Statutory accounts

Complete statutory accounts service

We don’t just prepare your year-end statutory accounts, we take time to understand your business, identify opportunities to save tax, help you understand you financial performance and position of the business and much more…

statutory accounts service

Our qualified team of chartered accountants is here to assist you. We can assess what information your company needs to give HMRC and Companies House with just one phone call. We can assist with collating all the relevant information required and guide you through the filing process and help you rectify any errors.

Working with us also gives you access to a wealth of expert advice that can help you improve your financial reporting.

At Fusion Accountants, we are very proud of our prompt delivery service with minimal fuss. Our job is to gather all the essential paperwork, go away and do the necessary number crunching, and prepare full accounts very quickly.

We proactively try to complete your company annual accounts (or your tax returns if self-employed) within 1 to 2 weeks from receiving the relevant information you send us. We always file your set of accounts with HMRC before your deadline date (9 months after the year-end).

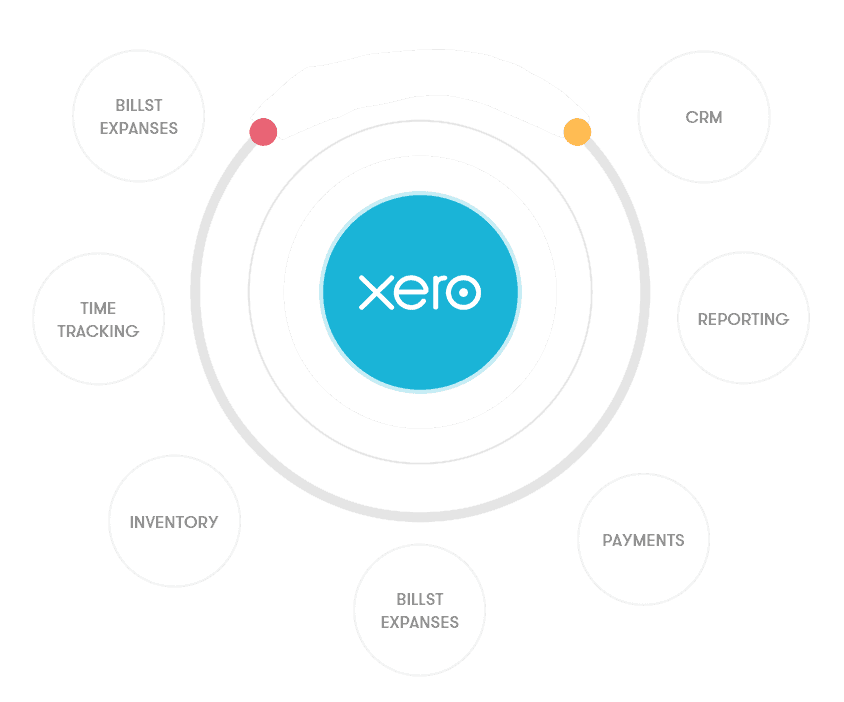

As a Xero Platinum Partner, we have a considerable advantage when compiling your statutory accounts. First, to process your accounts quickly at year-end, we require all your data in the correct format. Secondly, keeping your records on Xero provides you with a clearer picture of your tax liability through its forecasting tools before the bill arrives.

We can assist you to minimise your tax liability, allowing you to save money! If you think Xero Accounting software could help your company, please contact us.

Knowing what information is required means you will never have to worry about running around last minute to get things ready for HMRC and risk forgetting vital paperwork and possibly incurring a fine.

We will take care of this process for you as we will get in touch well in advance to remind you of any information we need or any payments required.

What Are Statutory Accounts?

Known as “Annual Accounts” or “Year-end Accounts,” all UK limited companies are required to submit Statutory Accounts to Companies House within nine months of their fiscal year’s end. The accounts of small businesses, on the other hand, are much easier to prepare than those of their larger competitors.

