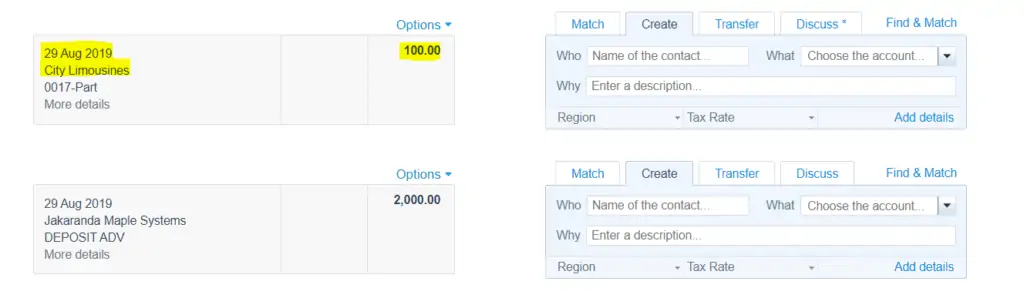

The customer then pays the invoice. The issue here is that you will receive the money from Stripe minus their fee. As you can see from the example below, the invoice was for a total of £105 but only £100 was received.

Step 3:

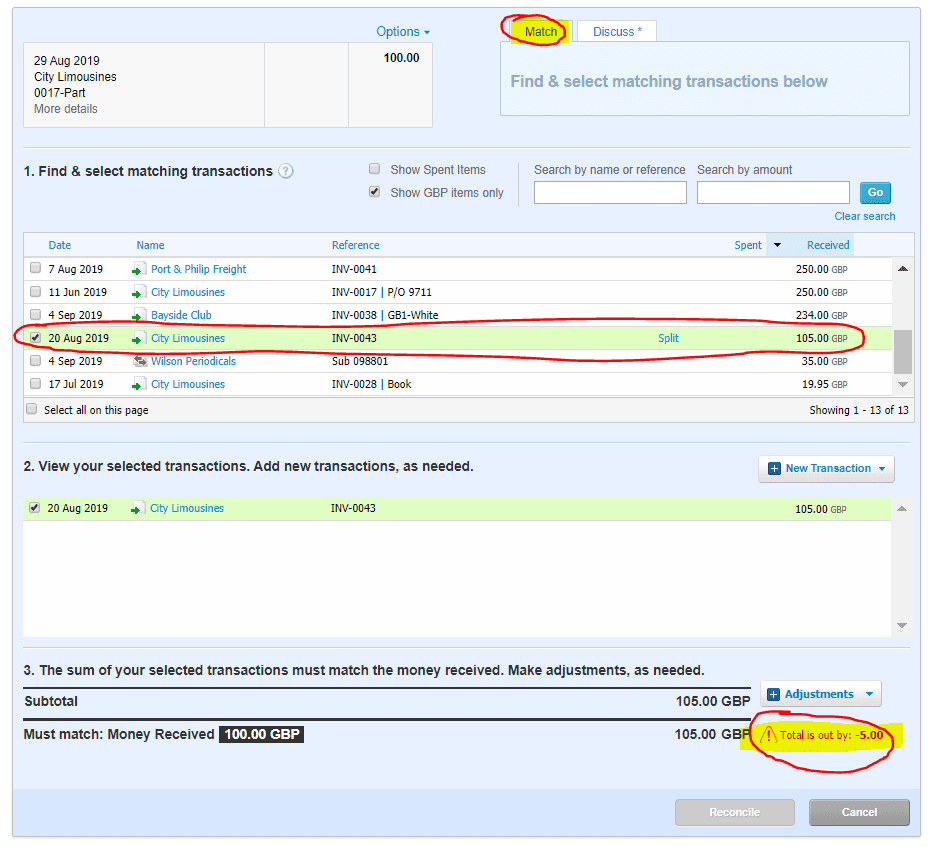

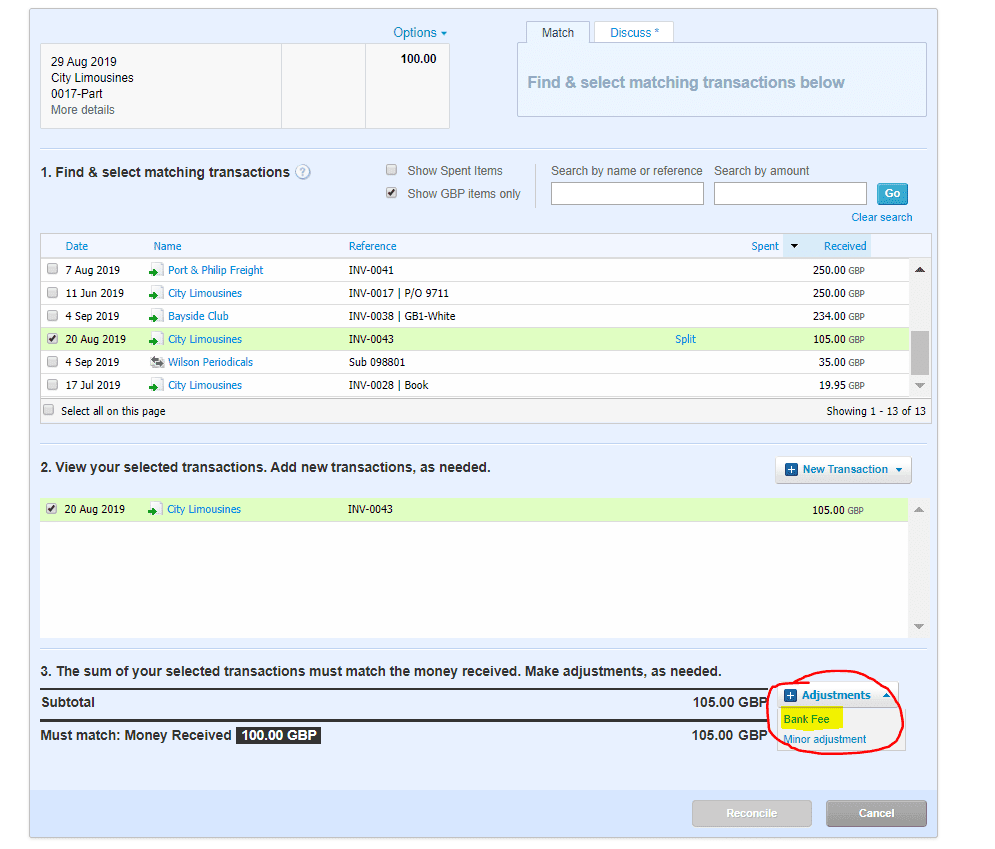

Click on ‘Match’ and select the invoice you wish to reconcile by selecting the check box. You will notice the amount paid in is off in this case by £5 which is the stripe fee.

Double Entry 2a:

- Cr Accounts Receivable £100

- Dr Bank £100

Step 4:

Select ‘adjustments’ and then bank fee.

