How QuickBooks integration with GoCardless works

Reading Time:

As you may already know, GoCardless makes it easy for its business customers to collect recurring, one-off, and variable payments from customers worldwide. So, you can sit back and let the software do all the work as it will reduce your time chasing payments from suppliers and customers.

How GoCardless work with QuickBooks?

GoCardless has a direct integration so that you can use it from within QuickBooks Online. GoCardless is a bank-to-bank payment method. It uses Direct Debit to collect payments from your customer’s bank account automatically. So, just set your customers up to pay via GoCardless within QuickBooks. Then, send your customer an invoice, and GoCardless will automatically collect the total amount directly from their bank account on the invoice due date. Once collected, the payment is automatically reconciled against your invoice. So simple! We go into much more detail below.

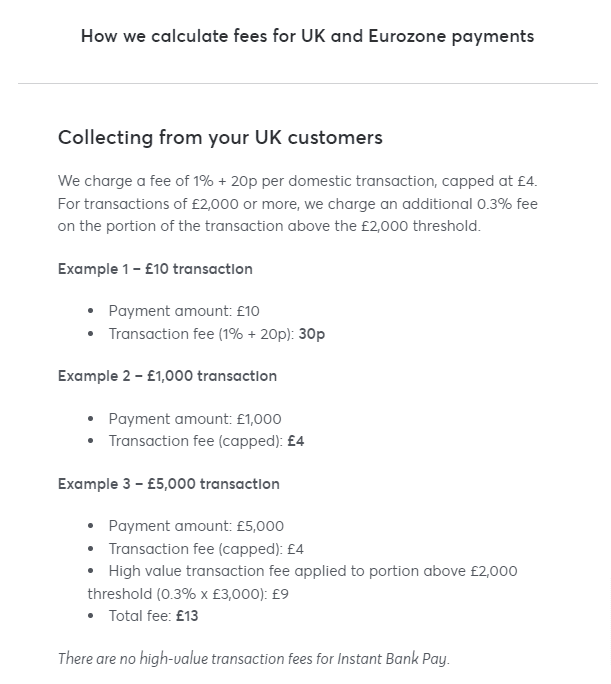

What are GoCardless fees?

GoCardless charges a 1% fee for every transaction that you make. The minimum charge is 20p up to a maximum of £4.

If you are using QuickBooks already and think this integration with GoCardless would help improve your business cashflow, let us walk you through the set-up process.

Initial set-up process

The whole procedure of setting up QuickBooks with GoCardless is pretty simple. Just log into your QuickBooks, then click on “Apps”. The whole procedure of setting up QuickBooks with GoCardless is pretty simple.

Step One: Just log into your QuickBooks

Step Two: Click on “Apps”

Step Three: From “Apps”, you navigate to “All Apps”

Step Four: Once there, type in GoCardless in the search bar. The search results will appear.

Step Five: Select “GoCardless for QuickBooks”.

Done! From “Apps” you navigate to “All Apps” and once there, type in GoCardless in the search bar. The search results will appear, and you select “GoCardless for QuickBooks”. Done!

A new page will appear which will have the option “Get App Now” and you need to select that.

GoCardless integration with QuickBooks

Once you have the app, your QuickBooks account will automatically connect you to GoCardless, where you will have the option to either create a new GoCardless account or use an existing account. After the registration process, all your direct debit payments will be logged automatically by QuickBooks. The fee that GoCardless charges (see above) will be added to QuickBooks as an expense.

The good news is that registering an account with GoCardless is free. As soon as it goes live, they will send customers notifications three days before any payment is taken. You will also receive real-time, automatic updates every time a transaction is successful or if a client cancels a direct debit.

Main benefits of GoCardless Quickbooks integration

Low, transparent fees

GoCardless charges only 1% of the transaction value, capped at £4, incredibly appealing to users. However, for transactions of £2,000 or more, they charge an additional 0.3% fee. In addition, there are no hidden fees, and no fees are levied for any unsuccessful payments. The entire setup procedure is also free.