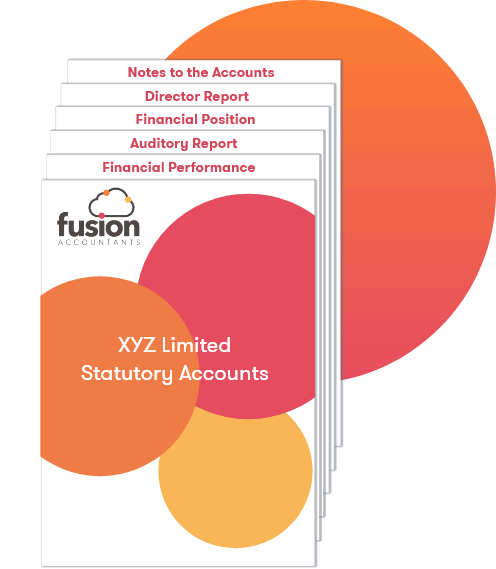

What’s included in statutory accounts?

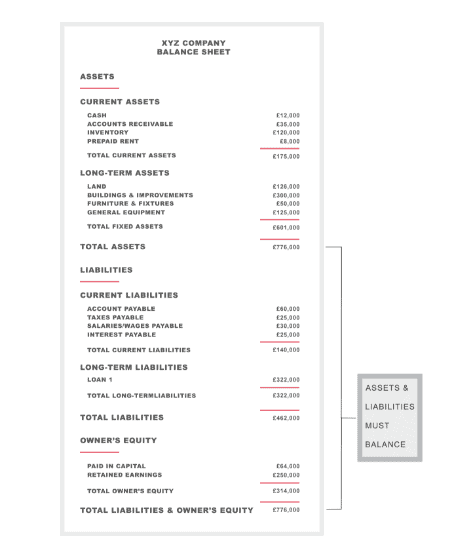

- A balance sheet

- A profit and loss statement

- Notes about the accounts

- A director’s report

- An accountants or auditor’s report

The deadlines for filing your set of annual accounts are within nine months of your Accounting Reference Date after the first year.

Example: Company ABC Ltd. must file its annual accounts from 1 November 2019 to 31 October 2020 no later than 31 July 2021.

What information

do statutory accounts include?

Statutory Accounts prepared for Limited Companies in the UK must be fully compliant with IFRS (International Financial Reporting Standards) or the UK GAAP (Generally Accepted Accounting Practice). These will typically include the following;

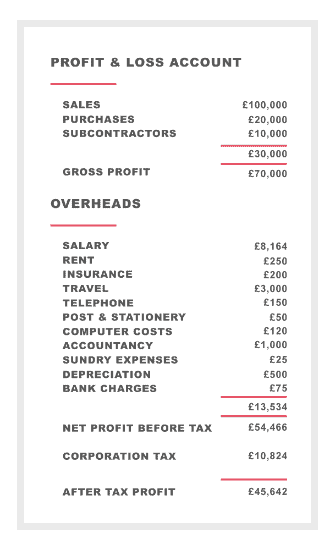

01. Profit & loss (P&L) account

Profit & Loss (P&L) shows the performance over the company’s financial year. It would typically show a summary of income received and the types of expenses incurred. But, of course, every business is unique.

Most companies will also file a Company Tax Return with HMRC every year to disclose their earnings, losses, loans, and other circumstances affecting their tax due.

A retail business, for example, with multiple stores, may want to see income & expenses split by each store. In contrast, a construction business may want to see the profitability of each project it undertakes.

P&L produced for management should therefore be tailor-made, keeping in mind the nature of business, the level of detail required, the frequency and the layout.

02. Balance sheet

A Balance Sheet shows the financial position of a business at any given point in time.

A Balance sheet should be prepared with notes to help indicate key business ratios, such as liquidity ratios, debtor and inventory days etc., which can highlight risk areas, so you are in a much better position to plan any cash flow needs.

03. Key performance indicators (KPI’s)

Notes to the accounts shed light on crucial information that would be useful to any stakeholder of the business. Typical examples of these would include things like;

- Breakdown of Fixed Assets to show amounts purchased, sold and depreciated

- Related Party Transaction during the year

- Detail of some of its creditor or debtors e.g. money owed broken between the bank, taxman or a director

04.Directors report

The Companies Act 2006 requires all larger companies to produce a Director’s Report in their Annual accounts to improve corporate transparency. It talks about the business’s principal activities, any significant events incurred during the year and its business impact.