Step 5:

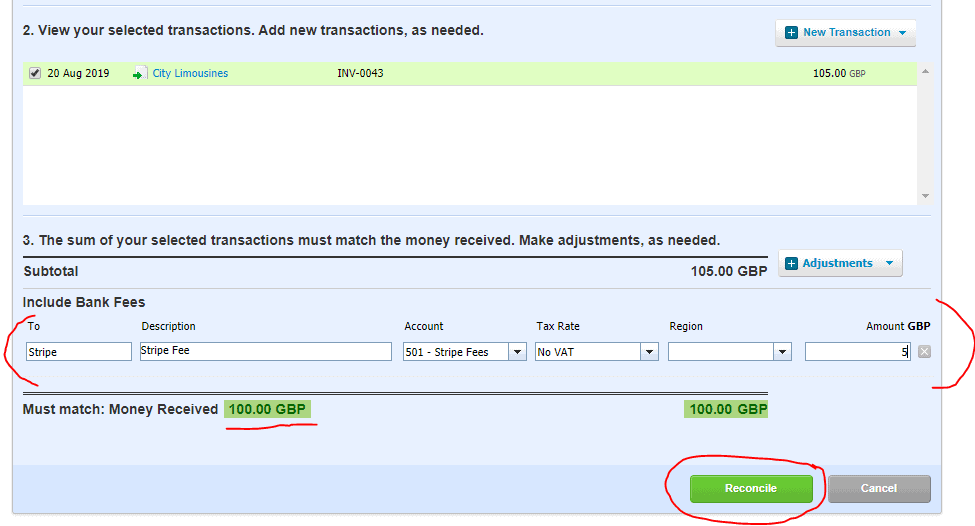

Fill out the bank fee adjustment fields as below and enter the value of the bank adjustment in this example £5 then click on ‘Reconcile’.

Double Entry 2b:

- Cr Accounts Receivable £5

- Dr Stripe Fees £5

Do you run an eCommerce or small business and need help with your accounting? As a specialist Online Accountant and Xero Platinum Partner, we understand precisely how your business operates, enabling you to grow through intelligent accounting, integrations, automation and financial insights. So why not give us a call on 020 8577 0200 to find out more!