Best Accounting Software for Small UK Businesses

Reading Time:

In this post, we look at four of the best-known software options that we think every business should have on their shortlist.

Some have more features than others, some are cheaper, but across all of these is a basic level of quality and usability that we believe business owners will love.

The Contenders

To be included in our list, the accounting software needs to be aimed squarely at new start-ups and small businesses. This is why you will not find the likes of Access, Oracle, and SAP featured in this article!

Sage is probably the best known of our quartet and for many years the desktop version was the name that every accountant would instantly recommend to their clients. Time has moved on and with the advent of cloud-based SaaS (Software as a Service) offerings, Sage’s dominance has waned somewhat. That having been said, they are still a very strong player.

Quickbooks, like Sage, has been around for several years and had an excellent reputation in the desktop market. They have also made the transition to a cloud service and have invested heavily ensuring that they have a wide-ranging support network.

Xero started life as a fully cloud-based, subscription service and very rapidly gained a wide and loyal following and is recommended by many accountants as standard, even though the online software did not arrive in the UK until 10 years ago. Arguably, the push for traditional software houses to move to SaaS came from Xero.

FreeAgent is our final contender and is possibly the least known of the four even though it has been around for slightly longer than Xero. Launched purely as a SaaS service, FreeAgent is based in Edinburgh and was acquired by the Royal Bank of Scotland in 2018.

Round 1: Usability – Winner FreeAgent

When investing time and money in accounting software you want something that it is the right fit for your business and is simple to use – this is the first category we are scrutinising.

|  |  | ||

| Usability |

= best

= worst.

FreeAgent

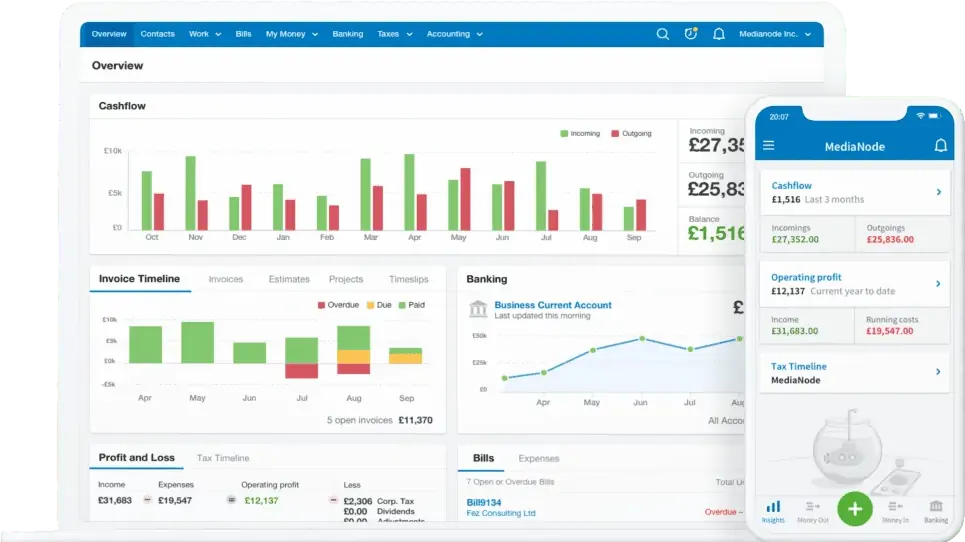

Top of the list has to be FreeAgent with its clear and uncluttered interface. It is pretty obvious that this has been designed with the average user in mind and it achieves this is in a simple and understandable way. Designed initially for Sole Traders and Contractor Accounting, the simplicity is also its downfall as it lacks functionality to handle more complicated businesses.

Xero

Xero is the next best option because of its user-friendly design and excellent usability. It is not as user friendly as FreeAgent, but it more than makes up for this by providing plenty of functionality and a huge range of third-party apps available in its marketplace.

Quickbooks

One of Quickbooks main problems (from desktop to SaaS), is the poor user experience of the interface. Whilst all the features are there it is not always obvious how to access them. Quickbooks have made a real effort in the last few years to improve their user experience, however we feel it still has a way to go when compared to its main rivals.

SAGE

Sage lags behind the rest of the pack as the system seems to have been designed to carry directly on from Sage line50 (the desktop version) which was aimed squarely at the trained and experienced accountant, either in-company or in practice. It is difficult and time-consuming to set up, and many of the features are over-complicated.