The report is an opportunity to provide greater detail about how the business has performed during the year any regulation impacts or changes in the economic outlook. It may also mention dividends the business intends to pay.

05. Auditors report

The Auditors Report is only required for Companies carrying out an Audit (whether Compulsory or Voluntary Audit) and is provided by the Company’s auditors. After a review, they will indicate whether the accounts give a true reflection of the business.

Different types of statutory accounts

Full Accounts

Full Accounts must include all the essential reports such as profit and loss, a balance sheet, and detailed accounts. In addition to this, full accounts must also include an accountant’s report and a director’s report. Both of which provide further important information about the company.

Abridged Accounts

We can send ‘Abridged accounts’ for companies that meet the Small Business or micro-entity criteria. Abridged accounts have a more straightforward balance sheet (a Balance Sheet and reduced number of notes to the accounts) – applicable if you do not want to include details like gross margins or annual profits. However, they exclude profit and loss.

Dormant Accounts

A company is dormant if it has had no ‘significant accounting transactions during the accounting period or may have recently been set up but not traded as yet.

Criteria for small companies

If your company meets two of the following conditions, it is considered as a small business:

- You have a turnover less than £10.2 million

- You have up to £5.1 million on your balance sheet

- You have less than 50 employees

As a small business, you can send Companies House abridged financial statements. In addition, a director’s report, a profit and loss account, and the option to audit or not are also available to small businesses.

Criteria for Micro-Entities

If your company meets two or more of the following conditions, you are defined as a micro-entity:

- You have a turnover lower than £632,000

- Your balance sheet shows a maximum of £316,000 or less

- You have 10 employees or less

Being a micro-entity means you do not need to prepare complex accounts, and you can send more straightforward balance sheets to Companies House instead. The same exemptions offered to small companies are also given to micro-entities.

Looking for help with your statutory accounts?

020-8577-0200

Fusion Services

We provide a comprehensive range of accounting and tax services to help launch your new venture.

Why our clients

love us

FAQ ‘s

Which companies are required to prepare and file statutory accounts in the UK?

All registered in the UK are obligated to prepare and submit statutory accounts. This includes limited companies, public companies, and certain other types of corporate entities.

What is the purpose of preparing statutory accounts?

The primary purpose of statutory accounts is to provide transparency and accountability about a company’s financial activities. They enable stakeholders, including shareholders, creditors, investors, and regulatory bodies, to assess the company’s financial performance, stability, and compliance with accounting standards.

Are there any exemptions for small companies regarding statutory accounts?

Yes, small companies might be eligible for certain exemptions. For instance, they might be able to prepare simpler accounts, omit certain disclosures, or qualify for reduced filing requirements. Micro-entities do not have to file a copy of the profit and loss account to Companies House.

What penalties can companies face for not complying with statutory accounts filing requirements?

Failure to prepare and submit statutory accounts on time can result in penalties and fines. The severity of these penalties depends on the duration of delay and the company’s size. Additionally, directors could be held personally liable for non-compliance.

Penalties for missing the deadline

| Length of period (measured from the date the accounts are due) | Penalty for a private company or LLP | Penalty for a public company |

|---|---|---|

| Not more than 1 month | £150 | £750 |

| More than 1 month but not more than 3 months | £375 | £1,500 |

| More than 3 months but not more than 6 months | £750 | £3,000 |

| More than 6 months | £1,500 | £7,500 |

Can a company's statutory accounts be publicly accessed?

Yes, once filed with Companies House, statutory accounts become part of the public record and can be accessed by anyone.

Can a company make changes to its statutory accounts after they've been filed?

While it’s generally not encouraged, companies can make amendments to their filed statutory accounts if errors or omissions are discovered. The revised accounts must be submitted to Companies House, and an explanation for the changes might be required.

Who is responsible for preparing and filing the statutory accounts to the Companies House

It is the responsibility of the directors to prepare and file company accounts before the deadline. Fusion Accountants has been helping many company directors to fulfil their duties to Companies House.

Do company accounts need to be signed?

The company accounts are approved by the board of directors and the balance sheet must be signed by a director on behalf of the board. However, filing company accounts through accounts production software the requirement of a handwritten signature is replaced by an authorisation code.