Setting up a Limited Company

Reading Time:

Setting up a limited company is one of the smartest and tax-efficient ways to manage your business and run it the smoothest way financially. As a new business owner new doors open to you to get work you would not normally get if you were a sole trader.

Being successful and running a thriving limited company certainly has its benefits and rewards, but with great power comes responsibility. Becoming your own boss means that you may initially be juggling numerous roles, from client management to marketing, and perhaps most importantly of all, handling all your own finances making sure you keep the lights on!

Operating as a limited company is one of the most tax-efficient ways of trading and is a popular choice for many businesses because it can legitimately reduce the tax you pay. If you are thinking about setting up your own Limited Company, we have put together a simple step by step guide to help you. Then once you are ready to go, please speak to us if you want help registering your company

If you are still undecided about what the right structure is for your business, we’ve put together a quick guide on the difference between being a Sole trader, Partnership and Limited Company,

Set up a Limited Company in 3 easy steps

1. Pick your company name

This part can be equally the most fun, and most frustrating part of the whole process. Much like your website domain name, your company name must be completely unique. You can differentiate in a few ways to make sure it is unique e.g. a limited company name can use either ‘Limited’ or ‘Ltd.’ (i.e. ‘Fusion Limited’ or ‘Fusion Ltd.’).

First, search for available names on the Companies House website to ensure that your planned name is available. Keep your name choice professional and business-like as your credibility will be undermined if you use an inappropriate name. Also, make sure your name is not similar to an existing company name as it could create confusion and lose you valuable new leads. Steer clear of using words and expressions deemed to be ‘sensitive’ by Companies House.

Struggling for great business name ideas? Try Shopify’s Business name generator

If you are going to conduct business overseas, make sure that your proposed company name is not likely to cause offence abroad. Avoid any trademarked names or expressions. Think about the long-term goals of your business as well and how that name will still be relevant then, not just in the present. offers right now.

2. Forming your limited company

You will need to provide certain personal details to help Companies House identify you as a company director, as well as the type of business your company intends to carry out.

Make sure you submit a Standard Industrial Classification code (SIC). To do this, go to Company House and select the code that best describes your business from their Condensed SIC code list

Decide what addresses you want to register for your business (you may have a registered office address and a different service address). You should not use your residential address for privacy purposes. Decide how many shareholders you want and how many shares they will each have (known as their shareholding).

If you prefer pass all the above information to us and we can sort everything out for you, liaising with Companies House on your behalf. Your limited company could be formed within a few hours!

3. Completing incorporation process

Companies House is responsible for the registration of all limited companies in the UK. They provide detailed information on the process or you can use our services to make things easier. Registering a limited company costs £10. Once you have done this, you will be up and running! Companies House will often have your limited company formed in just a few hours.

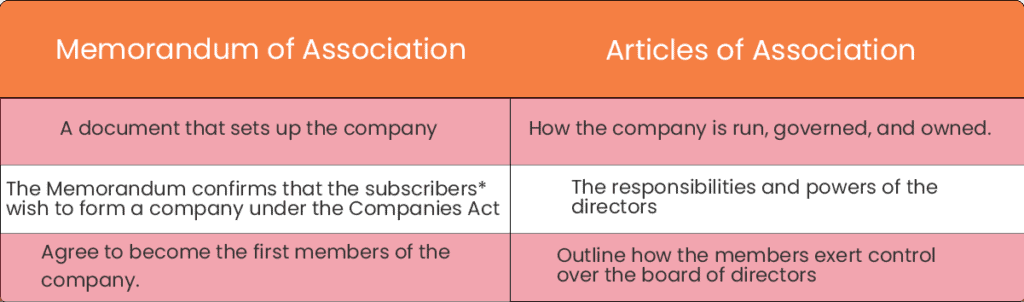

Memorandum of Association and the Articles of Association are required for a company formed in the UK under the Companies Act 2006 and previous Companies Acts.

Here are the main differences between thew two and your responsibilities:

*The initial shareholders in a private limited company are called subscribers because, as part of the company formation process, they subscribe to the company’s Memorandum of Association

In the case of a company that will have a share capital, they undertake to subscribe for at least one share each.

Form 10 – the director’s name, address, and registered company address (this does not have to be where you work but will be where the legal correspondence from HMRC and Companies House will be sent).

Form 12 – states that your company complies with the terms and conditions of the Companies Act.

There are exceptions to the unlimited powers now given to companies. Charitable companies must state the charitable purposes to which the company is restricted. Similarly, community interest companies (CICs) must restrict the company to purposes that benefit the community. A community interest company is a special form of non-charitable limited company, which exists primarily to benefit a community or with a view to pursuing a social purpose, rather than to make a profit for shareholders.

That is how you start a limited company! We hope you found this information useful. If you have any questions about setting up a Limited Company please get in touch on 0208 577 0200 or you can schedule a meeting with one of our experts who can provide all the tax advice you need.

What you need to do next

Why not take a look at our next blog post in the series entitled ‘Next steps after setting up your limited company’ that covers opening a bank account, shares Company Director responsibilities, how to write a business plan, shares and shareholders.