Round 2: Features – Winner Quickbooks/Xero (tie)

|  |  | ||

| Features |  |

When you look at software you need to understand what features are built-in and what additional features you will have to pay more for, or even buy in another app.

When you are looking at the features list of your future software, remember to check what is included and only buy things that you need and make sure none of them is volume-limited as you could end up paying more than you anticipated.

Quickbooks/Xero

Quickbooks accounting has an excellent range of features and even the cheapest version includes their receipt scanner, PayPal enabled invoicing and mileage tracking. Upgrade to £30pm and get the full suite including stock management, multi-currency, and budgeting.

Xero falls down a bit here when it comes to features as many of the processes that you may wish to do, require additional (paid for) apps or optional extras. Whereas Sage and Quickbooks have unlimited category tracking, Xero limits users to just two and things like expense tracking (£3 pm) and Projects (£5 pm) are add-ons. However, where Xero disappoints in free functionality, it more than makes up for it with its huge range of third-party apps available on its marketplace.

SAGE

The basic version allows you to track stock, manage departments, deal with cashflow and has excellent reporting. If you want to manage projects and use sales and purchase orders, then you will have to pay for a professional licence.

FreeAgent

FreeAgent offers the least features of the four providers, however, this probably reflects the fact that it is designed with freelancer accounting in mind. Few freelancers will need more advanced features such as multi-currency support or departmental tracking and so the lack of different methods is not necessarily a disadvantage here.

Round 3 – Support – Winner FreeAgent

|  | |||

| Support |  |  |  |

If you have a question, or get stuck using the software, you hope that there is easy and accessible support available to come to your rescue! Although as accountants we should know everything about accounts, but we do not always know everything about accounting software, so we have to sometimes access support as well from time to time, so this is an important aspect for us and the clients we work with.

FreeAgent

FreeAgent accounting has a good level of support with training webinars, knowledge base articles. You can also book a call directly with a support agent whose overall knowledge is pretty good.

SAGE

Sage has been in the software business for years, but it has suffered a fair amount through having a poor reputation for support. Customers can call in, but the line is a standard rate number, so you can be held in a long queue waiting for them to answer.

Quickbooks & Xero  (we have a tie)

(we have a tie)

that, from our experience of dealing with QBs support team, we found that the knowledge level has not always been their strong point and fixing a problem can sometimes take days, if not weeks.

Xero also has a well-developed support network, and their training videos are superb. It does not, however, have a helpline which is extremely disappointing. Instead, you need to raise a query through a ticketing system, which is not ideal as the query can go back and forth which is really frustrating. Sometimes you just want to be able to pick up the phone and speak to someone!

The one thing that trumps all of the support options is that if a system is so good and so user friendly that you do not need any help, then support is irrelevant. So, I must give credit to Xero and FreeAgent, where we have had very little issues with the actual system’s performance over the years.

Round 4 – Pricing No real Winner here

|  | |||

| Pricing |  |  |  | |

| Starter (per month) | £12 | £12 | £12 | £29 |

| Starter (per month) | £24 | £26 | £22 | N/A |

| Payroll (per month) | Pricing from £7 (from 5 employees). | £5 (up 5 employees then £1 for each additional employee) | £1 | N/A |

Note 1: Prices correct at time of publishing – March 2022

Note 2: Most of the above providers offer significant discounts for the first 3 or 6 months, we have not taken these into consideration and only looked at what you would need to pay in the long run.

Note 3: All prices above exclude VAT and are based on monthly subscription

As you can see there is not much between the different online software providers when it comes to pricing. Though the overall cost may differ depending on each user’s needs, we have decided not to declare a clear winner here.

It is worth noting that the software platforms also advertise more pricing options for Sole Traders, but for our review we are only looking to compare prices for Small Businesses operating as Limited Companies.

Quickbooks leads the way for the smaller businesses, and if you want something simple that will handle your VAT submissions, invoicing, and receipt tracking then you will only pay £12. This increases to £22 for multi-currency, stock management and time tracking. Their payroll charge is £1 per employee.

Sage is initially neck and neck with Quickbooks. For £12 you can create and send invoices, track invoices and payments, automatic bank reconciliation and calculate and submit VAT, but their Payroll is an additional extra at £7 per month.

