Accountants for sole traders

Our sole trader accounting services

that perfectly fit your business

We will look after your sole trader accounts.

Make confident financial decisions and grow your business.

The accountancy package starts at £25+ VAT per month.

Monthly reviews offer advice to fine-tune business efficiency.

Automated reminders when to file or pay your taxes

FreeAgent, Xero or QuickBooks

Call for free when you need help or tax advice

What is a Sole Trader?

As a sole trader, you can take total control of your business, making critical financial and business decisions quickly and easily. The upside is you can keep all the profits (once you have paid tax on them, of course!). The downside is that you are responsible for your business venture’s success (or failure) and personally liable for all business debts.

You will need to set up as a sole trader if any of the following apply:

- You earned more than £1,000 from self-employment between 6 April 2020 and 5 April 2021

- You want to make voluntary Class 2 National Insurance payments to help you qualify for benefits

As soon as you start working for yourself, you will be classed as a self-employed “Sole Trader”, this happens even if you’ve not informed HMRC.

How do I register as a sole trader?

To register, you need to tell HMRC that it can expect a Self-Assessment tax return from you. You can either do this by registering online or printing out and posting the relevant form from HMRC’s website.

What happens next?

If you tell HMRC you intend to work as a sole trader, they will issue you with a Unique Taxpayer Reference (UTR) and create an online account for you to use for Self-Assessment purposes.

Soon after that, HMRC will send you a letter with an activation code for your online account. Get information about your tax status, including how much tax you’ve paid in previous years, your tax code, and when you are due to file.

Get your business off

to the best start.

We have helped thousands of UK businesses with their accounting needs. We seem to be doing a good job

as our clients are always happy to tell us.

Why our clients

love us

Advantages & disadvantages of being a sole trader

In the UK, many self-employed professionals choose to work as sole traders. A sole trader is a self-employed individual. Most potential self-employed choose sole traders or limited companies. Listed below are the benefits and drawbacks of being a sole trader.

Advantages

Faster decisions

Larger businesses often have multiple levels of management, owners, and stakeholders, all with competing goals, making simple decisions difficult. You are the owner and manager of a sole trader, so you make all the decisions.

Cheaper accounting

Limited companies must complete a balance sheet and cash flow, while sole traders are only required to complete a profit and loss account. Accountants charge sole traders less than limited companies because they have less work to do.

Keeps all profits

A sole trader gets to keep all the profits (after tax) that they make. There’s no Corporation Tax to pay, and there’s usually no employees to pay.

More privacy

Limited companies don’t get to keep certain information private, as they have to register with Companies House, which means it is in the public domain.

Disadvantages

Self-Assessment return SA302 sole traders

Because sole traders are not legally separate from their businesses, they are personally liable for any debts incurred. Therefore, the sole trader will lose income, but they will also owe money.

Can be difficult to get large clients

It’s challenging to secure work from big clients because many businesses, especially larger ones, see sole traders as small and a liability. Although a limited company can be owned and managed by one person, it is often more prominent.

No sick pay

If a sole trader is sick, they will not be paid, and their business will not provide the service they agreed to do for another person or supplier. When you are unable to provide your services, clients may look elsewhere.

Still needs to do some accounting

Sole traders need to keep receipts, pay tax (and VAT if they earn over £83,000) and National Insurance. We are specialist sole trader accountants who will do most of the work for you for a fixed monthly fee.

Sole Trader and Landlord Prices Starting From £25

Our pricing plans for sole traders and landlords start at just £25 per month. Whether you’re managing your own business as a sole trader or renting out properties as a landlord, we have tailored packages to meet your needs.

With features such as award-winning real-time accounting software, dedicated account managers, self-assessment tax returns, and unlimited support, we ensure you have the tools and assistance required to stay on top of your finances.

Our accounting software partners that will grow your business

Our fixed-price packages include everything you need as a Sole Trader, from online software to comprehensive accountancy support.

Your accounting records will be so much easier to keep track of, thanks to our partnership with Xero, Freeagent, and QuickBooks. In addition, if you are using these online platforms for the first time, we can provide you with one-on-one training.

