The 4 best payroll software providers for the UK’s Small Businesses

Reading Time:

Running your payroll is a popular choice amongst UK small businesses, especially when you start to take on your first few employees. However, a big part of getting your payroll right is about making sure you select the software that will work best for your business – and for that, you will need the right software.

When looking for a payroll solution, whether paid-for or free, you need to make sure that it can report to HMRC in real-time every time you pay an employee, known as Real-Time Information (RTI) compliant. HMRC regularly checks payroll software to evaluate whether they are RTI compliant and holds a list of free or paid-for approved software suppliers.

Every business will have different requirements, but you will need payroll software that:

- Records employee details

- Calculates statutory pay

- Work with your pension scheme provider

- Calculates pay and deductions

- Reports in real-time to HMRC

- Calculates how much you need to pay HMRC

Some software packages have comparatively limited features, and this is particularly common for free options, so make sure you properly evaluate your options before deciding.

In our review article, we have taken four of the UK’s most popular small businesses software products and reviewed the following areas: Usability, Features, Connectivity and Price and put together a brief guide that helps you make the right choice for your payroll needs.

As part of our review, we have taken as standard items such as printing out payslips, P60s and employer’s reporting and have only included payroll providers compliant with GDPR legislation.

Introducing the contenders:

Here is a quick overview of all the payroll providers featured in our review, if you are not familiar with them:

QuickBooks is an accounting software package developed and marketed by Intuit. QuickBooks products are geared mainly toward small and medium-sized businesses managing payslips, pensions, and statutory pay, with real-time submissions to HMRC.

Your payroll data is connected to your other accounts, so you get the complete picture of your business – anytime, anywhere. There is one interface to understand and pay just one bill.

QuickBooks has two payroll products: Simple, Essentials and Plus, with prices currently ranging from £12-32 per month + VAT and does offer huge monthly discounts.

Xero, our second contender and probably the best-known supplier in our list, has been around since 2006, and its SaaS accounting software has over 2 million subscribers. Like QuickBooks, you can subscribe to a Xero payroll only plan using different accounting software.

Xero allows you to enter a pay run, make bulk payments, and email or print payslips for employees according to government legislation. In addition, web access (or via the Xero Me mobile app) gives employees self-service options, making your life much easier.

Xero has three different plans to choose from Starter, Standard or Premium, with prices currently ranging from £12 – £33 per month + VAT. Payroll is charged at £5 per month for up to 5 employees, then £1 for each additional employee across their packages.

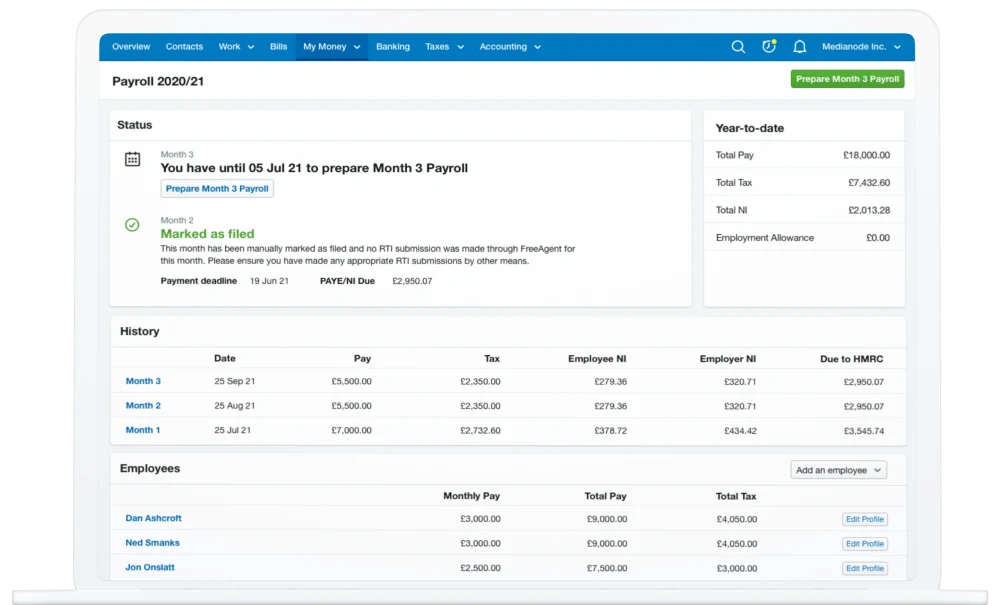

FreeAgent payroll is our third option. Its easy-to-use HMRC-recognised payroll software allows you to run your monthly payroll and file the PAYE and National Insurance contributions that have also been calculated directly to HMRC.

FreeAgent automatically generates payslips each month for all your employees, which you can view and edit online and print them off as PDFs. You can generate P60s for all your staff members at the end of the tax year.

The Freeagent subscription package is different from our first two contenders. Its charges are based on the type of business you run (i.e., Limited Company, Partnership/LLP, or Sole Trader) rather than the services you use and includes payroll as standard.

Their monthly pricing starts from £9.50 for Sole Traders, £12 for Partnerships & £14.50 for Limited Companies. If you are a NatWest or RBS business account holder, you can get full access for free if you retain your bank account.

Brightpay is our final contender and is the only provider that offers an optional cloud add-on to your desktop payroll software which includes automated cloud backup, online employer dashboards, annual leave management, client payroll entry and approval and an employee self-service portal.

BrightPay includes payroll journal API integration with several accounting packages, including Xero, Sage One, QuickBooks Online, FreeAgent, Kashflow and AccountsIQ. In addition, it allows users to send the payroll journal directly to the account’s software from BrightPay. They process payroll for over 250,000 businesses in the UK & Ireland.