FreeAgent prices its offer based on the type of company that is using the service. For self-employed people, the charge is £19, for partnerships £24 and Ltd companies £29.

Xero has a starter plan that only costs £6 (not shown in the table above) but this only allows the production of 20 quotes and invoices, 5 bills and 20 bank transaction reconciliations. In our view, this would only be of use for companies that have a very low number of transactions. For their standard option, you will pay £12 for the additional bulk reconcile transactions

and cash flow and business snapshot, and the premium package which includes multi-currency at £33.

Price is important so make sure you take some time to investigate what you get for your money first, and do not be swayed by initial special offers. Expect to pay more if you want to have more users logging on to the system.

Round 5 – Reporting – Winner (No real winner here too ☹)

|  | |||

| Reporting |

It is all very well having your information stored in a shiny new system, but how good are they at accessing the information you need? In other words, how good is the quality of the reporting aspects?

QuickBooks, we feel has a bit of a problem. It has a superb dashboard that is fully customisable and has excellent methods of tracking unlimited departments and projects, but some of its reports can let it down (and in common with the desktop version) the export feature does not always work very well.

Xero has the ability (like QuickBooks) to have customised report templates and the company has developed a new reporting dashboard. The system does have the basics like cash flow, P&L and Balance sheet but the standard built-in reports are not as extensive as Sage and QuickBooks and the limited analysis codes make it less useful.

FreeAgent has an excellent front end dashboard, which for most users, will prove adequate for their needs. It does not have the depth of reporting or the massive amount of customisation options of Quickbooks, but it gets by.

Sage has an exceptional array of complex accounting features, but its reporting could do with some improvement. The system does include standardised reports and you can customise them using the report designer, but the user interface is clunky and has a fair old learning curve.

As you can see it is difficult to select a clear winner here.

Round 6 – Connectivity – Winner Xero

|  | |||

| Features |  |  |  |  |

One of the best aspects of a SaaS system should be connectivity with other services.

We have taken it as read that all these systems can connect seamlessly with banks. But what about other services like PayPal, Futrli, Dext etc?

Xero

Xero has a wide array of different apps that you can connect to, either by getting them from the Apple Store or Google Play or by using the Intuit App collections.

Quickbooks

Quickbooks also does well in terms of apps and connectivity with a wide range available on their marketplace. These vary from time trackers to inventory.

FreeAgent

FreeAgent has fairly limited options. It still does, however, have some keys apps that will integrate well including things like Zapier, Stripe and Basecamp.

SAGE

Sage feels like it lives in a different age, and there has been widespread criticism of the company for many years. Its connectivity offering is pretty limited and whilst it will integrate with other Sage products like Sage Pay and Payroll, if you are looking to get this seamlessly patched into your CRM system then you may be disappointed.

If you are running a highly integrated business such as an eCommerce company then you need to make sure that your financial software will work with your other systems.

Conclusion – what software should you buy?

For ease of use, we have produced the following table and we have rated each aspect on a star basis:

= best

= worst.

|  | |||

| Pricing* | ||||

| Features |  |  |  | |

| Support |  |  |  |  |

| Usability |  |  |  |  |

| Reporting |  |  |  |  |

| Connectivity |  |  |  |  |

There is no real single answer to this question, but we hope that by teasing out the issues involved we have given you some food for thought.

If you are a very small business or a freelancer then have a look at FreeAgent because its user interface is exceptional and although it has a limited feature set it is probably all you need and the learning curve for a more complex system probably is not justified.

If you run a slightly bigger business and need a wide array of features, and happy to pay a little bit more, then Xero or QuickBooks are probably the best online accounting software. They are both reasonably priced, have excellent flexibility and can connect with a wide array of other services so could be a good choice whatever your needs but especially if you are in eCommerce or use a CRM extensively.

Sage has been a little disappointing overall and given its late entry into the cloud accounting we feel it has quite a way to catchup.

Our final piece of advice is to say make sure you choose the right software that is right fit for you or your small business. If your software does what you want it to do, then that is all you need.

Software V5 design? Click-throughs in logos

If you would like to talk over your software options, or if you need help with implementing a new online accounting system for your business then why not get in touch with specialist Accountants in London. We would love to help.

Also Read: Getting ready for Brexit – How to prepare your business