Keep track of your finances from any mobile or desktop device. Send invoices, import bank statements, record expenses, and see your accounts and the amount of tax you owe in real-time.

Our sole trader accounting service

- VAT Registrations & Returns

- Payroll Registrations & RTI Returns

- Pensions & Auto-Enrolment

- Bookkeeping

- Tax Investigation Service

- Business Plans

- Management Accounts

Responsibilities of a sole trader

Here are some of the responsibilities that a sole trader has to look after.

- You must pay Income Tax on any profits of your business

- Pay your National Insurance

- Keep all records of your expenses and sales

- Register for VAT if you expect your takings to be more than £85,000 a year

- Your businesses debts

- Pay bills for anything related to your business

- If you are a contractor or sub-contractor in the construction industry you will need to register with the Construction Industry Scheme (CIS)

Complete sole trader

accounting service built for you

Dedicated accountant

Our Sole Trader accounting packages include a dedicated accountant to ensure you receive the best possible service. They will spend the time necessary to learn about your business and provide you with the best advice possible.

Self-Assessment return SA302 & sole trader accounts

We will submit your Tax Returns and Sole Trader Accounts to HMRC on your behalf. We will advise you on tax rates and payment dates. We also help our clients prepare financial reports that will support business decisions.

Award winning accounting software

We offer market-leading software. Choose from award-winning UK cloud accounting suppliers: FreeAgent, Xero or QuickBooks. Even better, the cost of this software is included as part of your package.

Never miss a deadline

As your dedicated accountants, we will ensure that you never miss a deadline. We will send out automated reminders and place follow up calls about when to file or pay your taxes.

Tax planning & advice

We believe in providing a service that adds value. Therefore, regular tax efficiency reviews are standard in our Sole Trader accounting packages to help you save money on taxes.

Fixed price – no surprises

When you call, need help, or advice about your accounts or other tax matters, you will not be charged extra as part of our fixed monthly packages.

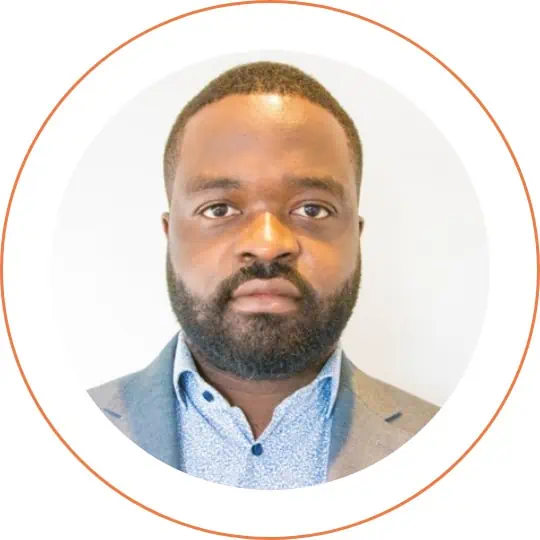

Meet our sole trader specialist

Allen Musongo

Client accountant

“I joined Fusion team in 2021, and as an ACCA qualified Client Accountant, I work closely with SME’s providing accounts, tax and business advice.

I am also certified with Xero, QuickBooks & FreeAgent.

I enjoy working with passionate entrepreneurs to assist with compliance and support their business growth.

I like playing football (BIG Chelsea FC fan – Mighty Blues). I also enjoy traveling and visiting new places. My favorites destination so far would have to be Lisboa.”

Follow Us:

We are modern accountants that help businesses grow

Find out how our great tax advice helped Rasmus Bech Hansen, Co-founder and CEO of Airfinity, tech start up business. “We worked with Fusion right from the beginning and they helped set up the company, register at Company House and have done all our accounting since then.”

Customer service reviews

Excellent service. Very friendly and professional staff, I always recommend their services whenever asked for a good accountant. Fees are very competitive. Mr Jawaad Hussein has helped me a lot in the beginning when I started my LTD co, always there whenever you need him, Big THANK YOU!!!