They provide a variety of pricing packages ranging from £59 – £599, which you can view here.

Round 1: Usability. The Winner is.…FreeAgent

|  | |||

| Usability |

= the best performer

= the worst

Aimed squarely at the SME and freelance market, FreeAgent has developed a reputation for developing unfussy software that is simple to use and has a very intuitive User Interface (UI).

With an excellent ‘tax timeline’, users can easily see what is owed to HMRC and when it needs to be paid and the employer reporting is again, easy to use and fuss-free.

Xero has an excellent interface, but due to the extra functions available in the software, it is naturally a little more complicated. However, RTI reporting is simple, and the UI is clean and uncluttered.

QuickBooks has come in for some criticism of its UI, some of which is justified. Bridging the gap between small and medium companies, the software is perhaps aimed more at professional finance users (such as accountants and bookkeepers), so some of its functions are harder to understand and find.

Brightpay is a professional payroll service offering. It has a myriad of functions and services, which means the interface is less developed than the others and naturally is more difficult to use for the business owner who may only need it to produce payroll once a month. Still, it is perfect if you are doing payroll all day, every day.

Round 2 – Features. The winner is ….BrightPay

|  | |||

| Features |

It is reasonable to assume additional capabilities from a professional software solution such as BrightPay. For example, BrightPay’s complex features like pensions, payments, and deductions allow you to operate several payrolls simultaneously from one platform.

QuickBooks includes several features, including complex pay schedules, multi-currency support, and the ability to send payments in foreign currencies using services like TransferWise.

Other impressive features of Xero payroll include technologies that were previously only available in high-end software. The programme is a true employment solution for small to medium businesses, with customisable payment schedules, numerous pay rates, and integrated timesheets.

FreeAgent suffers a little on the functionality scores but for understandable reasons. First, the software is specifically aimed at smaller businesses that may only have a few employees and will not need the extended functionality of BrightPay. Consequently, functionality is sacrificed to make the UI more intuitive and cheaper.

Round 3 – Connectivity. The winner is ….Xero

|  | |||

| Connectivity |

One of the biggest advantages of using online software is the ability to connect with other online software and service providers by simply changing a few settings or downloading their app. It is also important to note that arguably the biggest drain on the time of any payroll staff is servicing enquiries from employees, and we are awarding extra points here for having self-service options.

Xero is the clear winner here simply for its excellent self-service capabilities. Employees can download the Xero Me app to their phone and instantly get access to their own encrypted e-payslips and payroll information. It also has a good range of add-on apps (found in their marketplace) that extends the usability of payroll by adding on extra services such as HR Partner or UpSheets. Ironically, you can even connect Xero payroll to Quickbooks accounts!

Quickbooks is a close second on employee connectivity, and although the app for this provider is slightly less usable than Xero the software does have a much wider availability of add-ons in their app store and so the gap is very small indeed.

BrightPay has a less refined connectivity and some of the integration is achieved by export/imports, but it does score well in one respect. As a bureau software, Brightpay will link directly to many pension providers to allow auto-upload of contribution records thus removing an additional layer of admin from the payroll schedule. FreeAgent has a less developed marketplace for its integrations but there are still some very well-known and usable apps including Zapier and Simple-Simon.

Round 4 – Price. The winner is ….Freeagent

|  | |||

| Price |

Pricing for payroll software often changes depending upon how many employees you have, which means that a solution that might look cheap when you have one staff member becomes expensive when you have 30. So, make sure you do all the necessary calculations before choosing if you are basing your decision primarily on price.

Where FreeAgent lost on features, it makes up for in price. For example, suppose you are looking for an integrated solution for your bookkeeping and payroll. In that case, FreeAgent bundles its payroll package in with its accounting solution, making it a clear winner.

That having been said, if you are looking for just payroll, then it is still keenly priced at only £9.50 pm for the first six months and £19 after that.

Xero has a simple payroll pricing plan at £5 per month for the payroll module and £1 per employee. The fact that this includes all the payroll functions makes it relatively cheap, especially if you only have one or two employees, but the price could mount up quickly once you expand.

Bear in mind that if you want to add on the accounting function, you will pay a minimum of £10 per month extra.

Quickbooks charges £4 per month for the package and then £1 per month per employee, but if you want the advanced payroll features, you will pay £8 per month plus £1 per employee. If you need to add on accounts, the monthly subscription will be at least another £12 per month.

BrightPay has a somewhat complex pricing method that depends upon how you want to use the software. Prices start at £59 for micro-businesses with up to 3 employees. Its next price tier is £109 for an individual employer with up to 10 employees up to £229 for larger employers and multiple employees.

Conclusion of the best software. The winner is ….

|  | |||

| Usability | ||||

| Features | ||||

| Connectivity | ||||

| Price |

If you are a very small employer who wants an easy-to-use system at a great price, then FreeAgent fits the bill.

If you have multiple companies with very complex payrolls, then you might be better looking at BrightPay.

For the two remaining payroll software providers, then you cannot go far wrong with either Xero or QuickBooks who have very similar offerings in terms of price, features and connectivity – we are big fans of the Xero ME app too!

Our Payroll Services – Designed For Your Business

We are a Xero Payroll Platinum Partner & QuickBooks Payroll specialists so we can run your payroll on your existing software.

If you want help choosing the right payroll package for your small business or want to talk about running your existing payroll with us, please get in touch.

We also offer a full or partial payroll service for businesses as you may want to retain control over parts of the process, or if you prefer, you can fully outsource your payroll to us for a low fixed monthly fee – saving you time & money!

With over 30 years of experience, Fusion Accountants in London prides itself on offering a simple, comprehensive, online payroll service provided by our dedicated team who fully understands payroll software and processes.