Seamless integration

Your customer completes the online mandate form with their bank details. This gives you the authorisation to collect payment from their bank account without further action from your customer.

Quick and simple set-up

The set-up procedure is also pretty simple. It takes no more than a few minutes, and you can start making use of it as soon as you are done without any delay. Watch this GoCardless and QuickBooks set up video for more information.

Improve cash flow

Running any successful business is about managing your cash flow well. GoCardless will provide you with a much clearer picture of your incoming & outgoing payments. It is perfect for regular or ad hoc payments and fixed or variable amounts.

Reduce admin

You will no longer need to chase after bills and manually keep records of everything, which will be a massive cost saving that can be ploughed back into the business, spending more time being productive and leaving the payments to QuickBooks and GoCardless.

Happier customers

The GoCardless and QuickBooks integration provide users with a safe and secure payment method which is easy to use and set up.

Other advantages of GoCardless and QuickBooks

Taking control of your cash flow with integrated Direct Debits and automating your bookkeeping reconciliation are just a couple of major advantages of integrating GoCardless with QuickBooks. Here are more reasons why GoCardless works with QuickBooks online so well!

Payments and transactions

The live feed shows all of your payments. Also, all GoCardless transactions appear in the live broadcast.

The system automatically reconciles your transactions and bills. QuickBooks links all incoming payments to the appropriate invoice. In addition, QuickBooks automatically handles and records the GoCardless fee as a cost. The automatic reconciliation saves your team time. In addition, faster and more efficient bookkeeping streamlines finances, allowing you to focus on higher-level work.

Improved and future cash flow projections

Cash management will be a breeze. Cash flow is shown in real-time by the integration. Determining future cash flow is also easy because all transactions are linked. A brief notification will be issued if any transaction or payment is declined. In this way, you never miss a client who hasn’t paid and can act accordingly.

On-time payments decreasing late payments

Around £26 billion is owing to SMEs. This integration reduces late payments as both applications work together to make payments on time automatically. When the invoice payment deadline approaches, accounts are automatically debited. In addition, the app’s aged debtor report syncs data from both apps to QuickBooks, keeping you informed of all late payments.

An evolving payment solution

According to GoCardless customers, they continue to find ways to make payments quicker, simpler, and more manageable. GoCardless’s direct integration with QuickBooks allows users to experience making and receiving digital payments. It continues to evolve and get better with time. New features are added frequently, making it better than before. Sharing business data becomes relatively easy, and intelligent cash flow allows for smoother funds management.

Accounting solution that provides a complete payment method

Recent research revealed that 78% of UK small businesses use more than one accounting cloud software to streamline their financial processes. By integrating QuickBooks with GoCardless, you will have access to:

- All your transactions will be automatically updated from your live bank feed, reducing time spent and improving the payment experience between yourself and your customer(s).

- You will have access to seamless and smooth payment and accounting records. The integration between GoCardless and QuickBooks allows for an accounting solution that provides a complete payment solution keeping your business finances in order and reducing your admin time.

In Conclusion

QuickBooks is one of the most popular cloud accounting software businesses use to manage their accounts today. Its integration with GoCardless makes it an even more attractive proposition in the accounting and financial marketplace. The automatic reconciliation, late payments records, and end-to-end payments make doing business a lot easier as a lot of time and effort is saved focusing on other productive tasks.

All in all, the GoCardless integration with QuickBooks is a game-changer. The software is changing how business people are doing their accounting by streamlining and predicting your cash flow, quick transaction payments, and no manual bookkeeping. In addition, every time you get a new customer, QuickBooks integration will automatically pre-populate their details for both software.

Fusion Accountants is a London-based accountancy firm and Quickbooks Platinum ProAdvisor. Over 500 clients now use our cloud-based software services.

We can assist existing users and organisations in setting up this programme for the first time and utilise Quickbooks’ simple-to-use and effortless capabilities to your advantage and that of your organisation. Call us to find out more.