Company formation – the next steps

Reading Time:

What happens after company formation?

You have received notification that Companies House that they have approved your application. Congratulations, you can now start trading through your new company!

If you choose to start straight away, your company is ‘active’, and you must register with HMRC for corporation tax within 3 months. If you do not want to trade until a later date, you must still HMRC that your company is dormant. When you are eventually ready to trade, you will need to register for Corporation Tax.

As a company director, there will be some admin to take care of and there are reporting and filing responsibilities you will need to maintain.

We have put together a simple step by step guide below to help you. Then once you are ready to go, please speak to us if you want help registering your company.

Now if you have a business and want it to grow, both in infrastructure and in sales and income, we have put together some great business growth strategies to help you continue on your successful business journey.

Setting up a business bank account

You really should have a separate business bank account for all company finances, but you are not legally required to have one. If you use your personal account, however, it will make it difficult to distinguish company money from personal money.

Firstly, you will need a business bank account for your limited company and some small business insurance to cover you and your business for any work you are doing.

The bank will often ask what your anticipated turnover will be, how many transactions you expect to process each month, and if you have any borrowing requirements (overdraft facility, etc.)

Some of the newer mobile app business bank providers (such as Tide, Mettle, Starling etc) will allow you to complete the application process entirely online saving you a lot of time.

If face-to-face contact is important to you, find a bank which will provide you with a dedicated small business account manager. They will have experience of dealing with small, limited companies and will be able to help with any questions you may have.

Company Registration Number

Your unique 8-digit company registration number (CRN) is displayed on your Certificate of Incorporation. You will also be able to find it on the public register of companies next to your company name and on any official documentation you receive from Companies House.

You must display your company registration number on all forms of company stationery, websites, and other online material. Except for dormant companies, you must always display your company name in the following places:

You also must state your registered office address on all forms of company stationery, websites, and online material. You should include the country of registration alongside your registered office address – i.e. England and Wales, Scotland, or Northern Ireland.

Make sure HMRC knows you are in business

HMRC will provide you a 10 digit Unique Tax Reference (UTR) to every incorporated company.

This number is important as it is needed to file your company tax returns. When you incorporate with us, HMRC will automatically send a letter with your UTR number to your company’s registered office within 3 weeks from your company’s incorporation date.

If you have not received the UTR number after 3 weeks, you should contact HMRC on 0300 200 3310

Write a business plan

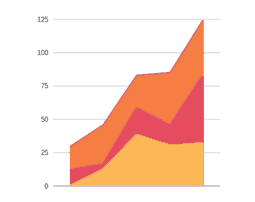

A business plan can help you work out whether your business idea will be successful and profitable.

You can also use your business plan to help your company move forward providing key milestones to reaching initial targets as you build your successful business.

Even if you are planning to start out as a solo-entrepreneur or sole trader, you can benefit from writing up a business plan. Do not forget that your business plan is not set in stone. It is a plan that is quite fluid and can be changed or updated as your company evolves into the future.

Include as much detail as possible so that should you want to encourage investors into your business or you want to seek out business credit from banks or other financial lenders you will have a solid plan to show them that includes a mission statement, detailed customer market research, and financial projections including costs for producing and delivering your product or service.

Shareholder Definition

Shareholders are the people who collectively own your company. You do not have to be a director of the company to be a shareholder. Each shareholder has an official view on major decisions relating to the company, also known as voting rights. The person with the most shares has the most voting rights (this is sometimes referred to as having ‘controlling interest’).

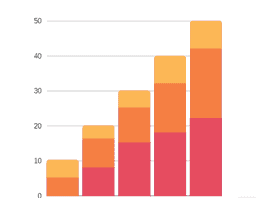

At the discretion of the company directors, dividends (payments from the company’s profits after tax) can be issued to shareholders in accordance with how many shares they hold.

Ownership and shares

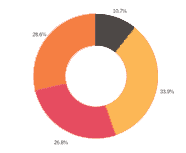

Shares define how the ownership of your company is divided up. Every limited company must have at least one share e.g. if a company has one share and is owned by one person, that person owns 100% of the company. However, if two people own a share each, then they both have 50% ownership of the company.

All shares have a nominal value which needs to be paid into the company bank account by the end of the company’s financial year. It is standard practice for a new company to have 100 shares at £1 when the business is incorporated. This means £100 needs to be paid into the company bank account by its shareholders.

What is the share value?

Share value is how much each share is worth e.g. the amount the shareholder has invested. This is different from the nominal value of the shares. When a company is formed, it has no value apart of the nominal value of the shares. As the business starts trading, the share will increase in value.

If you want an uneven divide of the company (e.g. one director owns more of the company than the other), you can split the 100 shares further. For example, you could divide the 10 shares so that one director has six shares (60%) while the other has four shares (40%).

There is no such thing as half a share, so if you want a more specific division of the company, you can always have more than 100 shares at £1 each and divide them accordingly.

You can always issue more shares at a later date. However, there are tax and accounting implications to this, so it is worth consulting an expert. We can advise you on this.

How much should I value each share?

If you are the sole director of a new company, it is easier to create 100 shares at a value of £1. This will give you 100% of the company with a share capital of £100. This keeps things simple when starting out.

Similarly, if there are two directors then you can issue 50 shares to each shareholder at the value of £1 each. This will give both of you 50% of the company with a share capital of £50 each.

What is the share capital?

The share capital in a private limited company is the amount of money invested by its owners in exchange for shares of ownership and is the total value of shares that have been issued e.g. if you issued four shares at £1 each, the share capital of the company would be £4.

Company directors are typically shareholders in their own companies. Shareholders exercise certain powers over how the company is run.

We hope you found this blog useful. If you have any questions about the process of trading as a new Limited Company please get in touch on 0208 577 0200 or you can schedule a meeting with one of our experts who can provide all the tax advice you need.

What you need to do next

Every limited company must also submit documents to Companies House to change any existing information about the company. If you are VAT registered remember VAT returns need to be sent to HMRC at least every quarter. And if you are employing people you will need to make monthly PAYE and NI contributions.

Why not take a look at our next blog post in the series entitled ‘Limited Company Duties and Responsibilities’ that show looks at your responsibilities as Company Director including filing VAT and Corporation tax